Gold Price Forecast: Technical chart warrants caution for the XAU/USD bulls

- Gold remains on the slippery ground after rejection at higher levels.

- US dollar weakness, vaccine doubts offer support to gold.

- Gold’s 4H chart signals caution for the bulls amid quiet trading.

With the US markets closed, celebrating Thanksgiving Day on Thursday, gold (XAU/USD) prices remained at the mercy of the sentiment around the US dollar. The bright metal benefited from broad-based US dollar weakness led by the weak US jobs data, which raised concerns over the economic recovery. Meanwhile, renewed hopes of monetary and fiscal stimulus worldwide offered support to the gold bulls, as investors fretted about the mounting economic risks amid a continued global surge in coronavirus cases. However, the metal-faced rejection once again at $1818 levels on the back of the underlying optimism around the coronavirus vaccines.

In Friday’s trading so far, the risk-off mood dominates after AstraZeneca’s coronavirus vaccine, which showed 90% efficacy, came under intense scrutiny. The upside in the precious metal remains elusive despite the tepid market mood and broad US dollar’s weakness. Market conditions are likely to remain thin, as the US markets operate partially amid the Thanksgiving holiday mood, leaving gold bulls vulnerable.

Gold Price Chart - Technical outlook

Four-hour chart

Gold’s rejection at higher levels keeps the sellers hopeful this Friday.

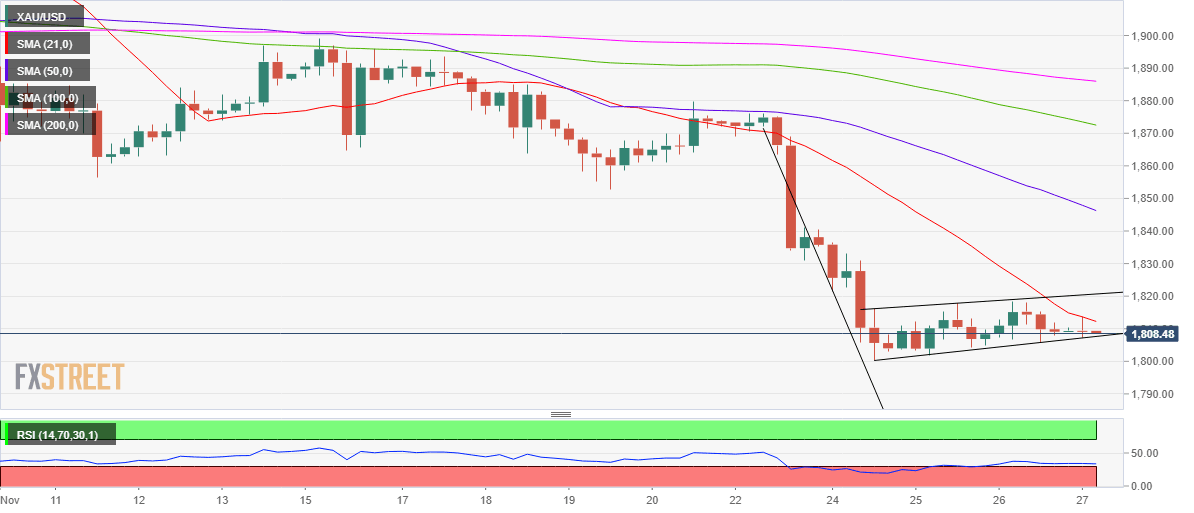

The drop seen earlier this week followed by the consolidation has carved out a potential bear flag formation on the four-hour (4H) chart.

Closing below the rising trendline support at $1807 on the candle would confirm the pattern breakdown, triggering a break below the critical $1800 support.

The next relevant support is seen at the May 18 high of $1765. The Relative Strength Index (RSI) trends lower below the 50.0 level, allowing room for more declines.

To the upside, the bearish 21-simple moving average (SMA) on the said time frame at $1812 offers immediate resistance, above which the intermittent top at $1818 could be retested.

Further up, the 50-SMA and the long-held support now resistance at $1850 will be the level to beat for the bulls.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.