Gold Price Forecast: A potential bull flag calls for a retest of multi-year highs

- Uphill task for gold bulls, as US dollar draws haven bids.

- Coronavirus fears to continue to limit the downside.

- Virus stats, US stimulus talks in focus amid a light docket.

- Technical set up favors the bulls in the near-term.

Gold (XAU/USD) started out a fresh week on a cautious footing, despite the positive close last week around $1810 levels. Resurgent haven demand for the US dollar across the board amid renewed concerns over the continued rise in the coronavirus cases globally dampened the market mood.

However, worries over the mounting virus risks on the global economic recovery, the EU Summit deadlock and US stimulus talks will continue to underpin the yellow metal, in the absence of US economic data due later this Monday.

It's worth noting that it could be an uphill task for the gold bulls to regain the upside momentum, as speculators reduced their bullish positions in gold (Comex contracts) and in the week to July 14.

Short-term technical outlook

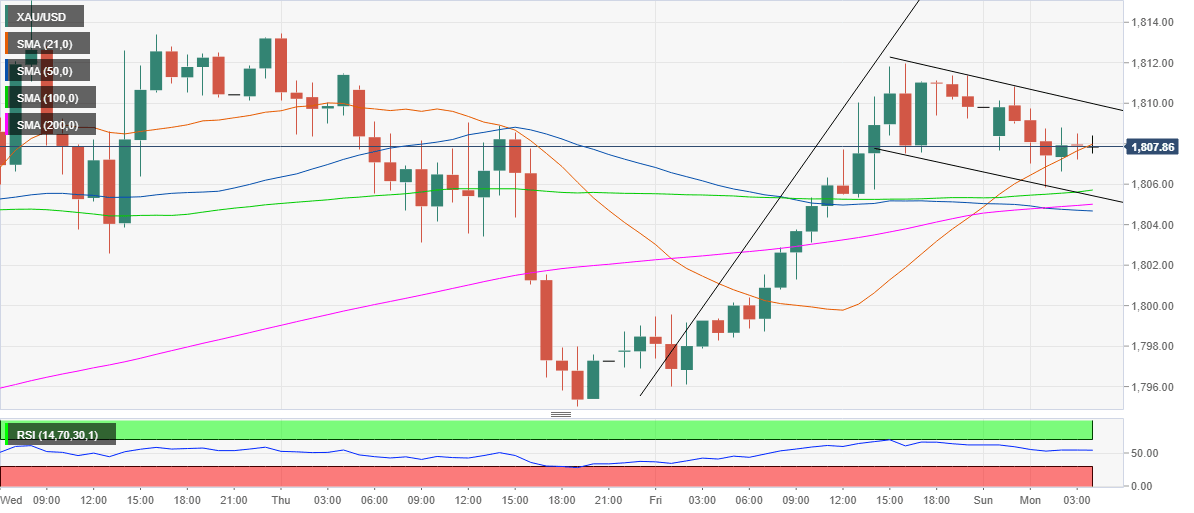

Gold: One-hour chart

A potential bull flag pattern is spotted on the hourly chart, with the pattern to get confirmed on a close above the falling trendline resistance at $1809.98 on an hourly basis.

A bullish breakout will call for a pattern target of $1827 in the coming days. In the meantime, the previous week of $1815.10 will challenge the bulls’ commitment.

The hourly Relative Strength Index (RSI) is trading flat but hold above the midline (50.0), suggesting more room to the upside.

Acceptance above the latter, the multi-year high at $1818.17 will be put to test, in a bid to test the $1820 round figure.

Alternatively, a cluster of supports is aligned around $1805, which is the level to beat for the bears in the near-term. That is the confluence of the 50, 100, 200-hourly Simple Moving Averages and falling trend line support.

Should the bulls fail to defend the aforesaid support, the next downside target is placed at the $1800 psychological level.

Gold: Additional levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.