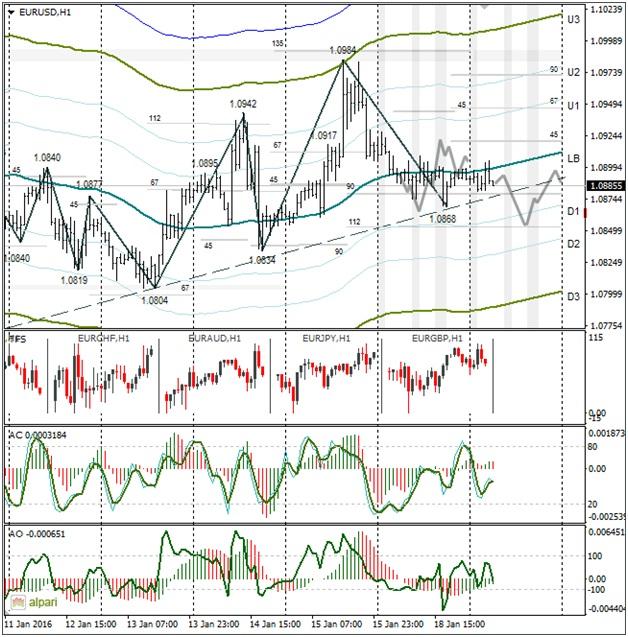

EURUSD 1H

Yesterday’s Trading:

On Monday the euro/dollar spent the day below 1.0900 due to Martin Luther King day in the US. The stock market situation stabilised. Market participants weren’t active as the release of Chinese stats approached.

Main news of the day (EET):

09:00, German December CPI;

11:00, Eurozone November balance of payments changes;

11:30, UK retail sales, PMI and CPI for December;

12:00, Eurozone business sentiment for January from ZEW and November CPI. German ZEW business sentiment;

14:00, BoE governor Carney to speak;

17:00, US housing market index from NAHB for January.

Market Expectations:

China published some data on GDP, industrial manufacturing volume and retail sales. Chinese GDP in 2015 slowed to 6.9% YoY against 7.3% in 2014. The data was as forecasted.

Industrial manufacturing volumes and retail sales were 5.9% and 11.1% against a forecasted 6.0% and 11.3%. The market hardly flinched on news of the data. This just confirms that market participants are having doubts about the dependability and credibility of the statistical data. The stock markets in this case are a better indicator for China. By 06:47 EET they were all up by 1.5% on average.

Trader attention on Tuesday will be on German and UK economic data. A V-shaped pattern with a 1.0854 minimum at 112 degrees is what I have for my forecast.

Technical Analysis:

Intraday target maximum: 1.0904 (current Asian), minimum: 1.0852, close: 1.0887;

Intraday volatility for last 10 weeks: 100 points (4 figures).

The euro/dollar is trading at around 1.0885. The price is near the trend line. Since the Asian stock indices are in the green zone and oil is in the red, in my forecast I’ve gone for a fall of the euro to 1.0854 with a subsequent rebound to 1.0887. I’ve gone for a fall due to the euro/pound cross.

EURGBP 1H

The stock market situation has stabilised. I expect the euro/dollar to fall before the ECB convenes. Due to this, I reckon the euro will be under pressure during the first half of today. According to the pattern, something should similar to yesterday should happen.

Daily

The situation isn’t clear on the time frame.

Weekly

The stochastic indicator and the AC are facing down and the CCI is facing up. There are risks we could see a return to 1.0820.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.