When China released its March exports data yesterday, investors thought that the larger than expected stimulus package would arrive soon, as early as in coming weeks after China releases its 1Q GDP. Aussie rallied against the Greenback after the exports announcement, while Dollar index edging higher in this short period of time, clearly reflecting that the consensus is welcoming a sizable stimulus package from China.

AUDUSD (white) vs. DXY (yellow)

Quite a number of investors may not realize that the headline numbers carried high possibility of being overstated, due to inflated invoices used to disguise carry trades conducted by a large number of Chinese companies during the same period in 2013. It became one of the best ways to detour capital controls by the Chinese government.

Fake invoice issues can be explained by the facts that Hong Kong imports from China (YoY) have been falling since last May, when the government started to crack down activities of carry trading. However, the good news is that its biggest trading partners registered decent numbers of imports from China. China’s exports to U.S. rose by 1.2% YoY, and to Germany rose by 9.2% YoY. Exports to these nations are less affected by the fake invoice saga last year. Still, the improvements indicated in the headline figure of minus 6.6% are not to be trusted.

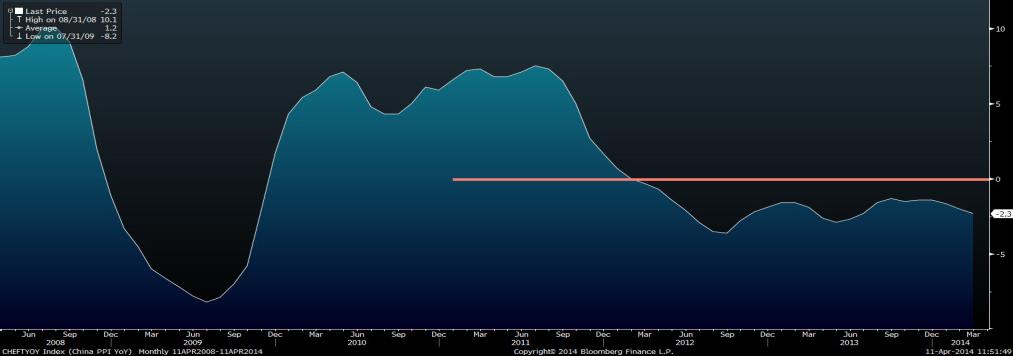

Even so, exports income may not scare policy makers in China. Rising inflation data today from 2% to 2.4% was mainly driven by food prices, not industrial demands. This means that the rising Consumer Price Index (CPI) number will not be sustainable. CPI that is related to sustenance in March rose 4.1% YoY, while it Producer Price Index (PPI) was down 2.3% from 2% last month. PPI has been under negative territories in 24 months. It suggested that industrial demands had weakened for a prolonged period of time due to a larger spare capacity.

China PPI YoY

Aussie buyers also should not be too excited on its domestic labor market report yesterday. Employment changes scored an 18.1K increase; but the number of full-time jobs declined by 22,100 in March, while part-time employment rose by 40,200. Australia’s participation rate, a measure of the labor force in proportion to the population, dropped to 64.7% in March from a revised 64.9% a month earlier. Can all these be considered a positive sign?

Rising Aussie diverged from its real economic underlying strength only prompted the Reserve Bank of Australia (RBA) to ease monetary policy further. Otherwise, the early efforts to lower the currency for its economy growth rebalancing will be unwound.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.