Hourly

Yesterday’s Trading:

On Wednesday the euro/dollar slid to 1.1157. The US dollar received support from US labor market data from ADP which exceeded market expectations.

The Chicago PMI fell from 54.4 to 48.7.

Employment creation in the US private sector stood at 200,000 in September (forecasted: 190k, previous: 190k).

Main news of the day:

From 10:15 to 11:00 EET, Eurozone, French, German and Spanish manufacturing and service sector PMI data for September will be released.;

At 11:30 EET, the UK is publishing its manufacturing sector PMI for September;

At 15:30 EET, US data for initial unemployment benefit applications is out;

At 16:45 EET, the US September index for business activeness in the manufacturing sector is out;

At 17:00 EET we will find out the ISM’s numbers for September manufacturing production.

Market Expectations:

The USD continued to strengthen against the euro in Asia. It is down against AUD due to stats from China and Australia which were positive. It is neither here nor there against GBP.

On Thursday there’s a lot of data out, but it won’t be enough to move the market. I reckon the dollar bulls will have another push forward before Friday’s NFP.

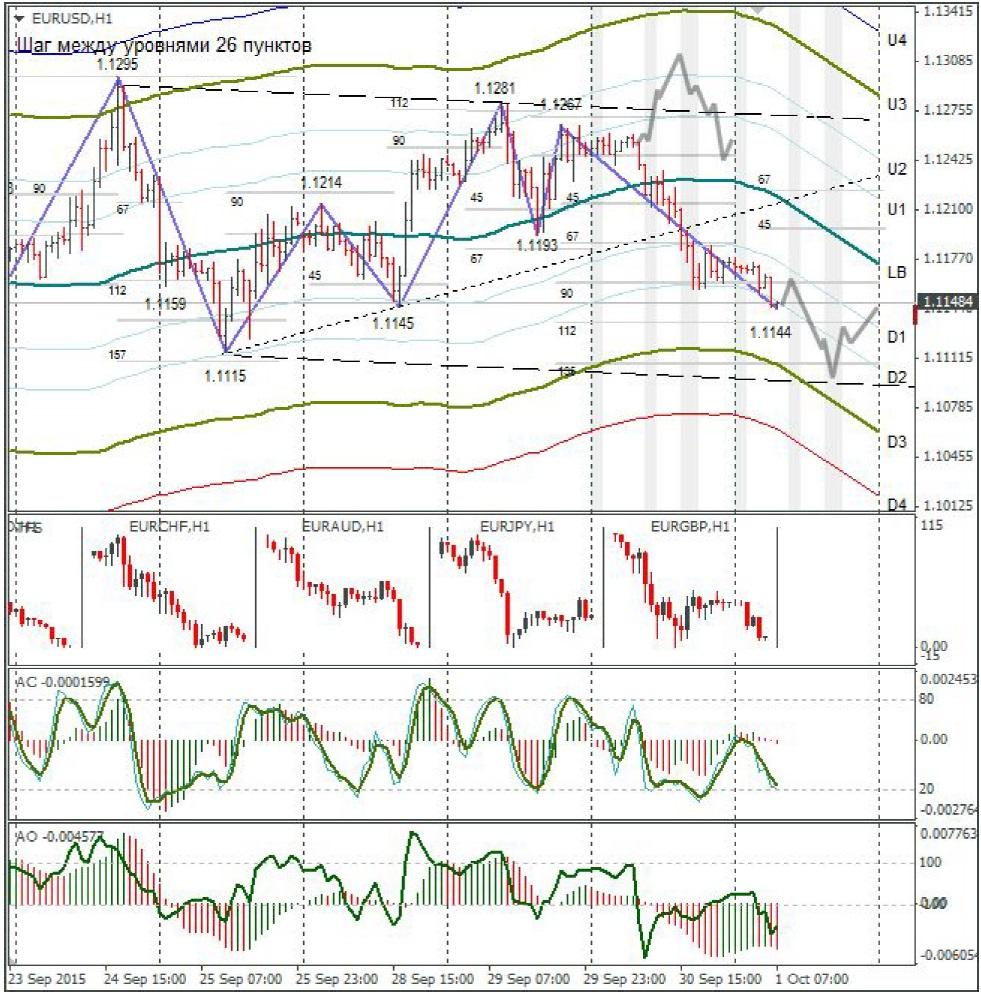

Technical Analysis:

Intraday target maximum: 1.1300 (Europe), minimum: 1.1225 (the States), close: 1.1240;

Intraday volatility for last 10 weeks: 123 points (4 figures).

The month’s candle closed on Wednesday. The month’s stochastic has turned downwards, indicating a fall for the euro for more than a month. The question is, can the bears turn this signal into reality? A triangle has formed on the daily and here we need to make a correct calculation point for the waves since the direction in which the rate will shoot depends on this. I’m forecasting a fall to the lower limit of the channel (dotted line) at 1.1096 and then a rebound from the D3.

Daily

The euro/dollar fell 130 points in three days. A triangle has appeared on the daily. Now we just need to clarify where we can calculate the wave from: 1.1712 or 1.1086. We do have a hint though: the triangle is heading downwards from 1.1712 to 1.1086 and this is wave A. From 1.1086 we get triangle a-b-c-d-e. However, with any unfolding, the euro/dollar should return to 1.1245 from 1.1095. If a break of 1.1086 takes place, we should forget about the triangle. In this case we’ll need to consider the flatness: this will be good for buyers. We could see an upturn from 1.1017 on it. Now to the Weekly.

Weekly

The euro/dollar is still trading in a sideways between 1.1086 and 1.1459. We need to wait for a depart from this channel.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.