Gold Price Forecast: Acceptance above $1900 is critical for XAU/USD, focus shifts to US CPI

- Gold price stalls the two-day recovery momentum on Tuesday.

- Fed’s tightening expectations and Inflation concerns leave investors cautious.

- US CPI due this week holds the key for the next direction in gold price.

Gold price (XAU/USD) extended the recovery rally from two-week lows and tested the $1900 level, having found support near $1880 region. Gold price witnessed good two-way price movements on Monday, as it initially dropped amid a broad rebound in the US dollar from the downbeat NFP-led slide. During the first half of Monday, the greenback drew support from US Secretary Janet Yellen’s optimistic comments over the weekend, which lifted the Fed’s rate hike expectations and drove the Treasury yields higher alongside4 the dollar.

However, the tide turned in favor of the dollar bears in the second half after Yellen appeared again and clarified that higher spending levels may not create inflation overrun. Gold ditched the downturn and rebounded firmly while Wall Street posted modest losses amid looming uncertainty over the US stimulus.

This Tuesday, nothing seems to have changed for gold price so far, in terms of the fundamental drivers, as inflation and Fed’s monetary policy expectations continue to influence. Markets eagerly await Thursday’s US CPI data to gauge the inflationary pressures and the Fed’s stance on monetary policy. In the meantime, gold retreats from above $1900 amid a broad-based rebound in the US dollar and falling inflation expectations, which hit a six-week low ahead of the key CPI report.

Gold Price Chart - Technical outlook

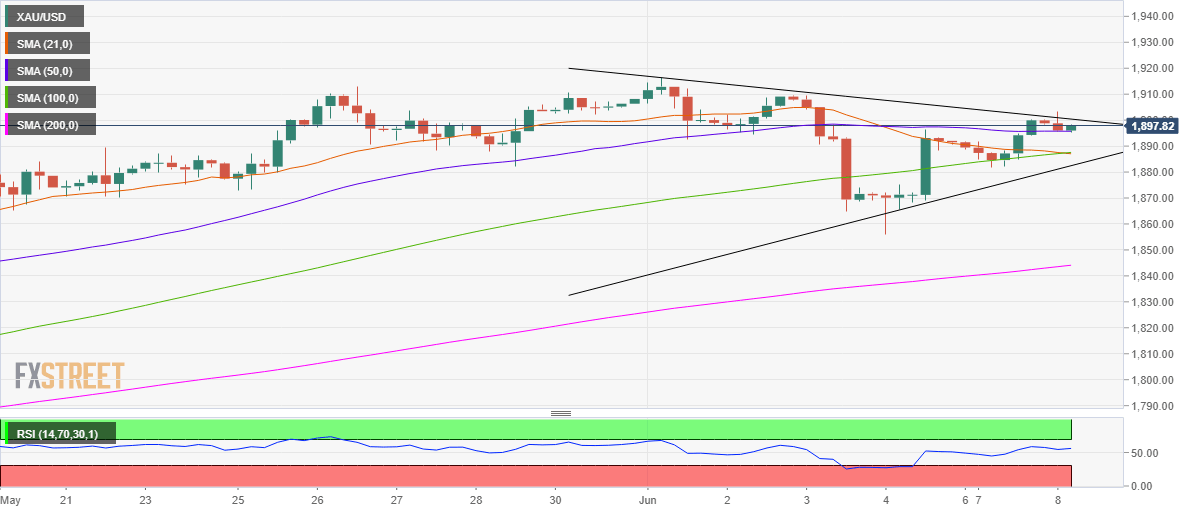

Gold: Four-hour chart

As observed on the four-hour chart, gold price is teasing a symmetrical triangle breakout, with awaited confirmation on a sustained closing above the falling trendline resistance at $1900.

At the time of writing, gold price is flirting with the 50-simple moving average (SMA) at $1896, following a retreat from three-day highs of $1903.

The Relative Strength Index (RSI) points north while above the midline, backing the case for further gains.

An upside break from the triangle could bring the multi-month tops of $1917 back on the buyers’ radars.

To the downside, the confluence of the 21 and 100-SMAs at $1887 is likely to be a tough nut to crack for the bears.

Further south, Monday’s low of 1881 could be retested, where the rising trendline support coincides.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.