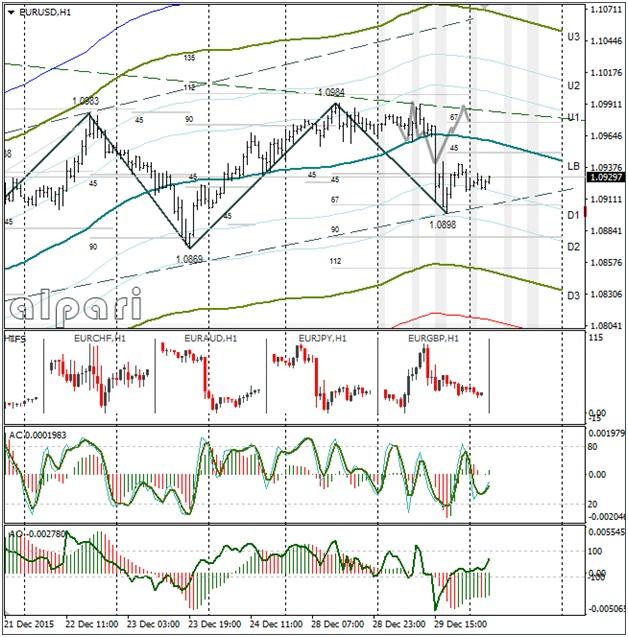

EURUSD 1H

Yesterday’s Trading:

Tuesday’s trading saw the euro/dollar sticking to my forecast up to the American session. By the end of the day the euro had weakened against the dollar by 50 points to 1.0919. The euro bulls couldn’t manage to strengthen above 1.10. The price slid from the daily trend line. The euro fell following the pound when the euro/pound cross switched its path southbound.

Without any news to drive the price, the euro/dollar will keep trading in a sideways with an average price of 1.0940 that it has had for the past 5 trading days.

The US consumer confidence index for December was 96.5 (forecasted 92.5, previous: reassessed from 90.4 to 92.6). This is an excellent figure, but the market knew it was coming.

Main news of the day (EET):

17:00, US data on November incomplete housing sales;

17:30, US Ministry for Energy is publishing oil reserve data.

Market Expectations:

I’ve not bothered with a forecast for Wednesday. The market is thin and the calendar is empty. We now need to think outside the box and against the technical side because the big players find it easier to take down stops and make money on the ruptures (stop orders) and to use large orders for opening positions at profitable prices on the bounce (limit orders).

Technical Analysis:

Intraday target maximum: 1.0988, minimum: 1.0941, close: 1.0983;

Intraday volatility for last 10 weeks: 101 points (4 figures).

The EUR/USD is trading sideways on the thin market. The spread range is 1.0900 – 1.0980. The bulls couldn’t manage to break the daily trend line yesterday. Due to the bearish candles on the daily time frame, the oscillator stochastic has crossed downwards. This means that you should expect the unexpected for today.

For the bears to take back the initiative, the day needs to close around 1.0860. For the bulls to capture December’s flag, they need to strengthen above 1.10.

EURGBP 1H

The euro/pound couldn’t make it out of the upward corridor. It supported the euro with its growth to 0.7393 in the first half of the day up to the American session and put pressure on the pound. No news was behind this movement. In the evening the euro/pound returned to the lower limit of the channel. Due to the USD strengthening, the euro/dollar dropped to 1.0898, the pound/dollar consolidated at 1.4797.

It’s highly likely that we will see a break in the lower limit of the channel and a fall of the rate to 0.7328 (D2) today. In this case, any growth of the dollar will see the pound/dollar stand still and the euro drop. A weakening of the dollar will see the pound/dollar rise quickly and the euro/dollar stand still.

Daily

The attempt to break the trend line didn’t meet with success. The oscillator stochastic has crossed downwards. If the euro/pound cross passes 0.7360, it’s unlikely the euro/dollar will lift above 1.10 this year.

Weekly

The weekly is unchanged.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.