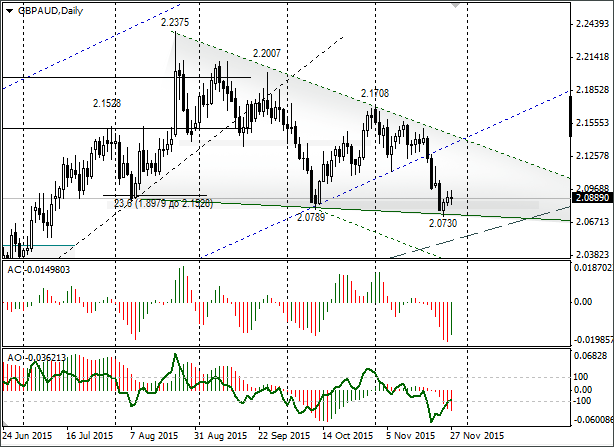

Trading opportunities for currency pair: a strong support from which the GBP/AUD managed to return to 2.0889 has formed. I’ll take a risk in saying that there’ll be growth to 2.13. Any growth above 2.1046 should tell you to hold off selling. A break through 2.0730 will see the rate drop to the trend line at 2.0525.

Background:

The last GBP/AUD idea I made came out on 14th September. The rate at that time was 2.1750. In September I looked at two scenarios. The first was a rebound (sticking basically with the trend) and the second was for if a break in the trend was to take place. In actual fact, the GBP/AUD broke the trend line and after a recoil the pound reached the calculated 2.0913 level (23.6% 1.8979 – 2.1528).

As things are at the moment:

Since August a support (2.0730-2.0873) has been forming. The support is strong. If we make a line along the minimums, we can see a formation that comes together. We now need to set out what we expect from the pair in December.

All trader attention is now on the ECB and FOMC meetings, along with the NFP that is on the horizon. For this cross it’s more important how the pound and the Aussie act against the USD. At the moment, we can look at setting buy stops below 2.0730 as well as pound sales if there’s a break in the support.

The potential for a strengthening of the pound is significantly higher than the potential for a weakening of the currency. If we see a bounce of the price from the support, we can set our eyes on 2.13 and if we see this break then we’ll be looking to 2.0525. I reckon that a fall in the pound will hold the main trend line from the 1.7212 (8th September, 2014) minimum – 1.8979 (6th May, 2015).

Last week saw representatives of the Bank of England, in addition to UK stats, disappoint the buyers. However, whilst the support isn’t broken, we better work with a rebound. A growth above 2.1046 should make you more than think twice about selling.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.