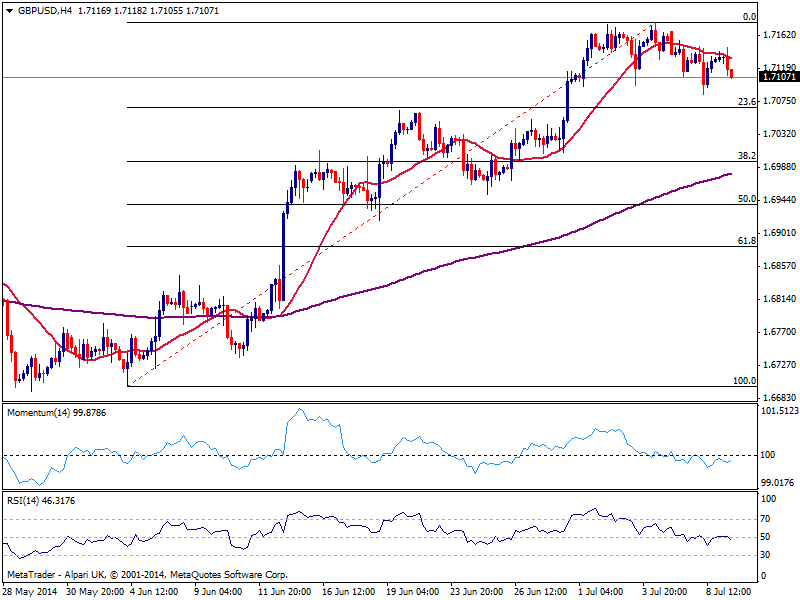

The long term outlook for GBP/USD is still bullish, and downward movements are understood mostly as corrective, giving buying opportunities rather than suggesting a top is in place: there’s a long way down before the pair can confirm a trend reversal, most likely a break below 1.6880, 61.8% retracement of the latest bullish run.

But in the short term, a mild bearish tone prevails according to the 4 hours chart that shows indicators turning south below their midlines, and price capped below its 20 SMA. 1.7060 is the immediate support as if below, the downward potential may extend down to 1.7000 price zone. On the other hand, a recovery above 1.7150 is needed to revert the short term negative tone, and see a quick recovery towards 1.7180, in route to 1.7220 price zone.

View Live Chart for GBP/USD

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.