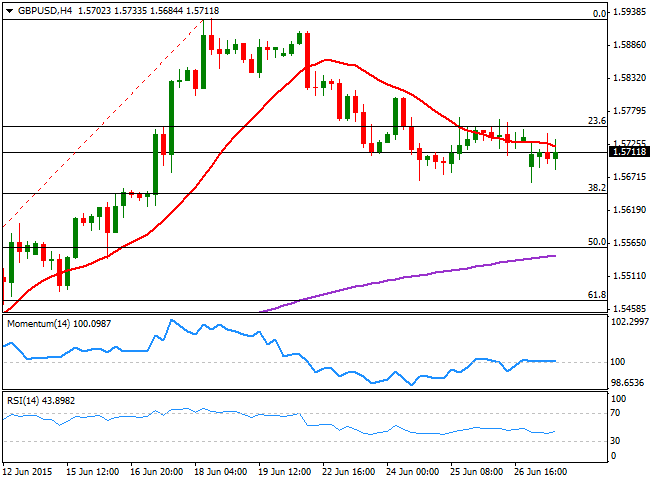

The GBP/USD pair hovers around the 1.5700 level this Monday, holding pretty well to market chaos. An early gap saw the pair falling down to 1.5663, but it was quickly filled and the pair continues to trade directionless, in between Fibonacci levels. In the data front, UK mortgage approvals fell in May from an over a year high. The decrease is being attributed to higher prices and less offer in the housing market, overall negative for Pound.

Nevertheless, the 4 hours chart presents a neutral technical stance, as the Momentum indicator holds horizontal around the 100 level, whilst the price stands around a mild bearish 20 SMA. The RSI indicator in the same chart, looks more bearish, heading lower around 40. Still the pair has to break below 1.5645, the 38.2% retracement of the latest bullish run to confirm a downward acceleration, eyeing then a 100 pips decline towards the 1.5550 region, 50% retracement of the same rally.

Selling interest is aligned at 1.5750, the 23.6% retracement of the same rally that capped the upside for most of the last week, so it will take a clear break above it to confirm a bullish extension, up to the 1.5800/10 region.

View live chart of the GBP/USD

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.