GBP/USD Forecast: Waiting for a bullish breakout

GBP/USD Current price: 1.4187

- UK Brexit Minister David Frost recognized that the UK failed to secure the wanted agreement.

- UK Retail Sales are foreseen surging a whopping 36.8% YoY in April.

- GBP/USD continues to depend on how investors see US inflation developments.

The GBP/USD pair bounced back, and trades near a daily high of 1.4189 as demand for the dollar receded. The market continues trading according to expectations of rising inflationary pressures in the US and how those could affect the Federal Reserve monetary policy. The favourite measures are government bond yields, which soared with FOMC Minutes on Wednesday, but quickly retreated to end Thursday near weekly lows.

UK Brexit Minister David Frost recognized that the UK failed to secure the Brexit agreement it wanted for Northern Ireland. The Irish Sea border is still causing difficulties to Irish producers with mounting tensions with France over fisheries. The market, however, seems to have already priced in the new Brexit “normal” and trades accordingly. The UK will publish April Retail Sales on Friday, expected to have increased by 4.5% MoM and 36.8% YoY. Markit will release the preliminary estimates of its May Services and Manufacturing PMIs for the kingdom.

GBP/USD short-term technical outlook

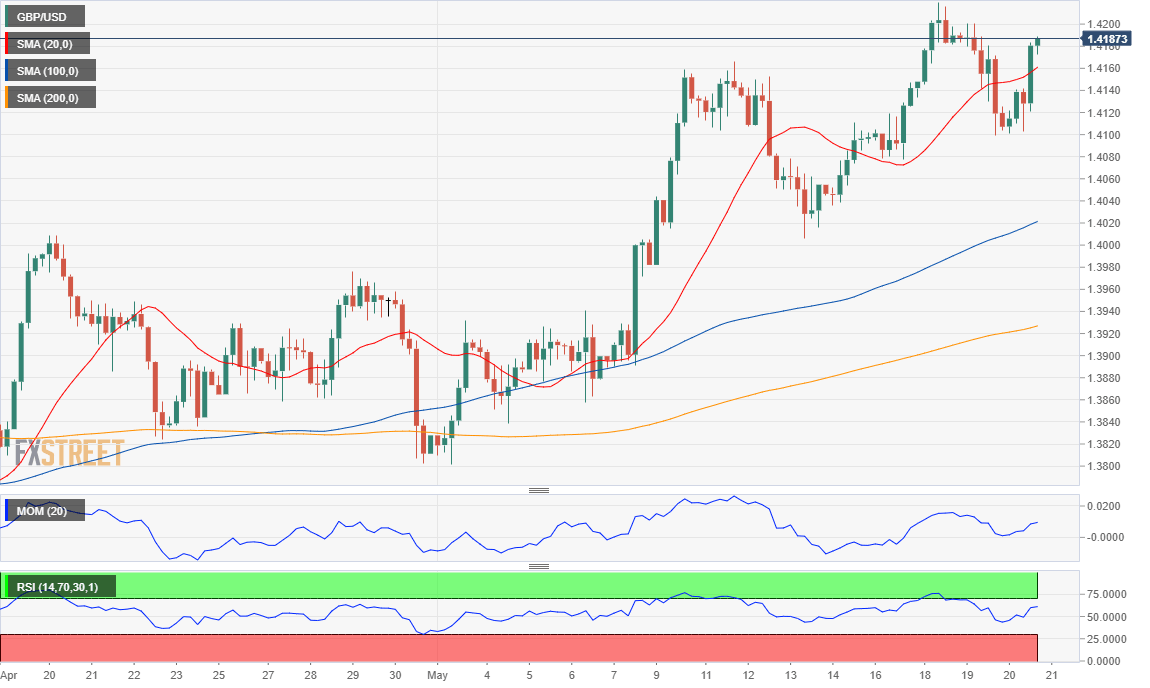

The GBP/USD pair is neutral in the near-term, and needs to advance above 1.4219, the monthly high, to resume its advance. The 4-hour chart shows that the pair recovered above its 20 SMA, which heads higher, although technical indicators lack directional strength, the Momentum within negative levels and the RSI at around 61. The pair could turn bearish heading into the weekly close if it breaks below 1.4095, a strong static support level.

Support levels: 1.4140 1.4095 1.4065

Resistance levels: 1.4220 1.4260 1.4310

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.