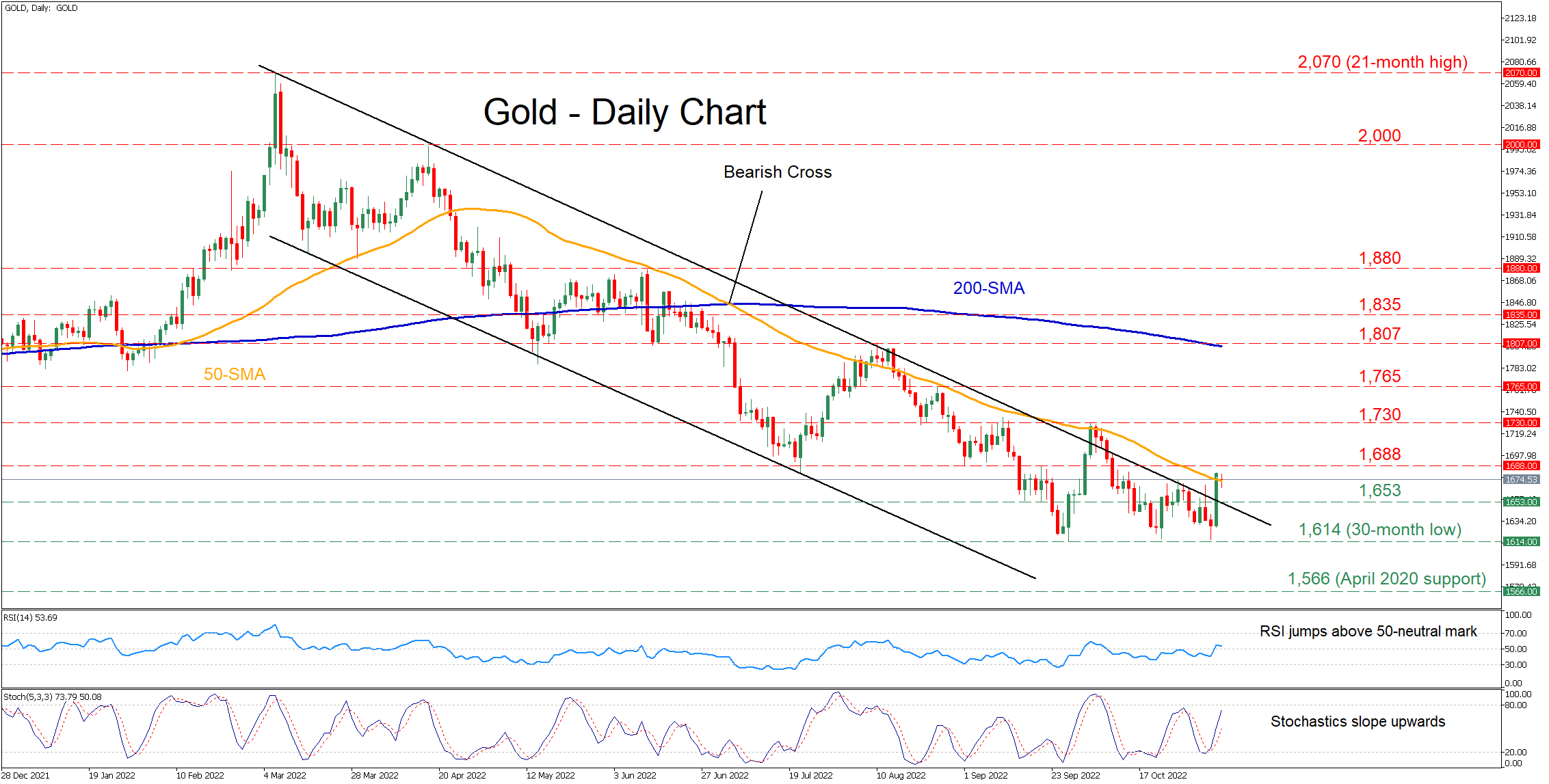

Gold has been losing ground since early March, generating a profound structure of lower highs and lower lows within a descending channel. However, in the previous daily session, bullion managed to profoundly cross above its restrictive trendline before the 50-day simple moving average (SMA) capped its upside.

The momentum indicators currently suggest that bullish forces are strengthening. Specifically, the RSI has jumped above its 50-neutral mark, while the stochastic oscillator is ascending after bouncing at its 20-oversold level.

To the upside, bullish actions could propel the price towards 1,688, which has acted as both support and resistance in the past two months. Conquering this barricade, the bulls could aim for the October high of 1,730. Piercing through this region, gold may ascend towards 1,765 or higher to test the August high of 1,807.

Alternatively, if the positive momentum wanes, initial support could be met at the 1,653 level. A violation of this zone could open the door for the 30-month low of 1,614. Failing to halt there, the price could descend to form fresh multi-month lows, where the April 2020 support of 1,566 might provide downside protection.

In brief, gold appears to be in recovery mode after managing to break above its long-term descending channel. Nevertheless, if the price falls again below the latter, the precious metal will most likely extend its downtrend.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD nears 1.0800 on broad US Dollar weakness

Optimism continues to undermine demand for the American currency ahead of the weekly close. EUR/USD hovers around weekly highs just ahead of the 1.0900 figure.

GBP/USD reconquers 1.2500 with upbeat UK GDP

Following BOE-inspired slump on Thursday, the British Pound changed course and trades around 1.2530. Better-than-anticipated UK GDP and a weaker USD behind the advance.

Gold resumes advance and trades above $2,370

XAU/USD accelerated its recovery on Friday, as investors drop the USD. Dismal US employment-related figures revived hopes for a soon-to-come rate cut from the Fed.

XRP tests support at $0.50 as Ripple joins alliance to work on blockchain recovery

XRP trades around $0.5174 early on Friday, wiping out gains from earlier in the week, as Ripple announced it has joined an alliance to support digital asset recovery alongside Hedera and the Algorand Foundation.

Euro area annual inflation is expected to be 2.4% in April 2024

Euro area annual inflation is expected to be 2.4% in April 2024, stable compared to March. Looking at the main components of euro area inflation, services is expected to have the highest annual rate in April.