- GBP/USD has been on the back foot as the dollar strengthens alongside rising yields and bubble concerns.

- Potential new taxes in the UK budget are set to cap any recovery.

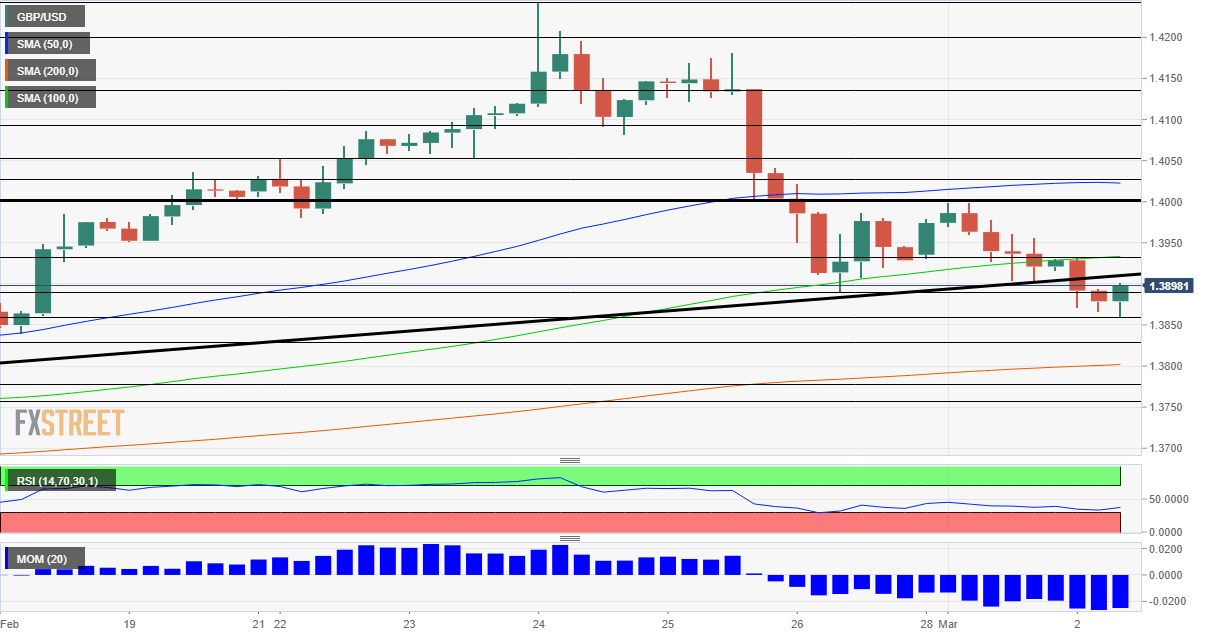

- Tuesday's four-hour chart is pointing to further losses for the currency pair.

Turnaround Tuesday – the relief rally on Monday has proven short-lived as the gloom returns to markets, and that is boosting the safe-haven dollar. The trigger came from a Chinese regulator who labeled foreign markets as a "bubble," but the greenback is mostly benefiting from elevated US yields.

Returns on ten-year Treasuries have been hovering around 1.40% and they make the world's reserve currency more attractive. The reason that investors continue to shy away from US debt stems mostly from the Federal Reserve's Lassiez Faire approach – it is more worried about ten million unemployed Americans than about prospects for inflation. The latest to this message was Thomas Barkin, President of the Richmond branch of the Federal Reserve.

Lael Brainard, Governor at the Fed, speaks later in the day and she is unlikely to express concerns about rising long-term borrowing costs. In any case, investors are awaiting Chair Jerome Powell's verdict on Thursday. The world's most powerful central banker will speak for the last time before the Fed enters its blackout period ahead of its mid-March rate decision.

Sterling bulls are also on standby ahead of the UK budget presentation on Wednesday. Chancellor of the Exchequer Rishi Sunak is set to lay out new economic forecasts and potentially corporate tax hikes. Concerns that businesses would struggle with higher costs will probably continue weighing on sterling, at least until the full details are out. Uncertainty hamstrings the pound.

While the UK's vaccination campaign gives it an edge, investors may err on the side of caution ahead of the budget and Powell's speech. Another event awaiting markets is the Senate's debate over President Joe Biden's $1.9 covid relief package, due for discussion only on Wednesday.

GBP/USD Technical Analysis

Pound/dollar has dropped below a long-term support line. Momentum on the four-hour chart remains to the downside and cable lost the 100 Simple Average. All in all, bears have the upper hand.

Support awaits at the daily low of 1.3860, followed by 1.3830 and 1.3775, which played a role in mid-February, on the way up.

Resistance awaits at 1.3930, where the 100 SMA hits the price, followed by the psychologically significant 1.40 level. Further above, 1.4025 and 1.4050 are the next levels to watch.

Five factors moving the US dollar in 2021 and not necessarily to the downside

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.