Gold Price Forecast: XAU/USD buyers recapture $2,000, what’s next?

- Gold price holds Friday’s solid gains above $2,000, as geopolitics dominate.

- US Dollar steadies, as US bond market action holds the key in the Fed week.

- Gold price eyes more gains amid a potential Bull Cross. Bull Flag remains in play.

Gold price has entered a phase of consolidation at the start of a new week, following a massive surge to a fresh five-month high of $2,009 set last Friday. Markets remain on a cautious footing amid the escalating Gaza-Israel ground conflict while bracing for a bunch of major central banks’ meetings in the upcoming week.

All eyes on Middle East strife and central banks

The Gold price rally is taking a breather early Monday, as risk sentiment remains in a tepid spot following Friday’s global flight to safety after Israel made deeper incursions into the Gaza Strip. Israel launched an intense bombardment with artillery and missiles fired from warplanes on Friday, extending over the weekend and into early Monday, in what it calls the “second stage” of its offensive.

Israel continues to bomb Gaza, with a particular focus on the north of the enclave. The Director-General of the World Health Organization Dr Tedros Adhanom Ghebreyesus has shared a “humble plea for ceasefire and peace” on X. Meanwhile, fears of a possible strike on Gaza’s Al-Quds Hospital grew after Israel ordered its “immediate” evacuation and as bombardment continues.

Amidst persistent tensions in the Middle East, investors continue to flock to the traditional safe haven, Gold price. Markets also remain jittery ahead of the key Bank of Japan (BoJ), US Federal Reserve (Fed) and the Bank of England (BoE) policy announcement.

Meanwhile, news that Hong Kong's High Court heard a winding-up petition against the embattled property developer, China Evergrabde Group, nearly two years after it defaulted on its debts tanked the company’s shares by 20%. China’s property market concerns keep investors in limbo, offering some support to the US Dollar. A pause in the US Treasury bond yield correction is also keeping the US Dollar afloat, capping the upside in Gold price.

However, the US Treasury is set to announce the quarterly refunding, which is likely to have a huge impact on the bond markets, eventually affecting the US Treasury bond yields. The increasing US budget deficit has been the primary reason that has driven the recent upsurge in the US Treasury bond yields, and therefore, Monday's announcement of borrowing estimates for the fourth quarter and the first quarter of 2024 will be closely scrutinized.

Meanwhile, the top-tier inflation and growth figures from Germany could also have a significant impact on the broader market sentiment, and in turn, on the US Dollar valuations. The Middle East conflict, however, will continue leading the sentiment and the Gold price action.

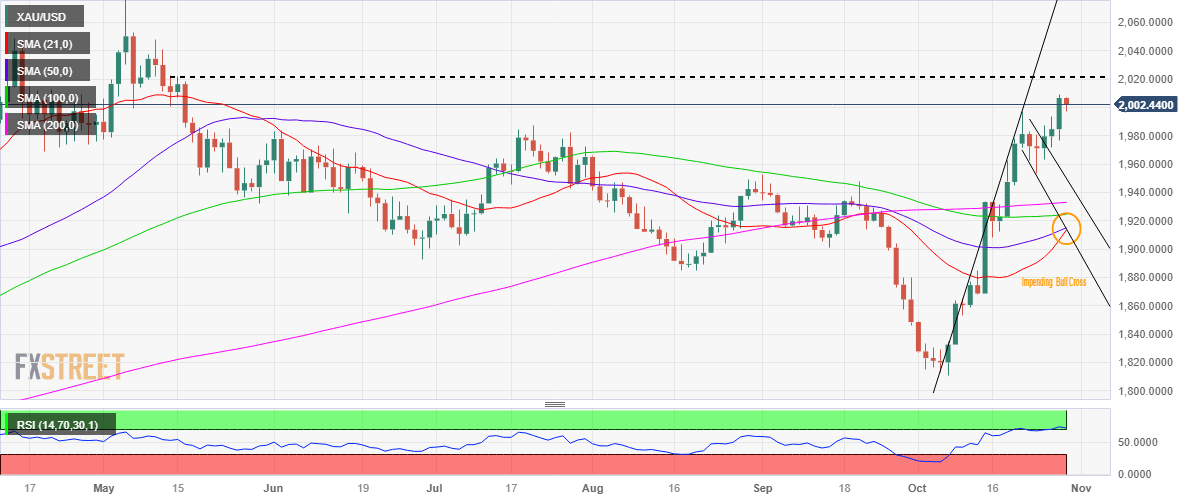

Gold price technical analysis: Daily chart

As the Bull Flag remained in play, Gold price witnessed a staggering rally and stormed through the key $2,000 threshold on Friday, currently defending the latter.

The 14-day Relative Strength Index (RSI) indicator is sitting just above the overbought territory, still indicative of more upside ahead.

The 21-day Simple Moving Average (SMA) is set to pierce the 50-day SMA for the upside. If that happens on a daily closing basis, a Bull Cross will be confirmed, opening the door for a fresh upswing.

In such a case, an extension to the ongoing uptrend toward the mid-May high near $2,020 cannot be ruled out. Ahead of that, the multi-month high of $2,009 will be retested.

A failure to defend the $2,000 level could see a correction ensuing toward the $1,990 round level, below which Friday’s low of $1,977 could come into play.

A sustained move below the latter will prompt Gold sellers to test the static support at $1,963.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.