Riot revenue rises 65% from 2023 but says hashrate plans hampered

Bitcoin mining giant Riot Platforms has posted a 65% year-on-year increase in revenue but has had to hamper its hashrate expansion plans due to challenges at its United States facilities.

“Riot recorded $84.8 million in revenue this quarter, representing a 65% increase over the same quarter in 2023,” said CEO Jason Les in an announcement on Oct. 30.

A “significant increase in deployed hash rate allowed us to produce 1,104 Bitcoin this quarter,” he added before saying that this was in line with production in Q3, 2023, despite the halving.

He said the firm “continued to achieve significant growth” during the first full quarter past the Bitcoin BTC $72,242 halving, which was driven by a 159% year-over-year increase in deployed hashrate to 28 EH/s (exahashes per second) at the end of September.

However, the net loss for the quarter was $154 million, or $0.54 per share, 92% higher than the net loss in Q3, 2023, primarily due to reduced power credits, increased operating expenses, and the halving impact.

The average cost to mine one Bitcoin was $35,376, around half of current spot prices, which are around $72,000. The firm attributed this to its energy efficiency, “achieving an industry-leading average all-in cost of power of 3.1 cents/kWh,” Les added.

The firm also reported “robust balance sheet strength,” with approximately $1.3 billion in cash and equity securities and 10,427 Bitcoin, worth around $750 million, held.

Hashrate projections shaved down

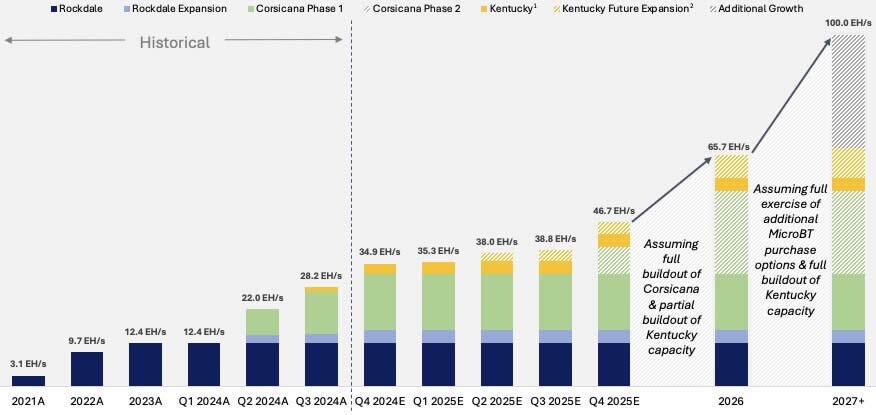

Les said that he was “incredibly excited” about the future path, with teams working to develop and deploy even more power capacity and hashrate across Texas and Kentucky “towards Riot’s next goal of achieving 100 EH/s in self-mining capacity.”

Riot hash rate growth projections. Source: Riot Platforms

However, its hashrate projections have been reduced to 34.9 EH/s by the end of 2024 from a planned 36.3 EH/s due to “slower-than-planned expansion” in its recently acquired Kentucky facilities.

Additionally, the Bitcoin miner now anticipates ending 2025 at 46.7 EH/s, lower than prior guidance of 56.6 EH/s, also due to expansion delays and longer than anticipated lead times for the next substation at its Corsicana Facility.

When both facilities are fully operational, the firm anticipates a hashrate capacity of 65.7 EH/s by the end of 2026.

Riot stock (RIOT) dipped 3.6% on the day to trade at $9.86 in after-hours trading on Oct. 30, according to Google Finance.

Its shares are down 32% year-to-date and have dumped 85% since their February 2021 all-time high of just over $70.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.