Global stocks were relatively unmoved today as investors waited for important economic and earnings data. On economic data, this week investors will receive the first quarter’s economic growth of China, inflation numbers from the European Union and employment numbers from the United Kingdom. On earnings, investors will receive the numbers from companies like Bank of America, Netflix, Goldman Sachs and UnitedHealth among others.

The price of crude declined today as investors wondered about the demand and supply issue. The decline came after data from Baker Hughes showed that the number of wells in the United States had increased in the previous week. The wells increased by 2 from 831 to 833. This is an indication that US producers are continuing to boost production as oil price stabilizes. Still, the number of wells was lower than where they were in November last year.

The price of gold declined slightly as investors continued to focus on the Federal Reserve. Over the weekend, the current and former central bank officials voiced their concerns about the stability and independence of the Federal Reserve. This is after a few months of criticism from the US president, who has even considered replacing the Fed chair he appointed. He has also announced that he will appoint Stephen Moore and Herman Cain to the Fed’s board. The two are not very experienced in Fed operations but have voiced their support of Trump’s polices.

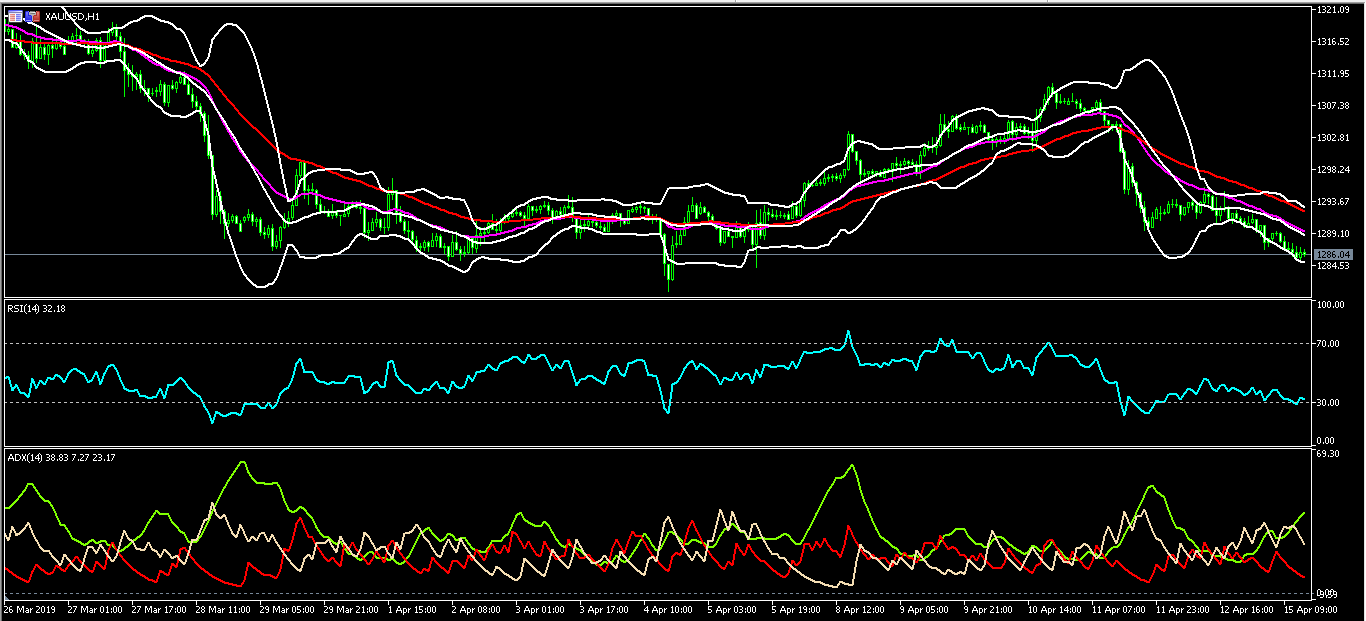

XAU/USD

The XAU/USD pair started declining on April 11, when it reached a high of 1310. Today, the pair reached a low of 1285, which was the lowest level since April 5. On the hourly chart below, the pair’s price is below the 25-day and 50-day moving averages. It is also along the lower line of the Bollinger Bands. The RSI has remained along the oversold level of 30 while the Average Directional Index (ADX) has increased to 38. The pair will likely continue moving lower to test the important support of 1280.

XBR/USD

The XBR/USD pair declined slightly to the intraday low of 70.40. On the hourly chart, this price is close to the important support of 70.30. In the past week, the pair has been trading within the 70.30 and 71.50 range. Today’s price is below the 25-day and 50-day moving averages while the RSI has moved slightly lower. It is also along the lower line of the Bollinger Bands. The pair is likely to continue moving lower, to test the 70.30 resistance level.

The EUR/USD started moving higher on April 2. Since then, the pair has moved from a low of 1.1183 to a high of 1.1323. On the hourly chart, the price is above the 25-day and 50-day moving averages. The money flow index has also moved higher while the on-balance volume has remained relatively stable. The pair could resume the upward trend to test the important resistance level of 1.1330.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.