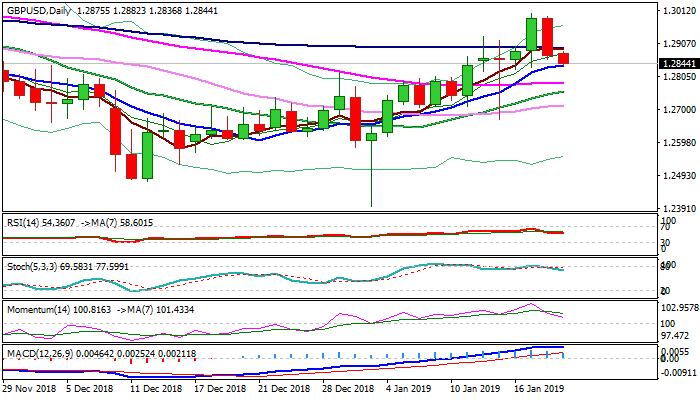

GBPUSD

Cable ticked lower in early European trading, after narrow-range trading in Asia on Monday, but remains at the back foot following Friday’s 0.9% fall after repeated rejection at psychological 1.30 barrier.

Sterling was hit by weak UK retail sales data on Friday which added to Brexit uncertainty, ending day firmly in red and generating negative signals on formation of bearish outside day pattern and daily close below 100SMA (1.2892).

Fresh extension lower penetrated daily cloud (cloud top lays at 1.2866) and cracked 10SMA (1.2840), also top of rising 4-hr cloud, which is narrowing and could attract bears, showing scope for test of next pivotal support at 1.2800 (Fibo 38.2% of 1.2476/1.3000).

Momentum and slow stochastic on daily chart created bear-crosses and head south, supporting negative scenario.

Also, last week’s close in long-legged Doji signals strong indecision and suggests that recovery off 1.2476 low might be running out of steam.

Negative near-term sentiment is maintained by Brexit concerns as PM May is due to reveal the ‘plan B’to the UK parliament later today, after her proposal for Brexit was heavily defeated last week.

Several scenarios over Brexit are on the table, but rising uncertainty is expected to keep sterling under pressure.

Sustained break below 1.2800 Fibo support would signal deeper pullback and expose 1.2735 (daily cloud base / 50% retracement of 1.2476/1.3000).

Only return and close above daily cloud top would ease bearish pressure, but lift above 100SMA is needed to neutralize.

Res: 1.2866; 1.2892; 1.2953; 1.3000

Sup: 1.2800; 1.2781; 1.2758; 1.2735

Interested in GBPUSD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.