Yesterday’s Trading:

The USD on Wednesday weakened throughout the market. The Fed decided to keep their interest rate at 0.25-0.50%. It was announced that the rate is to be raised twice this year, and not four times as was said earlier. It is this that caused a sharp fall of the dollar.

The Kansas Fed president George voted to lift rates by 0.25%, with the other 9 voting to keep things unchanged. The forecast for the economy and inflation was dropped. After Yellen spoke, experts began saying that the Fed is setting things in motion for rates to be dropped.

US stats came out mixed. The US industrial production index for February stood at -0.5% (forecasted: -0.1%, previous: 0.8%).

The US CPI for February was -0.2% (forecasted: -0.2%, previous: 0.0%). The CPI which doesn’t take food and energy prices into account for the month was 0.3% (forecasted: 0.2%, previous: 0.3%).

Housing construction in the US for February stood at 1.178 million (forecasted: 1.153 million, previous: 1.120 million). There were 1.167 million construction permits issued (forecasted: 1.205 million, previous: 1.202 million).

Market Expectations:

On Thursday the key event of the day for the currency market is the Bank of England’s meeting. The bank is set to keep its interest rate and asset purchases at previous levels. No surprises are expected. I reckon the euro/dollar pair will continue to rise to 1.1280.

Day’s News (EET):

12:00, Eurozone February CPI and January balance of trade figures.

14:00, BoE interest rate and asset purchasing decision, along with BoE minutes.

14:30, US balance of trade for Q4, initial unemployment benefit applications and Philadelphia Fed PMI for March.

Technical Analysis:

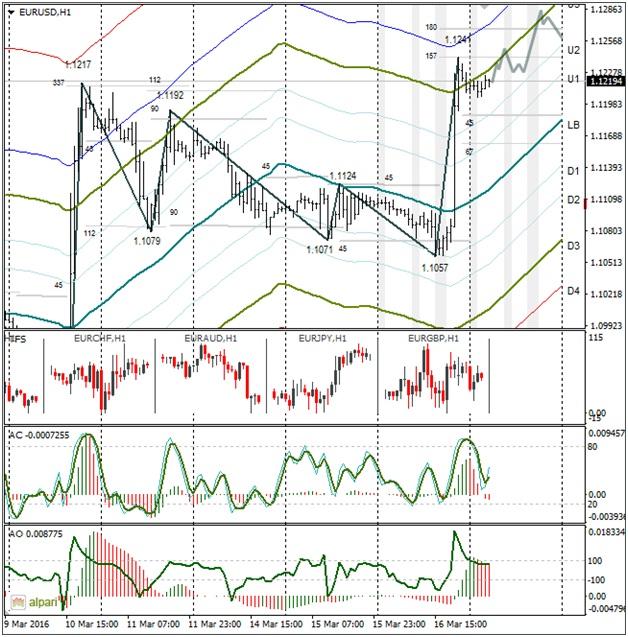

Intraday target maximum: 1.1280, minimum: 1.1205 (current Asian), close: 1.1255.

Intraday volatility for last 10 weeks: 103 points (4 figures).

After the Fed meeting, the euro/dollar headed above the U3 (upper limit of the MA channel). This line will keep the euro from strengthening further. To shift higher, we will need to see the rate hold at its current level for 6 hours. The MA line is facing upwards, so in 6 hours the road to 1.1280 will open up.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.