GBP/USD Weekly Forecast: Ugly coronavirus contest between UK and US focus of next moves

- GBP/USD has suffered from insufficient BOE support and coronavirus concerns.

- Preliminary UK PMIs, US investment and consumption figures, and coronavirus developments are eyed.

- Mid-June's daily chart is showing bears are gaining some ground.

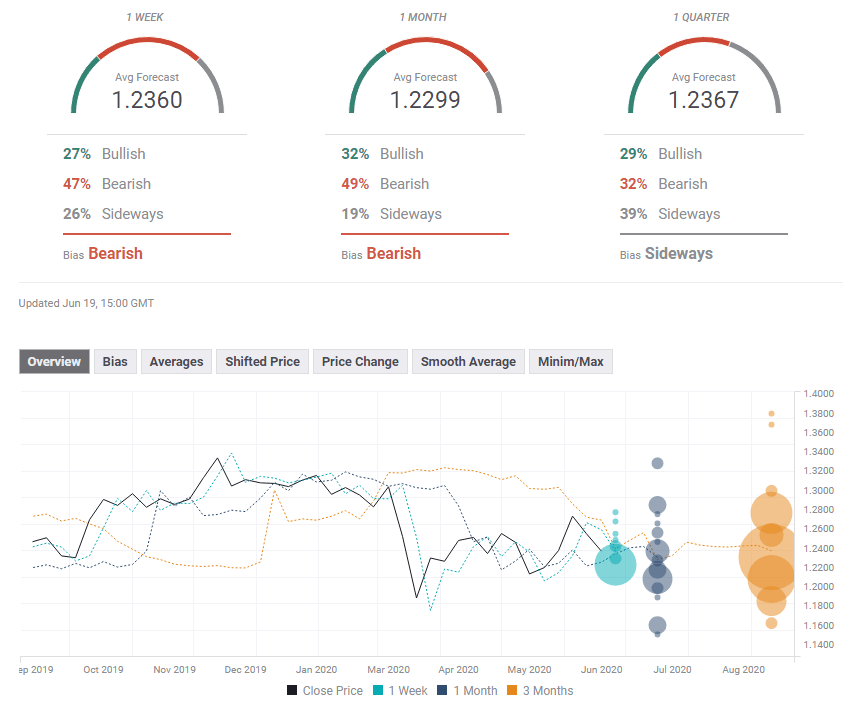

- The FX Poll shows experts are bearish in the short and medium terms.

Bailey has bailed out – the insufficient central bank support has weighed on the pound and rising coronavirus cases in the US boosted the safe-haven dollar. Apart from disease data, forward-looking UK figures, and hard US statics are eyed.

This week in GBP/USD: BOE blow, coronavirus comeback

Andre Bailey, Governor of the Bank of England, seems to have hit the brakes. While the BOE topped up its bond-buying scheme with an additional £100 billion, investors wanted more support. Moreover, the slower purchase pace hinted by the bank also weighed on the pound.

Contrary to the pre-pandemic era, the pound rose when the BOE printed more money and has now dropped as support is drying out.

See BOE Quick Analysis: Three reasons to sell sterling as Bailey seems burned out

Brexit tiger in the tank: Prime Minister Boris Johnson expressed optimism after holding a videoconference with top EU officials. Talks about future relations between the UK and the bloc will restart with format changes and new hopes for a deal. That gave the pound a boost.

However, Germany reportedly expects negotiations to heat up only in September, leaving limited time to clinch an accord before year-end, when the transition period expires. Without an agreement, British companies will find themselves trading at unfavorable World Trade Organization terms.

The UK coronavirus curve continues edging lower, and the government eased the lockdown, with non-essential shops now open to the public. On the other hand, incoming passengers are required to quarantine for 14 days – all but killing the tourism industry. The pound lagged behind some of its peers.

Economic figures were mixed. While the Unemployment Rate remained low at 3.9% in April, jobless claims disappointed with an increase of over 500,000 in May, worse than expected. Headline inflation fell to 0.5% yearly, as expected, but signaling economic weakness.

On the other side of the pond, data was mostly positive. The consumer-centric US economy enjoyed a leap of 17.7% in May's Retail Sales, leaving hope for those seeking to see a V-shaped recovery. Housing Starts remained below one million annualized, yet markets ignored the release. Weekly US jobless claims stabilized around 1.5 million.

Jerome Powell, Chairman of the Federal Reserve, poured some cold water by striking a more cautious tone. While he seemed encouraged by the expenditure data, he repeated his warning that a return to pre-pandemic output may have to wait until the health issues are resolved.

Coronavirus continued worrying investors, as cases and hospitalizations continue accelerating their increase in several southern states such as Florida, Texas, and Arizona. The concerning developments in the south are countered by the ongoing improvement in the greater New York area. The former hotspot continues its gradual return to normal.

Circling back to Britain, researchers at Oxford University proved that a cheap steroid reduced mortality from the disease. That will not have the effect of a vaccine but certainly sounds promising.

UK events: Crushing the curve and PMIs

Brexit talks resume only on June 29, so that should provide a potential break from the saga, yet any significant statement by Johnson or others could rock the pound.

UK coronavirus statistics remain central to the pound, as they indicate the path forward for the reopening – including the 14-day quarantine requirement. Investors will likely ignore figures published on Monday when the "weekend effect" is most pronounced. Figures on other days and new government measures are of interest.

The economic calendar features Markit's forward-looking Purchasing Managers' Indexes for June. The manufacturing sector suffered less and may extend its recovery closer to the 50-point threshold separating expansion from contraction. The services sector is still struggling and had a score of 29 in May. It is also likely to rise.

Here is the list of UK events from the FXStreet calendar:

US events: Watching the Sun Belt, and lots of data

President Donald Trump is holding his first election rally in Tulsa, Oklahoma – an event that will draw some 20,000 people inside and also protesters outside. It may be seen as the firing shot in the campaign after months of focus on coronavirus. Trump's campaign is aware that the rally could turn into a super-spreader event, and asked attendees to waive liability.

Trump is lagging in the polls and may trigger some outstanding comments, especially after his former adviser John Bolton revealed that the president asked his Chinese counterpart for help. However, it is unclear if markets will tune in later in the year.

COVID-19 statistics in Flordia, Texas, and other states remain of interest. A more significant reaction could come if local or state officials reimpose restrictions.

The economic calendar is packed. Markit's preliminary PMIs will likely remain below 50 in June while housing figures are projected to stabilize.

Thursday features a big bulk of events, with the final US Gross Domestic Product set to confirm the annualized 5% drop in the first quarter. Investors may focus on the more recent Durable Goods Orders numbers for May, which are projected to be mixed. The nondefense ex-aircraft figure – "core of the core" – will likely have a considerable effect on markets.

Weekly jobless claims complete Thursday's trio, with a greater focus on continuing claims for the week ending on June 12 – the time when Non-Farm Payrolls surveys are held. A figure above 20 million would be disappointing.

Friday's statistics may also move markets. Personal Income leaped by 10.5% in April amid massive government support and will likely fall. On the other hand, spending crashed by 13.6% and has probably bounced.

Here the upcoming top US events this week:

GBP/USD Technical Analysis

Pound/dollar has broken below the uptrend support line that has accompanied it since the dark days of March and also during May's upswing. It's recent swing also sent it below the 50-day Simple Moving Average – another bearish sign.

Confirmation of the breakout and a loss of upside momentum is necessary for another push to the downside. Nevertheless, trading below the 100 and 200 and SMAs adds to the case for more falls.

The next support line is at a.1.2360, which capped cable in late May. It is followed by 1.23, which was a swing high in mid-MAy, and then by 1.2250, a support line from April. The next lines to watch are 1.

The 50-day SMA hits the price around 1.2410, and that remains a battle line. Some resistance awaits at 1.2460, which provided support in mid-June. It is followed by 1.2680, a swing high from the same time, and close to where the 200-day SMA hit the price. The peak of 1.2810 is the next line to watch.

GBP/USD Sentiment

The downtrend has room to extend, for technical and fundamental reasons. The UK's struggles with coronavirus, Brexit, and sufficient help from the central bank will probably weigh on the pound. The greenback may receive another boost from concerns about US coronavirus and perhaps the end of the sugar rush from the rebound in retail sales.

The FXStreet Forecast Poll is showing that experts see further losses for cable in the short and medium terms, with targets for both terms suffering a downgrade. In the longterm, there is a broad variety of opinions, resulting in a sideways bias.

Related Reads

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.