- The dollar is gaining ground as President Biden may eventually pass a large stimulus bill and yields are rising.

- America's vaccination campaign is catching up with Britain's, also supporting the greenback and weighing on GBP/USD.

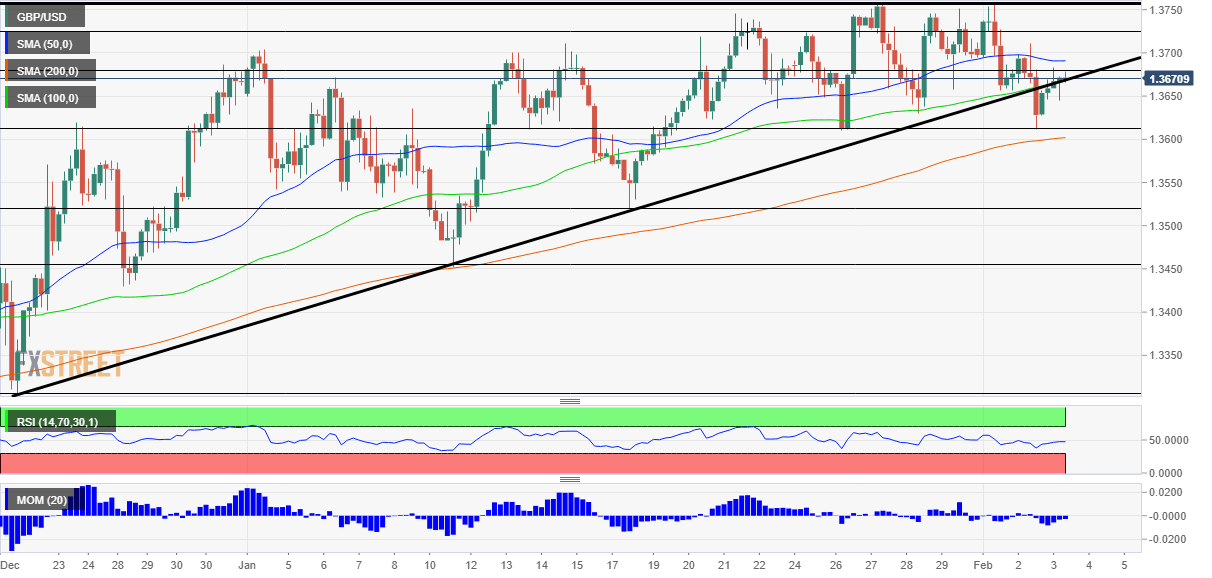

- Wednesday's four-hour chart is pointing to further losses for cable.

Any positive thing has to come in the right dosage – America's stimulus package may be larger than expected and that is weighing on GBP/USD after boosting it earlier. The US dollar has been gaining ground as investors sell Treasuries in response to higher prospects of a generous relief package.

Senate Democrats have advanced a partisan reconciliation bill, taking the first step in potentially approving President Joe Biden's proposed $1.9 trillion stimulus package. The move on Tuesday surprised markets after the Commander-in-Chief met a group of ten Republican lawmakers who offered a counter proposal of only $600 billion. The unilateral move by Biden's party raises the chances for "going big" – support worth closer to the upper edge.

The prospects of more robust US growth – as well as elevated debt issuance – weigh on bonds and the resulting higher yields make the greenback more attractive. Moreover, America's economy is getting a shot in the arm from a ramped-up vaccination campaign. Pharmacies are set to begin administering vaccines next week while both Pfizer and Moderna also upgraded its forecast for delivering doses of the vaccine.

The UK is mostly reliant on AstraZeneca's immunization solution, and there is good news on the front as well. Britain's bet on a three-month gap between the first and second inoculations has proved more efficient than a tighter timetable. That would allow reaching more people quickly, boosting the economy. Will this upbeat news boost sterling? That remains an open question.

On both sides of the pond, coronavirus cases and hospitalizations are declining, keeping a tight race. Apart from the vaccine and political developments, pound/dollar is set to move in response to two top-tier US data points. ADP's labor figures are projected to show a small increase in private-sector employment, while the ISM Services Purchasing Managers' Index is forecast to edge lower. Both statistics serve as leading indicators toward Friday's Nonfarm Payrolls.

See

- ADP Employment Change January Preview: A return to hiring?

- Purchasing Managers' Index January Services Preview: No reason to pull back now

All in all, the battle is raging, but sterling lost the edge it had.

GBP/USD Technical Analysis

Bears have defied the ascending triangle pattern – a bullish one. Pound/dollar has slipped below the uptrend support line. While it is still fighting to recapture the line, the currency pair has slipped below the 100 Simple Moving Average on the four-hour chart, a bearish sign and momentum remain to the downside.

Support awaits at the weekly low of 1.3610, followed by 1.3520 and 1.3455, which were stepping stones on the way up in January.

Resistance is at 1.3675, the recent high, followed by 1.3720, a previous 2021 peak, and then by 1.3752, the multi-year high.

GBP/USD Price Forecast 2021: Cable braces for calendar comeback amid three exits

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.