Yesterday’s Trading:

The euro/dollar closed slightly down on Wednesday. The euro restored from a 1.0945 minimum to 1.1034 on the American session. The buyers managed to win back their day’s losses but couldn’t hold on to their positions above 1.10.

The Reserve Bank of New Zealand (RBNZ) and Canada didn’t have much effect on the euro with their interest rate decisions. However, the risks of a fall for the euro against the New Zealand dollar increased significantly, thereby making the euro fall 156 points against the USD after the RBNZ made their announcement. The Kiwi could provoke a weakening of the euro during European trades.

The RNBZ unexpectedly dropped its rate by 0.25% to 2.25%. The regulator announced that it did so due to the slowing of European and Chinese growth, in addition to that of emerging markets.

The Bank of Canada kept its rate unchanged at 0.5%.

Market Expectations:

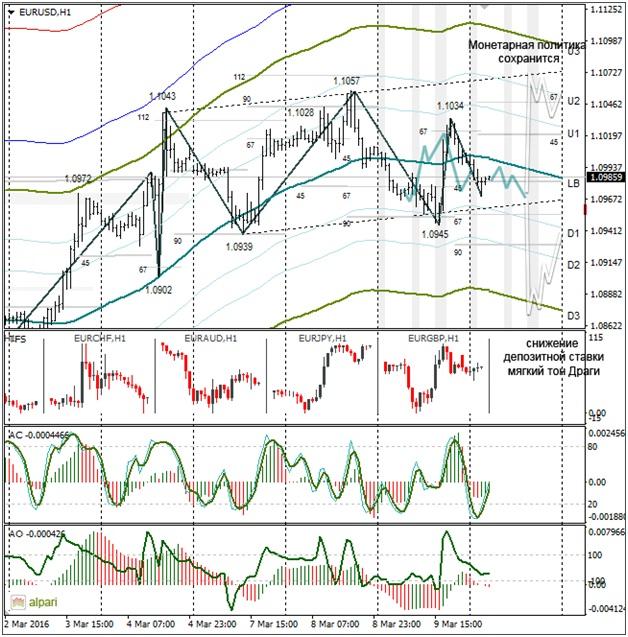

A corridor of 120 points has formed over the 3 days before today’s ECB meeting. EUR/USD is trading around 1.0973. The price is at the lower limit of the corridor.

The market is waiting for the ECB to make an announcement regarding interest rates. Market participants expect interest on deposits to be dropped by 0.1% to -0.4%. Together with this, the ECB could increase asset purchasing from 60 to 75 billion euro per month.

If the ECB undertakes such measures then we can expect the euro/dollar to fall to 1.0880. Since the market has already taken these measures into account, the fall will last a few moments and then shoot back up. It’s unclear what Draghi will say at the press conference, but I reckon what he has to say will be more important than the decisions themselves.

Day’s News (EET):

14:45, ECB decision.

15:30, Draghi press conference.

15:30, Canadian January new housing price index, US initial unemployment benefit applications.

Technical Analysis:

After the fall of the NZD/USD, the euro/dollar fell to 1.0973. The price is near the LB meaning that the market on the hourly is balanced.

No sharp fluctuations are expected before the ECB’s decision comes out. In my forecast I’ve marked out the approximate amplitude of the fluctuations after the decision and Draghi’s speech. Forecasts in different directions are not recommendations to trade. This is how I reckon the market will react; what you think is up to you. I’m against trading during fundamental events due to high volatility and price slippage.

The technical picture on the daily is contradictory. The oscillator stochastic has formed a euro sell signal. Wednesday’s candle is indicating a strengthening of the euro to 1.11. Draghi should allow the situation and set the path of the euro for the month ahead.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.