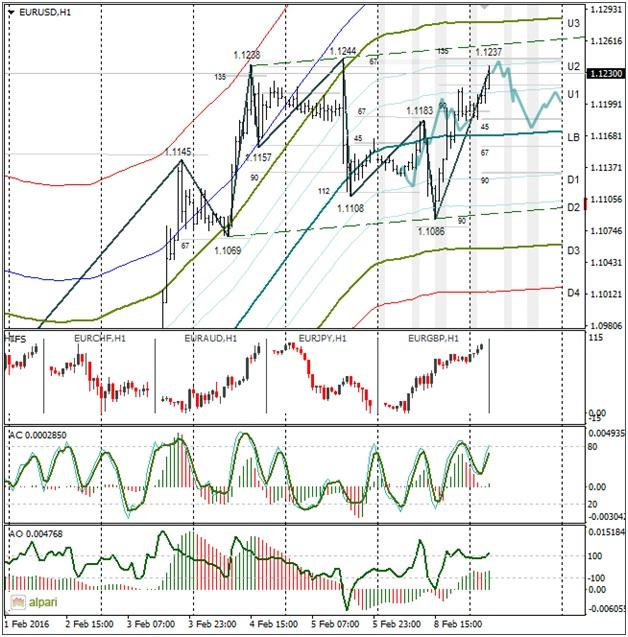

EURUSD 1H

Yesterday’s Trading:

A fall in the oil and stock indices has facilitated a fall in the dollar/yen to 114.20 and a rise of gold to $1,200 per troy ounce. The euro has strengthened against the dollar to 1.1215. The rate rose to 1.1237 in Asia.

The markets are closed for a week in China. Falling oil prices as more reserve reports are set to come out is putting pressure on the stock markets and bonds. The market is in a turbulent zone. The Nikkei 225 has fallen 5% this morning.

Main news of the day (EET):

09:00, German industrial production and balance of trade for December;

11:30, UK December balance of trade, BoE’s financial stability deputy governor, Jon Cunliffe, to speak.

Market Expectations:

The calendar is empty today. Trader attention is on Janet Yellen who is set to speak tomorrow and Thursday (17:00 EET). If she signals that the Fed is to wait and see whether to put up rates this year and not be neutral, the euro/dollar will shoot up. If the Fed chief is neutral, the market will sit in a sideways with sharp fluctuations up and down.

Technical Analysis:

Intraday target maximum: 1.1242, minimum: 1.1168, close: 1.1200;

Intraday volatility for last 10 weeks: 102 points (4 figures).

A complex wave structure has formed on the hourly period above 1.10. The resistance zone passes through 1.1238-1.1244. If we take a look at the channel, we may have a price blowout to 1.1258.

The euro/pound has bounced from the D3 and formed a pinbar. If the European indices don’t fall following the Nikkei 225, a downward correction will begin. The correction on the euro/pound will cause a downward movement on the euro/dollar. Volatility is high so the price could quickly head down to 1.1168 and then return back. So could the euro weaken against the dollar to 1.11? It could we do. Keep an eye on the stock indices and oil.

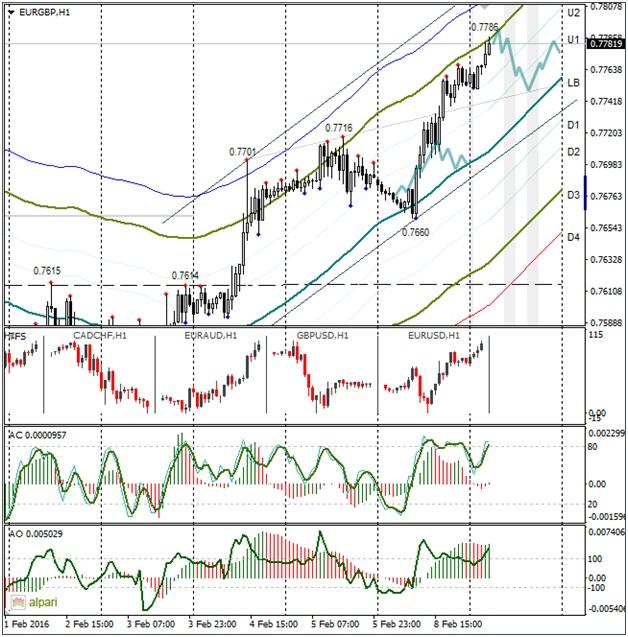

EURGBP 1H

A running from risks has caused a rise in demand for euro throughout the market. The euro/pound bounced from the LB and rose to the MA U3. I expect to see a recoil to the LB on Tuesday, just as we saw on 5th February.

Daily

A euro sell signal is still forming on the stochastic. The CCI indicator is nearing the +100 limit. If the stock indices fall hastens, the technical signals won’t work off and the euro/dollar will depart to 1.1370. If we go off the indicators used on the graph then it’s risky to sell euro.

Weekly

The euro/dollar will shift to 1.1366/70. The sellers can’t stop the euro from strengthening. The fall of the stock indices is supporting the buyers.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.