The GBP/USD pair trades near its recent lows, having fell down to 1.5452 late Wednesday. Pound was on a one-way ride towards the downside, as fears over a delay in a rate hike, following Chinese turmoil, extended to the UK.

Additionally, investors returning to the greenback on equities advances weighed on the British currency and the pair consolidates its recent losses, having found selling interest in the 1.5500/10 during the ongoing European session. The only macroeconomic release in the UK was the Nationwide House Prices for August that grew at a slower pace yearly basis, down to 3.2% from 3.5% in July. For the month, prices rose by 0.3%. The US will release its advanced GDP reading for the Q2 in a couple of hours, and if the number matches or surpasses expectations, the pair can extend its decline. Anyway on Friday, the UK will release its own GDP figures, which may result in another strong directional move, depending clearly, on the result.

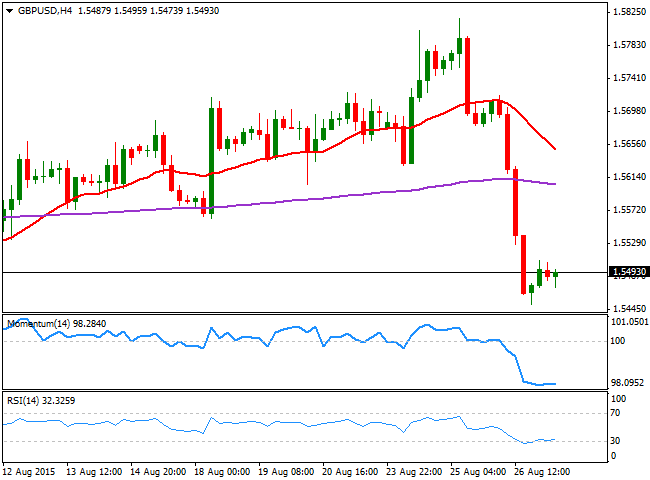

Technically, the 4 hours chart shows that the bearish bias prevails, as the price is well below its moving averages, albeit the technical indicators have lost their downward strength near oversold territory, supporting additional consolidation, or even an upward corrective movement up to the 1.5540/50 region, where selling interest is expected to resume. Above this last however, the pair can extend up to 1.5580/90, should US data disappoint.

Below the mentioned daily low on the other hand, the ongoing bearish trend can extend down to 1.5410 in the short term, and once below this last, towards 1.5370.

View Live Chart for the GPB/USD

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.