EURUSD 1H

Yesterday’s Trading:

The euro/dollar renewed its maximum of 1.0804 to 1.0887. The euro’s strengthening was facilitated by two factors: a fall in American stock indices and in oil prices after the US Ministry for Energy published its oil reserve report.

The DIJA closed down by 364.81 points (-2.21%) to 16,151.41 by yesterday’s close. The S&P 500 closed down by 48.40 points (-2.50%) at 1,890.28. The Nasdaq Composite closed down by 159.9 points (-3.41%) at 4,526.1.

US oil reserves in the week ending 8th January were up by 0.2 million barrels to 482.6 million barrels. The rise is only slight, but oil extraction and petrol reserves were also up.

Main news of the day (EET):

14:30, ECB minutes from last meeting;

15:30, Canadian new-build housing price index for November;

15:30, US import price index for December, initial unemployment benefit applications, FOMC member Bullard to speak;

16:00, Draghi and Coeure to speak.

Market Expectations:

Thursday’s events of the day are the BoE meeting and ECB minutes. I made a forecast, but it’s hard to tell what the reaction of the crosses will be to the news.

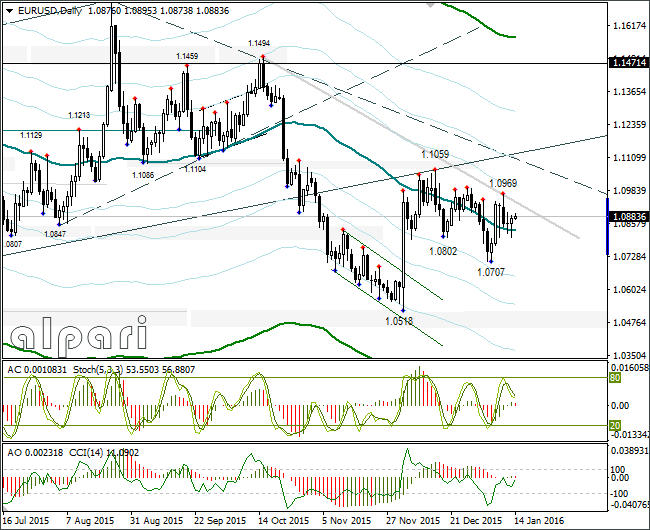

The euro/dollar was trading around 1.0895 at 6:39 EET. The day closed with a pinbar, so prepare yourselves for a renewal of the 1.0969 maximum in the coming days. In my forecast I’ve gone for a rebound to the LB and then a strengthening of the euro to 1.0915. If the euro will strengthen straight up, we should expect to hit 1.0969 today. The Chinese indices are in the negative and the yuan is down.

Technical Analysis:

Intraday target maximum: 1.0911, minimum: 1.0855, close: 1.0895;

Intraday volatility for last 10 weeks: 100 points (4 figures).

The eurobulls have been defending the 1.0800 level. The pair has bounced 90 points from it and there are ongoing attempts in Asia to test the solidity of 1.0900. In my forecast I’ve gone for a rebound to the LB and then a growth. The euro could head straight up since the Chinese indices are in the red zone. The European indices could fall from trade opening in a show of solidarity with the Chinese. The euro/dollar will shift up sharply, so look to sell the euro only at 1.0969 (U3 and 11th January maximum).

EURGBP 1H

The euro/pound cross on Wednesday headed up and thus gave additional haste to the euro. Since the MA is headed upwards, the cross could easily shift to 0.7605. You can decide for yourself whether my forecast is worth a look; it doesn’t take the BoE meeting or the ECB minutes into account.

Daily

After yesterday’s bounce upwards, a pinbar was formed. Its rise was accompanied by risks of a break in the trend line increasing and an increase of the rate above 1.0969. After a rebound to 1.0860, on Thursday we can consider a euro strengthening against the dollar.

Weekly

We need to wait for the weekly candle to close. The balance is tipped in favour of the buyers on the daily.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD remains on the defensive around 1.2500 ahead of BoE

The constructive tone in the Greenback maintains the risk complex under pressure on Wednesday, motivating GBP/USD to add to Tuesday's losses and gyrate around the 1.2500 zone prior to the upcoming BoE's interest rate decision.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.