Key FX developments

FX traders should note that risk sentiment is in the driver's seat and should have at least one eye on the major equity markets through all of this, especially as we're not trading far from the key 200-day moving averages again in the likes of the S&P500, the key developed market risk barometer.

Heavy selling in global equity markets was most supportive of the euro today, as EURUSD cemented its move above 1.1000 and USDJPY crumbled to the first key support, the Ichimoku Cloud level.

When risk sentiment goes weaker, it is all about the relative effects across currencies, with USD seemingly worse affected, followed by perhaps GBP and the commodity dollars and then the JPY jockeying with the euro for top spot, though it wasn't much of a competition today for the latter two currencies. Still, let's watch the 137.00 area in EURJPY, just above which the 200-day moving average comes in.

EURCHF solidified its break higher by looking above 1.0600 for the first time since March – a new trend in the making until proven otherwise.

Elsewhere, while the commodity and smaller currencies started the day on a weak note, they regained ground versus the increasingly hapless US dollar later in the day.

Gold didn't cut much of a profile, and doesn't seem to offer any kind of safe haven status at the moment, but Friday saw a strong bullish reversal and the bears are more like to find traction if risk sentiment improves again and the USD rallies. For gold, then, the sticking point on closing levels looks like the 1,080/1,100 zone.

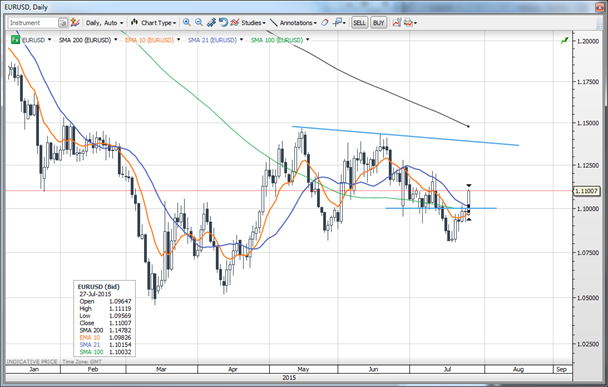

EURUSD

EURUSD cemented its move above 1.1000 today after flirting with the level on Friday. This makes 1.1000/25 the new key support zone and opens up the topside to at least the top of the descending line of consolidation and perhaps back toward the 200-day moving average as long as risk appetite remains on the defensive.

EURUSD has picked up momentum

USDJPY

This pair is pressing down on the first key support at the Ichimoku daily cloud today, a break of which could open up for the bottom of the cloud in the low 122.00s, which would begin to give the overall chart a rather bearish feel, so it is important for any remaining bulls to see selloffs picked up quickly and for risk sentiment to improve if we're to see new highs beyond 125.00 again.

The yen has been making gains against the dollar

EURJPY

The fight for the upper hand among the defensive currencies is being won at the moment by the euro, which has fought back higher toward 137.00 today versus the JPY. Note the 200-day moving average as the pair of currencies continue to duke it out. Traditionally, the JPY has done better when risk sentiment is weak.

EUR is making gains against the yen

EURCHF

We have a new trend in the making until proven otherwise, as EURCHF closed free of the local range highs amid all of the euro strength. This may alter the market's psychology on the franc's safe haven status, given the lack of interest despite the perilous descent in global equity markets since Friday, and that could have negative repercussion for the franc even when risk sentiment shifts more positive.

The next level of interest is the highest level since the January 15 shock revaluation up around 1.0800.

(Please ignore the closing level on the Friday bar in the chart below – this was due to a spike in the price feed.)

Swissy's on a roll

NZDUSD

It is interesting to note that a currency like the kiwi can rally against the US dollar when the whole world goes into defensive mode – so different from past market cycles and likely due to defensive position squaring as the market has been quite short this pair for some time due to the prolonged downtrend.

Bears will be increasingly vulnerable if we continue to lose downside momentum here and if risk sentiment remains weak.

NZDUSD bears could be vulnerable

- The author(s) and Saxo Capital Markets HK Limited are not responsible for and not liable to any loss arising from any investment based on any recommendation, forecast or any other information contained herein. The contents of this publication should not be construed as an express or implied promise, guarantee or implication by Saxo Capital Markets that clients will profit from the strategies herein or that losses in connection therewith can or will be limited. Trades in accordance with the recommendations in an analysis, especially in leveraged investments such as foreign exchange trading and investment in derivatives, can be very speculative and may result in losses as well as profits, in particular if the conditions mentioned in the analysis do not occur as anticipated. Investors should carefully consider their financial situation and consult their professional advisors as to the suitability of their situation prior to making any investments.

- Risk warning: Leveraged investments in foreign exchange or derivatives carry a high degree of risk and may result in significant gains or losses. You should carefully consider your financial situation and consult your independent financial advisors as to the suitability of your situation prior to making any investments.

Saxo Capital Markets HK Limited holds a Type 1 Regulated Activity (Dealing in securities); Type 2 Regulated Activity (Dealing in Futures Contract) and Type 3 Regulated Activity (Leveraged foreign exchange trading) licenses (CE No. AVD061) issued by the Securities and Futures Commission of Hong Kong.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.