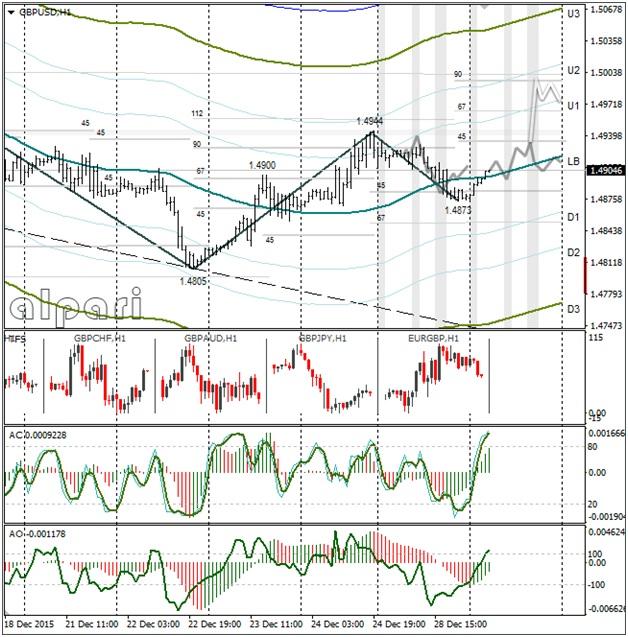

GBP/USD 1Н

Yesterday’s expectations went as planned. Due to a growth in the euro/pound rate the USD weakened. The market is still thin. Be watchful and ready for sharp fluctuations. The hunt for decent stops before New Year is what the big players love most. The calendar is empty, so a spike in volatility is likely to occur through the cross rates.

I’m going for fluctuations near the LB because of the cycles. A break to 1.4995 is also likely since the weekly has seen a hammer form on it.

EUR/GDP 1Н

I added the euro/pound cross because recently it has been hindering me from forecasting the direction of price movement for the euro/dollar and pound/dollar. After the fall to 0.7306 on 23rd December, the pair has flipped into a consolidational phase. The pair has been in an upward corridor for 55 hours. This pattern carries with it risks that the euro will strengthen against the pound to the U3 at 0.7441. Keep track of how the price behaves near the lower limit.

If the sellers are able to pass 0.7350, the pound will have real weight behind it. In the forecast I’ve indicated how the price may move if it leaves the corridor.

Daily

The GBP is trying to win back losses from the USD. All the indicators used in this review are in the camp of the buyers. The GBP is preparing to strengthen on the hourly.

Weekly

I’ve highlighted an inverted bar (hammer) on the graph. If the bulls manage to make a go of the bullish pattern, the GBP/USD will shift to 1.51.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.