Gold Price Forecast: XAU/USD could stage a rebound if $1,810 support holds

- Gold price meanders in fresh seven-month lows below $1,820 on Tuesday.

- US Dollar, US Treasury bond yields continue cheering US economic resilience.

- Gold price is heavily oversold on the daily chart; a rebound could be in the offing.

Gold price is consolidating its week-long run of losses while languishing at its lowest level in seven months below $1,820. The underlying bullish tone around the United States Dollar (USD) remains intact, in the wake of surging US Treasury bond yields, exacerbating the pain in Gold price.

US JOLTS Job Openings next in focus

Gold price remains battered for a seventh day in a row early Tuesday, as the US Dollar keeps rallying alongside the US Treasury bond yields on the back of encouraging signs of a resilient United States economy.

US ISM Manufacturing PMI improved in September, climbing to 49.0 from 47.6, surpassing the expected reading of 47.9, as production and employment picked up. Further, the US Federal Reserve (Fed) policymakers continued to voice their support for the higher for longer’ interest rate view, noting that policy will need to stay restrictive for "some time" to bring inflation back down to its 2% target.

The persistent hawkish Fed rhetoric and the ongoing bond market turmoil send the US Treasury bond yields northward, with the benchmark 10-year US Treasury bond yields sitting at 16-year highs above 4.60%. Amidst firmer US Treasury bond yields and upbeat data, the US Dollar also drew support from a mixed market environment, as traders digested the news that the US government avoided a shutdown. The current funding, however, is extended for 45 days.

Mixed Chinese business PMI data also added to the cautious risk tone, favoring the safe-haven demand for the US Dollar. In light of these factors, the USD-denominated and the non-yielding Gold price faced intense selling pressure and tested the March 10 low of $1,828.

Early Tuesday, Gold price remains vulnerable to further downside risks, tracking the unabated demand for the US Dollar amid an extended risk-averse market scenario in the Asian trading. A Golden Week holiday in China is corroborating with the downbeat momentum in Gold price while traders remain wary ahead of the US JOLTS Job Openings data release.

The US jobs data will set off this week’s critical labor market indicators, critical to determining the next US Dollar direction and Gold price trend in the coming weeks. US job openings dropped to the lowest level in nearly 2-1/2 years to 8.827 million in July. In August, the gauge is likely to show a modest improvement to 8.83M.

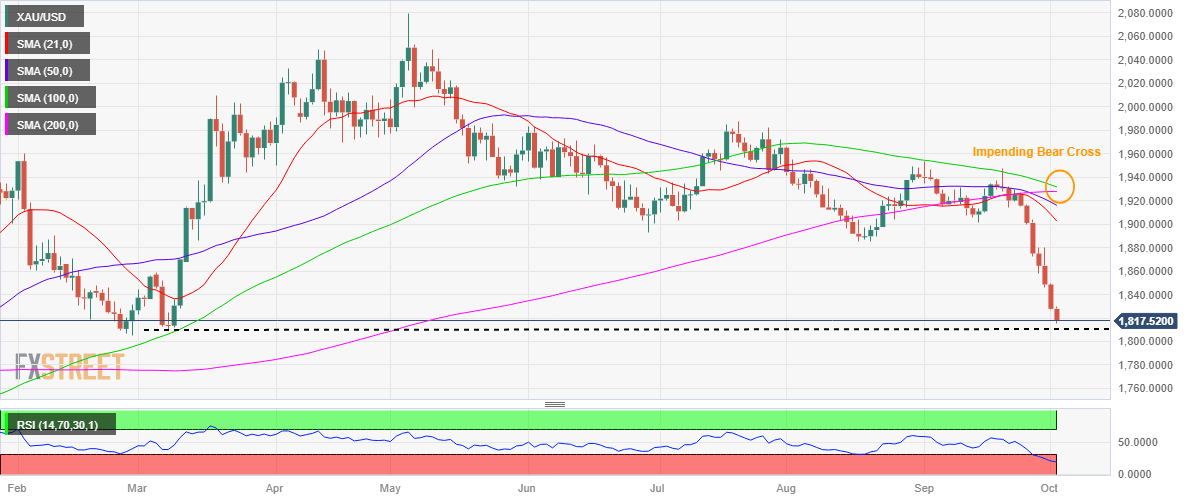

Gold price technical analysis: Daily chart

The daily technical setup for Gold price suggests that a rebound could be in the offing before a fresh downtrend resumes. The 14-day Relative Strength Index (RSI) indicator stays deep within the oversold territory, warranting caution for Gold sellers.

A corrective bounce could test the initial support-turned-resistance at the $1,850 level, above which the September 28 and 29 highs of $1,880 will offer powerful resistance to Gold price.

Failure to find acceptance above the $1,850 barrier could reinforce the selling interest around Gold price. The immediate support is now seen at the $1,810 level, where the March 8 low aligns.

The $1,800 threshold will be the level to beat for Gold sellers.

The 100-Daily Moving Average (DMA) is looking to cross the 200 DMA from above, in a sign of further bearishness for Gold price.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.