Today’s AM fix was USD 1,194.00, EUR 953.60 and GBP 762.65 per ounce.

Yesterday’s AM fix was USD 1,200.75, EUR 957.61 and GBP 766.08 per ounce.

Gold prices fell $13.80 or 1.15% to $1,183.00/oz yesterday. Silver slipped $0.08 or 0.49% to $16.14/oz.

Gold in USD - 5 Days (Thomson Reuters)

Gold declined for a second day in volatile trade. The market rose following the Russian central bank gold announcement but priced were then capped in mid morning trading in London.

Some attributed the weakness to the negative gold poll in Switzerland. However, gold had fallen prior to the release of the Swiss poll and was trading below $1,180/oz and near the lows of the day at 1600 BST when the poll results were released.

The poll yesterday showed Swiss voters will likely reject an initiative that would require the nation’s central bank to boost bullion holdings. 47% percent of voters are seen as voting “no” on the Nov. 30 Swiss gold proposal and 15 percent were undecided, according to a gfs.bern poll for Swiss public broadcaster SRF. It was conducted Nov. 7 to Nov. 15 and had a margin of error of 2.7 percentage points.

Although many such polls favouring the establishment position have been very wrong in recent years.

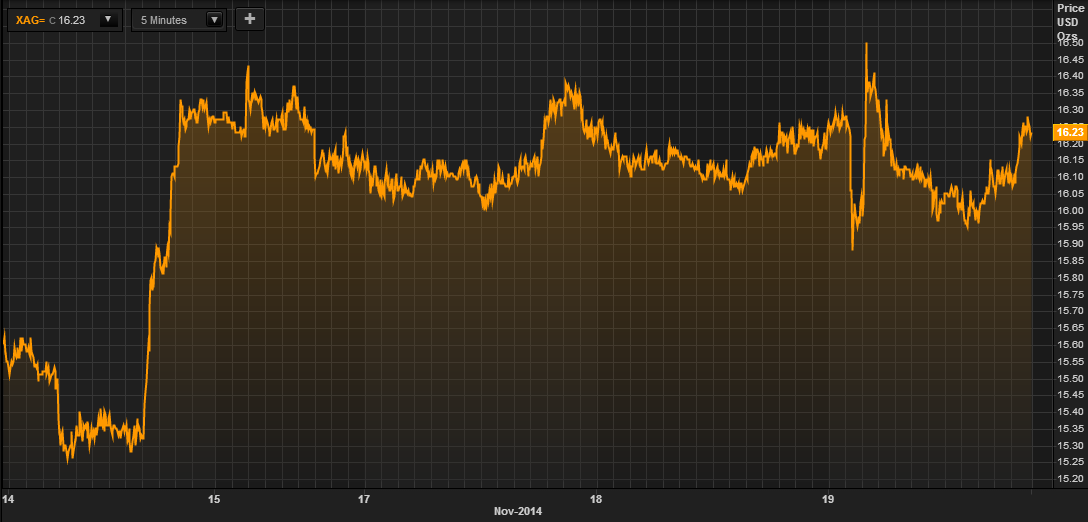

Silver in USD - 5 Days (Thomson Reuters)

One way or another, gold and silver quickly bounced higher again. Gold retested $1,200/oz prior to further weakness set in once again in less liquid markets after the close in New York.

Besides ongoing manipulation, gold’s weakness may also be related to traders selling as the dollar remains firm and oil prices weak. For now they are ignoring the continuing ultra loose monetary policies globally and focussing on the Fed’s ‘jawboning’ and signalling that they will increase interest rates. We will believe it when we see it.

Monetary policies globally have actually become looser in recent days due to Japan’s monetary ‘bazooka’ and the threat of ‘Super Mario’s’ bazooka.

Futures trading volume on the Comex was more than double the 100-day average for this time of day, data compiled by Bloomberg show. Holdings in gold ETFs fell 1.9 metric tons to 1,616.7 tons yesterday, the lowest since May 2009 as traders and weak hands sell and gold flows to stronger hands in allocated storage and in Asia.

Buy Gold Bars in the Safest Way and at the Lowest Prices

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.