Maker Price Forecast: MKR could stage 40% rally

Maker price today: $1,270

- Maker could rise by nearly 40% to $1,721 if it breaks above the upper boundary of a falling wedge pattern.

- The DeFi token has to overcome several key hurdles to achieve the 40% target.

- MKR's on-chain metrics support the bullish outlook, but rising exchange reserves pose risk.

MakerDAO (MKR) is up 2% on Thursday and could be set for a 40% rise in the coming weeks if it successfully maintains an extended move above the descending trendline of a falling wedge. On-chain data also supports the bullish outlook after a four-month-long decline.

MKR's rally is dependent on breakout above key trendline

MakerDAO, the protocol behind the DAI stablecoin, has seen nearly a 10% gain in the past week as it is looking to break out of a four-month decline that saw its price reaching lows last seen in August 2023.

MKR's price seems to have bottomed, and it's looking to test the upper boundary of a falling wedge pattern. A falling wedge pattern is a bullish formation that signifies a potential price reversal during a downtrend. It occurs when the downtrend gradually loses momentum over time.

MKR/USDT daily chart

In MKR's case, a breakout above the upper trendline near $1,450 could see the DeFi token rally nearly 40% to $1,721 in the next few weeks, especially as bullish pressure is also rising in the general crypto market.

To complete such a move, MKR would have to overcome the key resistance level around $1,441. Notably, the 50-day, 100-day and 200-day Simple Moving Averages (SMA) converge with key resistance levels on the daily chart.

The Relative Strength Index (RSI) momentum indicator and its SMA are testing their midline and descending trendline, respectively. A cross above both lines could strengthen the bullish momentum.

The Awesome Oscillator (AO) has posted a series of declining green bars below its midline, signaling a weakening bearish momentum.

On the flip side, a daily candlestick close below the support near the $1,000 psychological level will invalidate the bullish thesis.

Maker's on-chain metrics show rising revenue amid other mixed signals

MKR's Market Value to Realized Value (MVRV) Ratio, which measures all holders' average profit and loss, is at -25%, per Santiment data. This indicates that all MRK investors are at an average loss of 25%. However, the MVRV seems to have bottomed on October 23.

MKR MVRV Ratio

DefiLlama data also shows that MKR's revenue has been trending upward again, rising by 75% since August 28.

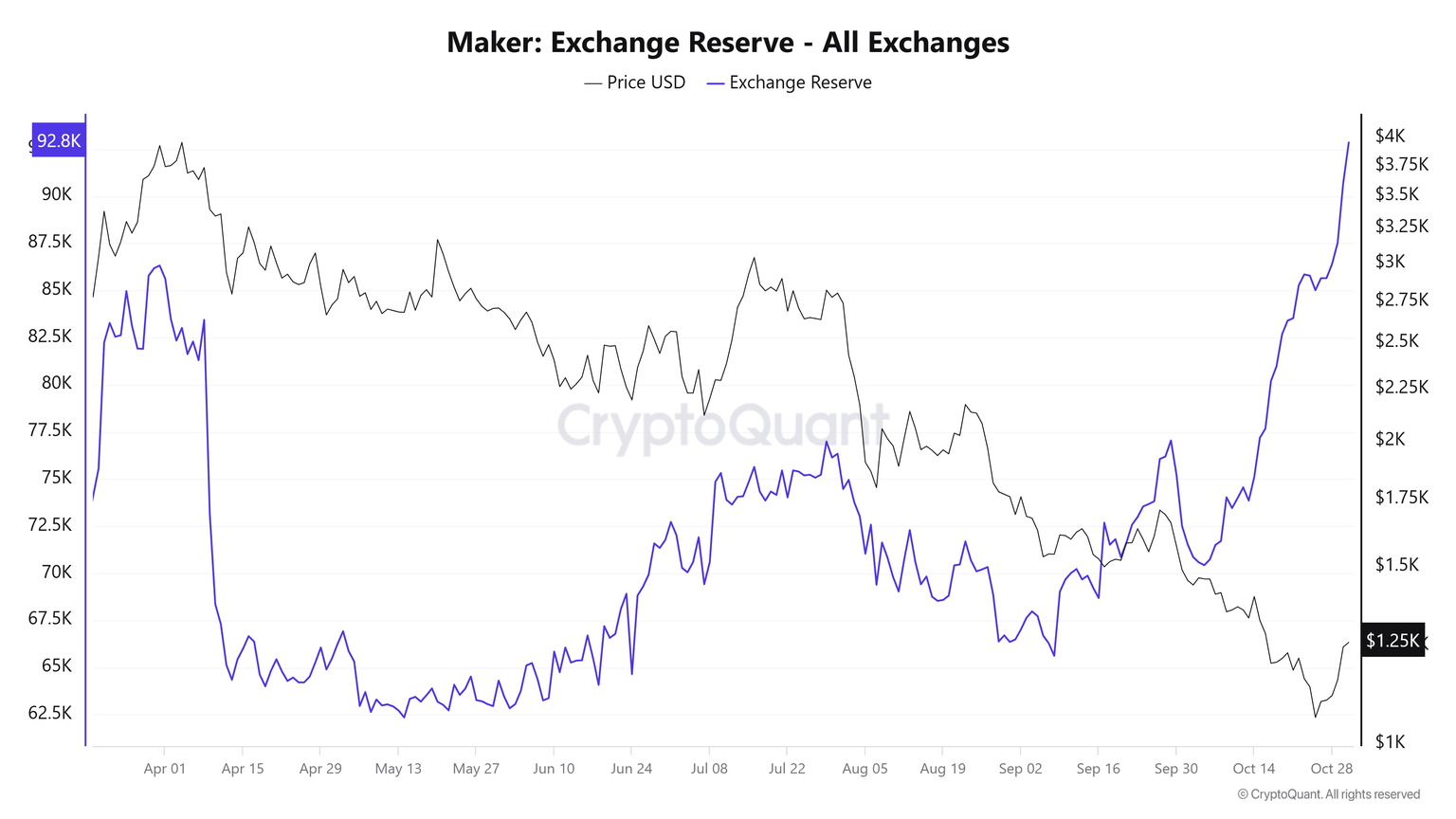

However, investors need to be cautious of a potential price impact from MKR's exchange flows, which have been trending upward in the past three weeks, per CryptoQuant’s data. Increasing exchange reserves could lead to high selling pressure on a token.

MKR Exchange Reserve

Meanwhile, MakerDAO's community is considering dropping the SKY brand name after spending about $25 million to rebrand its governance token and products. The protocol will organize a governance poll on November 4 to decide whether to keep the Sky name or revert to Maker.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi

%2520%5B22.51.51%2C%252031%2520Oct%2C%25202024%5D-638660128657345394.png&w=1536&q=95)