EURUSD 1H

Yesterday’s Trading:

Yesterday the GBP fell throughout the market and forced the euro bulls to drop to 1.0819. The UK industrial manufacturing index fell to a three year low. Other key currencies followed the pound downwards. After trading closed in Europe, the euro/dollar returned to the LB at 1.0877.

When Chinese balance of trade data came out in the morning and the stock indices switched into the green, the euro/dollar renewed its minimum at 1.0810.

Main news of the day (EET):

- 12:00, Eurozone industrial manufacturing data for November;

17:00, US level of labour market vacancies and work force turnover for November;

17:30, US Ministry for Energy’s oil reserve report;

21:00, Fed Beige Book.

Market Expectations:

All I see for the end of today is a flat. In the first half of the day I expect to see the rate return to 1.0877 and then a sideways until Thursday. There is no important news planned for the euro. The oil reserve report could be a driver for the Canadian and this could put pressure on other currencies.

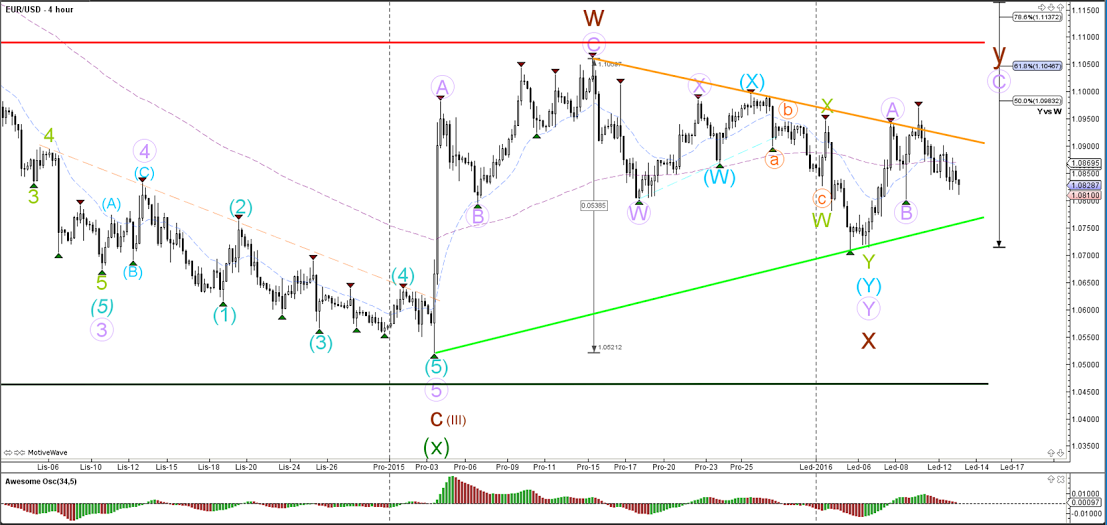

Technical Analysis:

Intraday target maximum: 1.0877 (current Asian), minimum: 1.0810 (current Asian), close: 1.0845;

Intraday volatility for last 10 weeks: 100 points (4 figures).

The euro stood at 1.0828 at 6:46 EET. Bull divergence has formed on the AO indicator. The stochastic has flipped downside up. The 1.0800 level is a decent support and the euro/pound cross could lend a hand too. Since the calendar is empty, my review is just for the European session.

EURGBP 1H

cross. The euro/pound has lifted to 0.7547. Since the Chinese indices are trading up today, the euro/pound has corrected to 0.7469. I’ve come up with two separate scenarios for Wednesday. The first is for a growth with the possible formation of a triangle. Since the growth of the stock indices and the strengthening of the yuan is weak, a fall could resume at any moment. The second scenario is for the formation of a double top.

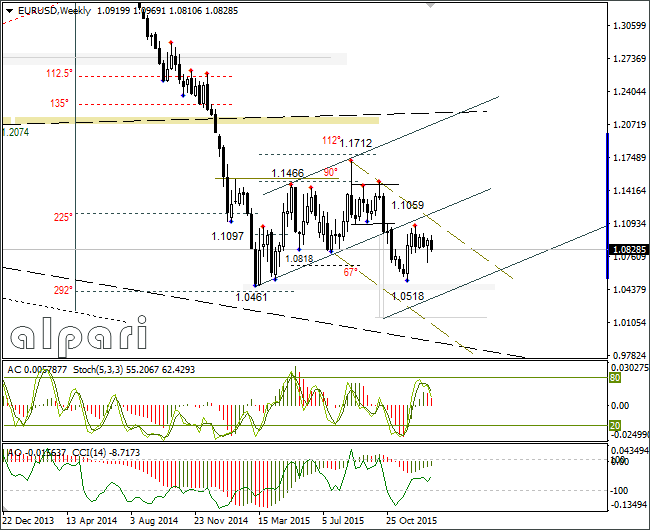

Daily

The euro/dollar has dropped to 1.0810 but didn’t close below 1.0802. There are risks we could head back to 1.0877 from the daily LB.

Weekly

The bears have returned the rate to 1.0810, but the intraday pattern for the past two days has a bullish twang to it. The situation remains unclear on the weekly.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.