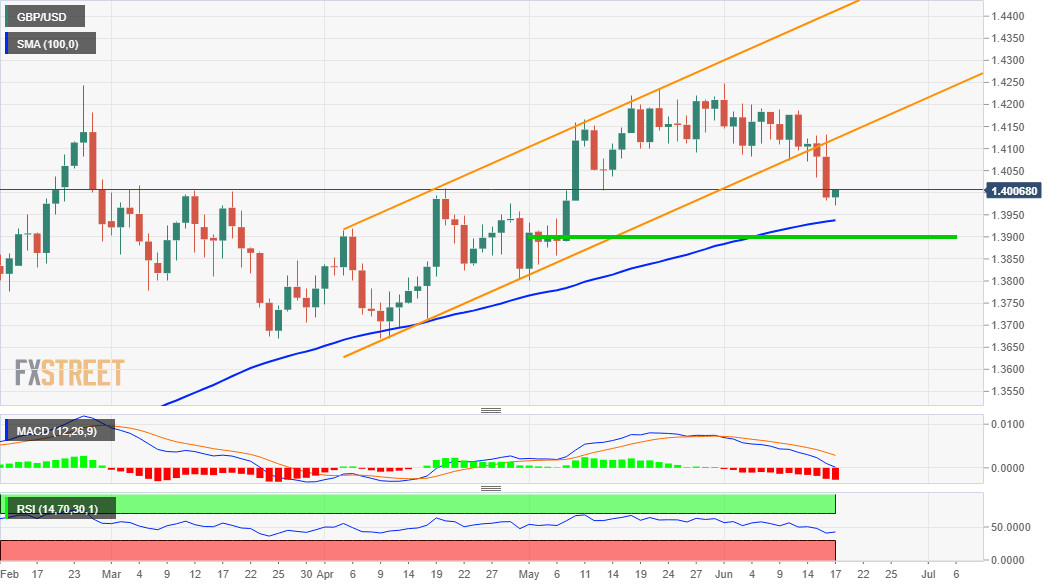

GBP/USD Outlook: Bears likely to target 1.3900 mark

- GBP/USD failed to preserve its intraday gains led by a hotter-than-expected UK CPI report.

- The Fed’s hawkish shifts pushed the USD sharply higher and prompted aggressive selling.

- Ascending channel breakdown supports prospects for a slide towards the 1.3900 handle.

The GBP/USD pair on Wednesday struggled to capitalize on its intraday positive move, instead witnessed a dramatic turnaround and tumbled nearly 150 pips from weekly tops. The pair gained some positive traction following the release of hotter-than-expected UK inflation figures. In fact, the headline UK CPI jumped above the Bank of England's target for the first time in almost two years and came in at 2.1% YoY in May. This marked a sharp acceleration from April's 1.5% and also surpassed consensus estimates for a reading of 1.8%.

The pair touched a daily swing high of 1.4132 before taking a turn for the worse in reaction to a sudden hawkish turn from the Fed, which triggered a massive rally in the US dollar. The Fed stunned investors and signalled that it might raise interest rates at a much faster pace than anticipated previously. The so-called dot plot pointed to two rate hikes by the end of 2023 as against March's projection for no increase until 2024. Adding to this, seven FOMC members pencilled in a rate hike or more in 2022 as compared to four in March.

The Fed officials also upgraded the economic projections significantly for this year. The US GDP is estimated to grow 7.0% in 2021, up from the previous estimate of 6.5%, and 3.3% in 2022. On inflation, the headline CPI is expected to reach 3.4%, a full percentage point higher than the previous estimate. The Fed Chair Jerome Powell, however, still described the price increase as "transitory" at the post-meeting press conference. Nevertheless, the Fed's super hawkish pivot pushed the US Treasury bond yields and the greenback sharply higher.

The downward trajectory dragged the pair below the key 1.4000 psychological mark for the first time since May 10. As investors digested the post-FOMC volatility, the pair found some support at lower levels and gained some positive traction during the Asian session on Thursday. The uptick could be solely attributed to a technical bounce from oversold conditions on hourly charts and runs the risk of fizzling out rather quickly. In the absence of any major market-moving economic releases from the UK, the pair remains at the mercy of the USD price dynamics.

Later during the early North American session, traders might take cues from the US economic docket – featuring the release of the Philly Fed Manufacturing Index and the usual Initial Weekly Jobless Claims. Apart from this, the US bond yields will influence the USD and provide some impetus to the major, allowing traders to grab some short-term opportunities.

Technical outlook

From a technical perspective, the overnight slump reaffirmed a bearish breakdown through a two-month-old ascending trend channel. This, in turn, favours bearish traders and supports prospects for additional weakness. The negative outlook is reinforced by the fact that technical indicators on the daily chart are holding deep in the bearish territory and are still far from being in the oversold zone. Hence, a subsequent decline towards 100-day SMA support near the 1.3945-40 region, en-route the 1.3900 round-figure mark, remains a distinct possibility.

On the flip side, any meaningful recovery attempt might be seen as a selling opportunity and remain capped near the 1.4040-50 region. That said, some follow-through buying might prompt some short-covering move and lift the pair back towards the 1.4100 round-figure mark. This is closely followed by the trend-channel support breakpoint, around the 1.4115-20 region, which should act as a strong headwind for the major.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.