Gold Price Forecast: Bullish flag breakout in play for XAU/USD

- Worries about the fast-spreading Delta variant of the coronavirus underpinned the safe-haven gold.

- A modest USD pullback from multi-month tops provided an additional boost to the precious metal.

- The market focus now shifts to Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium.

A combination of diverging forces failed to provide any meaningful impetus to gold and led to a subdued/range-bound price action on the last day of the week. Firming expectations that the Fed will begin reducing the pace of its massive asset purchases later this year turned out to be a key factor that acted as a headwind for the non-yielding yellow metal. The FOMC meeting minutes released last Wednesday now seem to have convinced investors that the Fed is comfortable to roll back its pandemic-era stimulus. Policymakers thought that the benchmark of substantial further progress criterion has been met in terms of inflation and maximum employment.

However, the uncertainties tied to the COVID-19 situation extended some support to the safe-haven precious metal. Investors remain worried about the potential economic fallout from the fast-spreading Delta variant of the coronavirus. Moreover, the current surge in new infections might have forced the market to probably reassess the timing of the Fed's tapering. This, in turn, prompted some US dollar profit-taking from a nine-and-half-month high and further underpinned the dollar-denominated commodity. Nevertheless, the XAU/USD managed to eke out modest gains for the second successive week and gained some traction during the Asian session on Monday.

The uptick was further supported by weaker PMI prints from Japan and Australia. That said, a generally positive tone around the equity markets kept a lid on any runaway rally for the commodity. Investors might also refrain from placing any aggressive bets, rather prefer to wait on the sidelines ahead of Fed Chair Jerome Powell's speech at the Jackson Hole symposium. In the meantime, the flash version of PMI prints from the Eurozone and the US would be closely watched to gauge sentiments. This, along with the USD price dynamics, might play a key role in influencing the commodity and produce some meaningful trading opportunities on Monday.

Short-term technical outlook

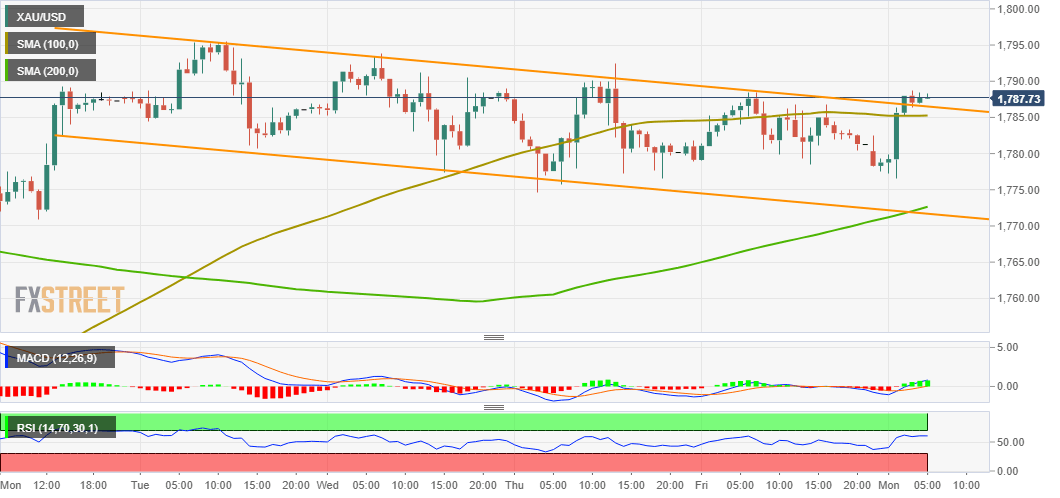

Looking at the technical picture, bulls are now looking to build on the momentum beyond a resistance marked by the top end of a one-week-old descending channel on the 1-hour chart. Against the backdrop of a strong rebound from multi-month lows, the mentioned channel constitutes the formation of a bullish flag pattern. Moreover, technical indicators on the daily chart have recovered fully from the negative territory. This, in turn, adds credence to the constructive set-up and supports prospects for a further near-term appreciating move.

From current levels, last week's swing high, around the $1,795 region, might act as an immediate resistance ahead of the $1,800 mark. A sustained strength beyond will reaffirm the positive outlook and allow the XAU/USD to surpass the $1,809-11 confluence zone, comprising of 100-day and 200-day SMAs. The momentum could further get extended towards the double-top resistance, around the $1,832-34 zone, which if cleared decisively should pave the way for additional gains.

On the flip side, the $1,777-75 area now seems to protect the immediate downside ahead of the trend-channel support, currently around the $1,768-67 region. A convincing break below will shift the bias back in favour of bearish traders and prompt some aggressive technical selling. The commodity might then accelerate the slide towards the $1,751 horizontal support. The next relevant support is pegged near the $1,718-17 region, below which the metal could eventually drop to challenge the $1,700 round-figure mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.