German 10-year bund signals lower US yields

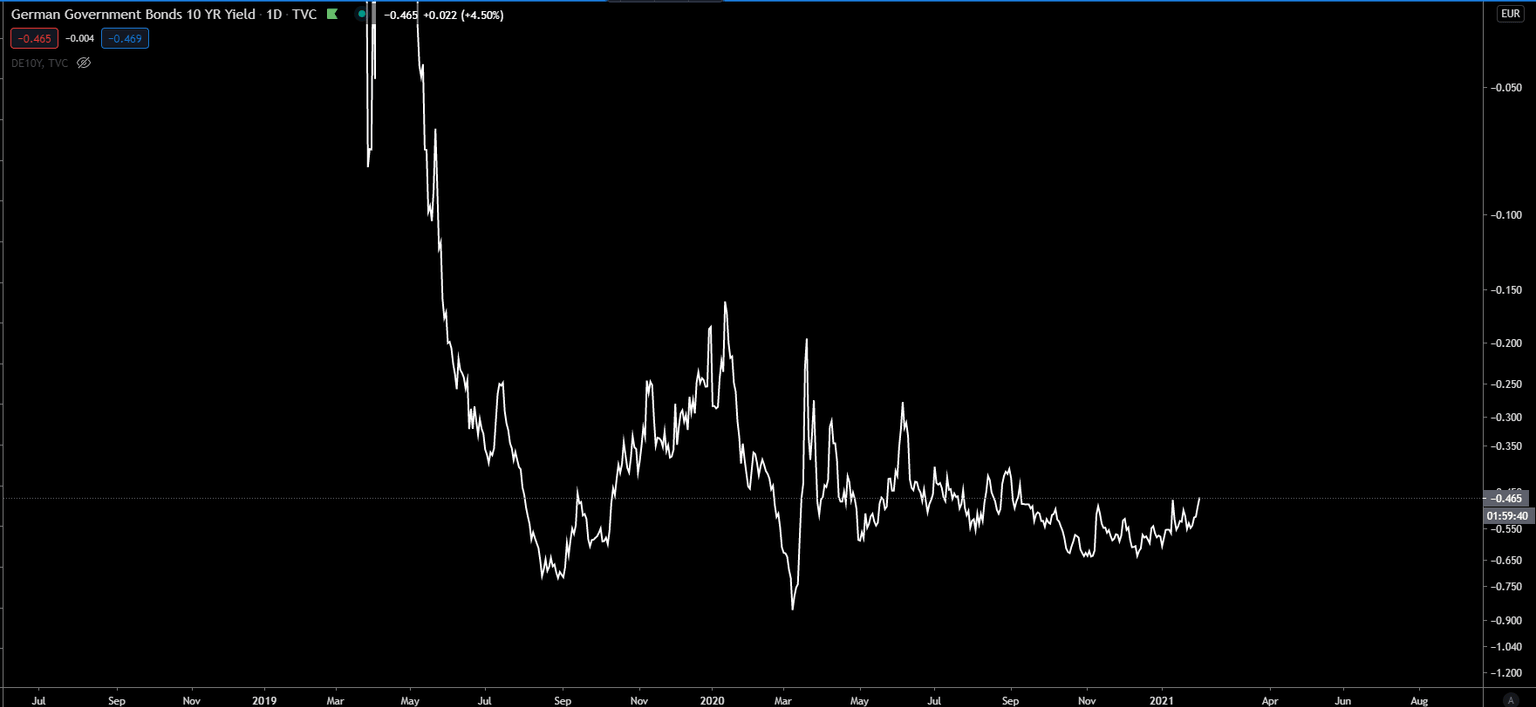

Many are currently looking at the US 10-year yield rising and interpret it as a signal for global reflation. Slightly above 1.00% where the 10s yield currently sits (below) is a far cry from their pre-pandemic high of just under 2% in December 2019 and their high of about 3.25% back in October of 2018. However, if we pretend that just over 1% is actually as meaningful as the mainstream would like us to believe then we should be seeing a similar picture elsewhere. Let’s take a look at the German bund market because Germany is the world’s third largest exporter. Germany also exports a lot to emerging market nations. Therefore, if reflation is truly happening, it should be reflective in the German bund market with higher yields. So, let’s look specifically at the 10-year German bund yield which would be the German equivalent of the US 10-year yield. If you take a look (below, 2nd chart) at the 10-year German bund yield, you can see it has been pinned down since July 2020 and has shown very few signs that it wants to move higher. Now, I understand the euro has been strong which would make exports less competitive, but if reflation was really upon us, certainly the 10s bund yield would be rising, it would then just be a question of its rate of change.

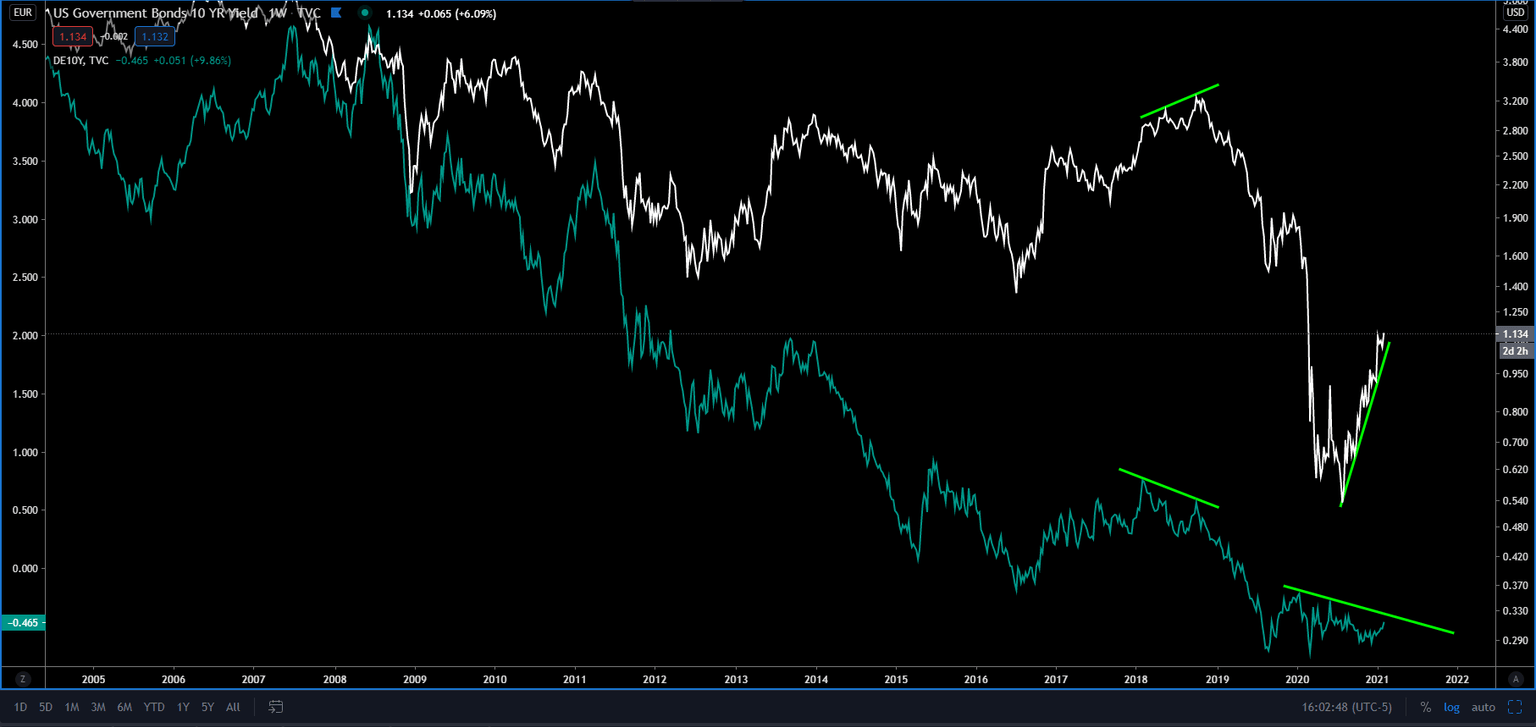

If you take a look (below) at the 10-year US (white) and German (blue) yields, you can see over the last several months they have decoupled from each other. This is significant because if you look at the relationship between the two, they normally move in the same direction. Ironically, the last time they decoupled from each other was in 2018, the last time this reflation/inflation theme was producing as much noise as it is today. The year 2018 was a fake out for the US 10-y yield because after a few months of decoupling they rejoined the 10-y German yield to the downside. About a year and a half later, we entered into a global recession (March 2020). I recently spoke about the US 10-year yield as a leading economic indicator and as a more reliable predictor of what’s to come when compared to equities. It appears the 10-y German bund was an even better leading indicator than the US 10-y this last go around. Sure enough, just like in 2018, US 10-y yield has decoupled from the 10-y bund yield, heading upwards as the 10s bund yield remains on its downward trajectory. If recent history is to repeat itself, that would mean another move lower in US yields, likely being caused by another deflationary shock.

Author

Ryan Miller

Ryan Miller Trading Economics

Ryan Miller received a Bachelors Degree in History from William Paterson University. Through his studies of U.S. history, he developed an interest in the implications the financial markets have on the economy.