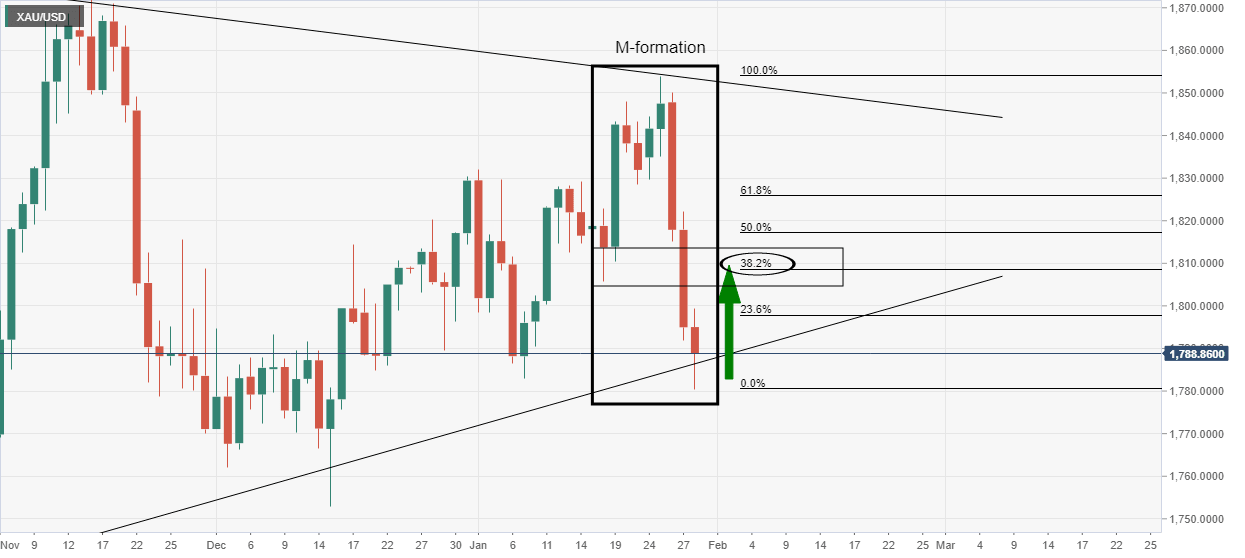

Gold, Chart of the Week: Bulls take on the 38.2% Fibo, now eye the 61.8% golden ratio

- Gold meets a critical level of resistance on the way to the 61.8% Fibo.

- Breakout levels will be back in focus beyond the 61.8% or if the 38.2% Fibo holds.

As per last week's ''Chart of the Week,'' the price of gold has moved into the suspected liquidity area and the question now is whether it can continue further into the M-formation's neckline and key confluence area for the week ahead.

Gold, last week's analysis

It was started that ''considering the trendline support and the daily M-formation, the technicians would argue that a significant correction of the bearish impulse could be in play first of all.''

The analysis was as follows:

It was explained that ''the M-formation is a reversion pattern that has a high completion rate with the price usually moving back to test at least a significant portion of the prior impulse if not all the way back to the neckline of the M-pattern. In the case above, the 38.2% Fibonacci retracement level near $1,810 has a confluence with prior structure as illustrated.''

Gold, live market

As illustrated, the price has run into the suspected target area for a perfect test of an old low. There has been some strong selling interest in the latter part of the correction which could signify that the bulls are going to have a tough time in their pursuit of deeper liquidity. Nevertheless, we have a 61.8% ratio screaming out from the M-formation's neckline around $1,830.

In any case, until the M-formation's neckline is broken, the focus is on the downside:

On the other hand, a break of the neckline will put a significant focus on the upside as follows:

Gold, weekly chart

There is a solid horizontal area of support all the way back across the historic timeline to May 2020 between $1,765 to $1,753, the last weekly low for the bears to target on a break of the dynamic trendline support. A break of $1,877 could open the way towards the psychological $2,000 mark over time.

For the week ahead, there will be a focus on the US Consumer Price Index, US equities and how the market will digest elements of the Nonfarm Payrolls that came in was a big surprise, such as wages. Much more talk of a possible 50bps move the next time the Federal Open Market Committee meets and the price of oil will be monitored in terms of inflation prospects for 2022.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.