Gold Price Forecast: XAU/USD going nowhere in a hurry ahead of NFP on Friday

- Gold lacks any directional bias and remains confined in a narrow trading range.

- Investors seem reluctant ahead of Friday’s release of the US monthly jobs report.

- Dovish Fed expectations continue to act as a tailwind for the non-yielding metal.

Gold oscillated in a narrow trading band on Wednesday and finally settled nearly unchanged, tracking moves in the US dollar. Uncertainty over the likely timing of the Fed's tapering plan and fading hopes for an early lift-off failed to assist the greenback to capitalize on its modest intraday gains. The market speculations were fueled by the disappointing ADP report, which showed that the US private-sector employers hired far fewer workers than expected in August. The US Treasury bond yields retreated a bit in reaction to dismal macro data and further undermined the USD. This, in turn, was seen as a key factor that acted as a tailwind for the dollar-denominated commodity.

Separately, the US ISM Manufacturing PMI surpassed expectations and rose to 59.9 in August from 59.5 reported in the previous month. An uptick in the manufacturing sector activity allowed the buck to pare some of its losses. This, along with the underlying bullish sentiment in the financial markets, kept a lid on any meaningful upside for the XAU/USD. Investors also seemed reluctant to place any aggressive directional bets, rather preferred to wait on the sidelines ahead of Friday's release of the US monthly jobs data. This was seen as another factor that contributed to the commodity's subdued/range-bound price action on Wednesday.

The closely-watched NFP report might provide fresh clues on when the Fed could begin rolling back its massive pandemic-era stimulus. This, in turn, will play a key role in determining the next leg of a directional move for the non-yielding yellow metal. Heading into the key data risk, Thursday's release of the US Initial Weekly Jobless Claims might do little to provide any meaningful impetus to the metal. That said, a scheduled speech by Atlanta Fed President Raphael Bostic might infuse some intraday volatility and produce some trading opportunities around the commodity.

Short-term technical outlook

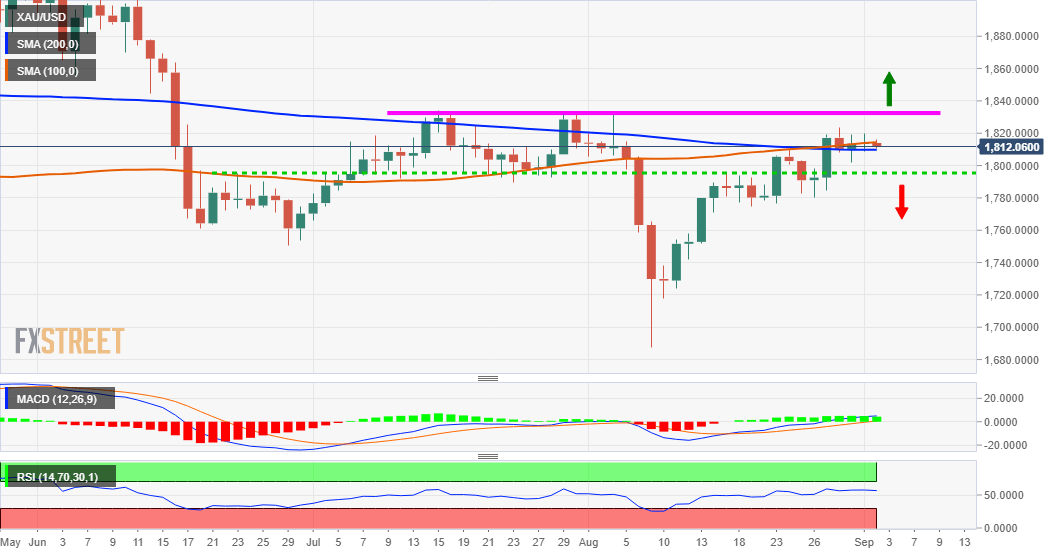

From a technical perspective, the range-bound price action witnessed since the beginning of this week might still be categorized as a bullish consolidation phase. However, the lack of any follow-through buying beyond the 100-day/200-day SMA confluence warrants some caution. This makes it prudent to wait for a sustained move beyond the weekly trading range hurdle, around the $1,823 area, before positioning for any further appreciating move. The momentum could then lift the XAU/USD towards a key barrier near the $1,832-34 region, which if cleared decisively will reaffirm the bullish breakout and pave the way for additional gains. The precious metal might then accelerate the momentum towards the next relevant resistance, around the $1,853-55 horizontal zone.

On the flip side, the weekly swing lows, around the $1,800 round figure, now seems to protect the immediate downside. A sustained break below might prompt some technical selling and drag the XAU/USD back towards the $1,778-74 congestion zone. Some follow-through weakness will shift the bias in favour of bearish traders and expose the $1,762 support zone, which is followed by the $1,751-50 region. The downward trajectory could further get extended towards the $1,730 area en-route the $1,700 mark and multi-month swing lows, around the $1,687-86 region.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.