Global stocks spike on Fed action and US infrastructure spending

Global stocks rose today as investors reacted to an announcement by the Federal Reserve. In a press statement yesterday, the bank said that it will now start buying corporate bonds from individual companies. These purchases will be in addition to the bonds it is buying through exchange traded funds. In addition, investors hope that the White House will reach a deal on an infrastructure spending bill worth more than $1 trillion. Most of the funds will be used for large-scale infrastructure projects like roads, 5G infrastructure, and rural broadband in the country.

The Japanese yen was little changed after the BOJ delivered its interest rate decision. As most analysts were expecting, the bank left the interest rate unchanged and announced that it would continue with its quantitative easing program. Also, the bank will continue with its yield curve control program, which ensures that the yield of the ten-year government bonds remains at about zero percent. Meanwhile, the currency did not react to the rising risks in Asia. Earlier today, North Korea destroyed the liaison office, raising the possibility of military action in the peninsula. At the same time, crashes between China and India led to the death of three Indian soldiers.

The Swiss franc was little changed today after the State Secretariat for Economic Affairs (SECO) released the economic forecast of Switzerland. The experts believe that the economy will contract by 6.2% this year. This forecast was slightly better than the 6.7% that was made in April. It also expects that the unemployment rate will remain at 3.8% this year. This report came approximately two days before the Swiss National Bank releases its interest rate decision. Analysts expects that the bank will leave interest rates unchanged and possibly announce more easing measures.

EUR/USD

The EUR/USD pair was little moved today as traders reflected on the new actions by the Fed. The pair is trading at 1.1310, which is slightly below last week’s high of 1.1420. On the four-hour chart, the price is along the 50-day and 100-day exponential moving average. It is also above the 61.8% Fibonacci retracement level. Therefore, at this point, the outlook of the EUR/USD pair is neutral. A move above yesterday’s high of 1.1350 will see the price rally. On the other hand, a move below the low of 1.1212 will see it continue falling.

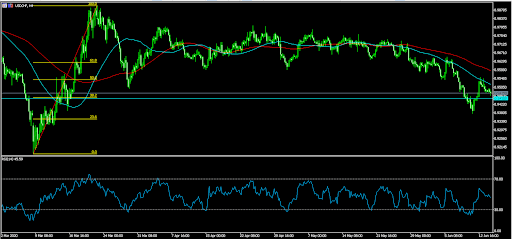

USD/CHF

The USD/CHF pair declined to an intraday low of 0.9462. On the four-hour chart, the price is below the 50-day and 100-day exponential moving averages. It is also slightly above the 38.2% Fibonacci retracement level. Also, the RSI has moved from a high of 59.23 to a low of 45.60. This indicates a possibility that the price will continue falling ahead of the SNB rate decision.

XBR/USD

The XBR/USD pair bounced back today as investors reacted to news that the US was planning to launch an infrastructure bill. On the four-hour chart, the price moved above the 61.8% Fibonacci retracement level. Also, the price is attempting to move above the Ichimoku cloud, which is considered to be a bullish sign. This means that the price may continue rallying ahead of the API inventory data. If it does, bulls will attempt to target the previous high of 43.27.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.