Gold prices suffered losses in the first half of the current week; falling from USD 1232.3/OZ to USD 1203/Oz today.

The decline in the prices was largely triggered by a recovery in the USD index on the back of a strong US housing sector data. The US dollar also got a boost due to the slump in the EUR on renewed Greek concerns. Moreover, the yellow metal failed to find support as a safe haven asset on Greek concerns.

Expectations of the dovish Fed minutes

Most of the major data sets in the US have disappointed market expectations off-late. The Retail sales report, industrial production figure released in the last week signaled weakness in the economy. Consequently, the markets are speculating that the minutes would show policymakers focusing more on the weak economy and indicating a scope for a delay in the rate hike.Thus, Gold recovered from the low of USD 1203 to trade at USD 1210 levels ahead of the minutes release.

In my view, the Fed is likely to focus on weak economic data, while stressing on the fact that Q1 slump is transitory and that economy and labor market would continue to improve at a modest pace ahead. We already have the April jobs report, which showed the job market rebounded in April after sharp weakness in March. With respect to Gold, minutes expressing concerns regarding the US dollar and more focus on domestic slowdown would be bullish.

Dovish minutes could trigger another round of currency wars

Nevertheless, a dovish tone is likely to support Gold prices in a big way, opening doors for a rise to USD 1300/Oz levels in a month or so as it could trigger another round of currency wars.Two major central banks – Fed and Bank of England – have long stood at the other end of currency wars since Oct 31st 2014. With UK inflation falling below zero levels in April for the first time since 1960 and EUR/GBP at multi year lows, the possibility of BOE turning dovish has increased. In its quarterly inflation report, the BOE revised its GDP and inflation forecasts lower and hinted at gradual hike in rates than expected earlier.

The dovish tilt by the Fed would mean both previously hawkish central banks have now switched sides. This could very well trigger retaliatory action by other major central bankers. We already saw fresh jawboning by ECB’s Coeure and Noyer yesterday, after which the EUR/USD fell to 1.1060 levels. Furthermore, the bond yields have gone up sufficiently for another round of currency wars to begin.

Thus, the yellow metal to stands to gain in case the minutes, tilt to the dovish side. Over the course of the next month or so, prices could rise towards USD 1300/Oz levels.

The upside momentum would strengthen even further in case the dovish Fed minutes today are followed by a weaker-than-expected core CPI (exp 1.7%, prev 1.8%) and hedline CPI (exp 0.0%, prev -0.1%).

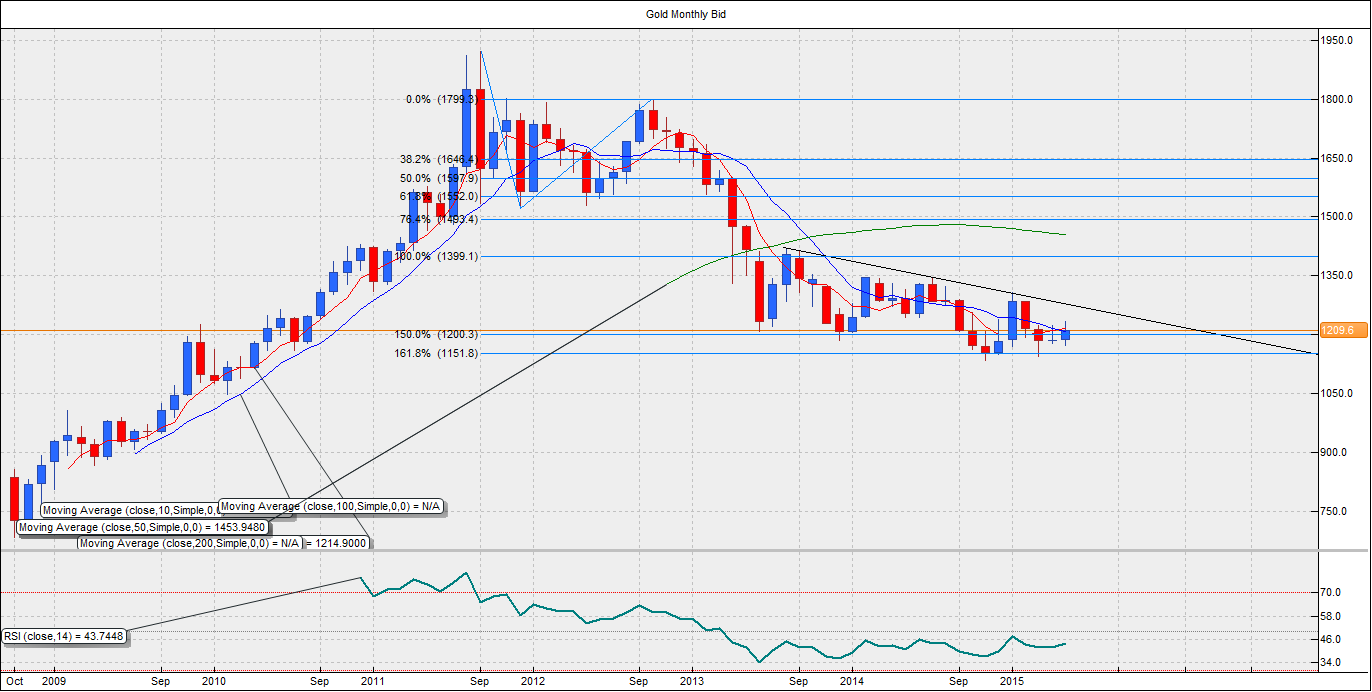

A look at the monthly chart indicates

- a close above USD 1200 (150% Fib expansion of 1920.8-1522.2-1795.6) could open doors for a re-test of falling trend line resistance currently located around USD 1970.

- A break above the same would shift risk in favor of a rise to USD 1300.95 (50% Fib retracement of 681.1-1920.8).

- 5-MA and 10-MA have already confirmed a bullish crossover.

- Prices have strong support around USD 1150-1155 (161.8% Fib expansion of 1920.8-1522.2-1795.6)

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.