ADP Employment Change January Preview: A return to hiring?

- January private ADP payrolls forecast to add 49,000 positions.

- Decline of 123,000 in December was the first since April.

- Nonfarm Payrolls predicted to return to job creation at 50,000 in January.

- Initial Jobless Claims have continued to rise in January.

- ADP prefigures national payrolls but does not impact markets.

American businesses are expected to regain the employment initiative in January as the California lockdown ends and viral diagnoses and hospitalizations recede, lifting concerns about overwhelming the US health system.

Payrolls for the private computer accounting firm Automatic Data processing (ADP) are forecast to add 50,000 employees in January after shedding 123,000 in December.

ADP Employment Change

Nonfarm payrolls (NFP), the national jobs statistic, are projected to return to hiring with 50,000 new workers in January following the loss of 140,000 in December.

Initial Jobless Claims and payrolls

Claims were the now famous signal last March that heralded the swiftest rise in unemployment in US history when almost 21 million people were fired in April 2020.

Jobless filing have also prefigured the decline in job creation in November and December for ADP and NFP.

Requests for benefits in November were split. The first and last weeks were 711,000 and 716,000, the lowest of the pandemic. But for the two weeks in the middle of the month claims rose 7.6% to 767,500. Notwithstanding the increases, the November average of 740,500 was the lowest of the era and and 58,000 less than October.

Initial Jobless Claims

FXStreet

Claims had increased briefly in July and in August but those gains had not augured a rise in layoffs or a drop in hiring. At the end of November, with the lowest claims average of the pandemic, the labor market could still be seen as improving.

That illusion ended in the first week of December. Initial claims jumped to 862,000 followed by 892,000, the highest two weeks since early September. The month averaged 837,500, the most since 870,250 in September.

Private and national payrolls reflected December's deterioration in the job market. Nonfarm shed 140,000 workers and ADP lost 123,000, the forecasts had been 71,000 and 85,000 respectively. These were the first losses for both since April.

The predictive issue for January is that claims have continued at the much higher pace, averaging 867,500 through January 22 and are forecast to be 830,000 in the week of on January 29 due this Thursday.

Analysts have postulated the resumption of hiring in January despite the still rising unemployment claims with 49,000 scheduled for ADP and 50,000 for NFP.

Conclusion

Based on the behavior of the claims and payroll statistics over the course of the pandemic lockdowns, the January forecasts for ADP and NFP would seem to be optimistic.

However, if the cessation of hiring in most of the country in December was based on concerns that the pandemic was still rising rather than the specifics of the California job market, then the reversal of those health statistics overt the past few weeks may have instilled sufficient confidence in employers to resuming hiring.

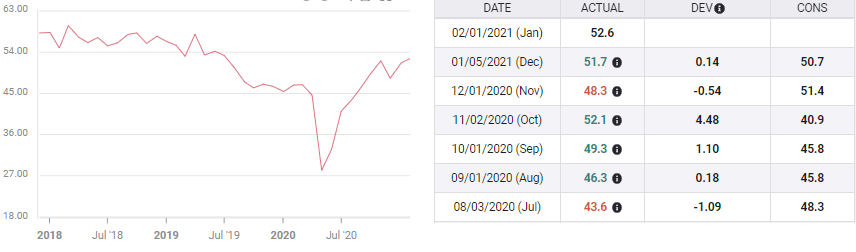

Business outlook remains strong and reflects a positive view of the future.The Manufacturing Employment Index from the Institute for Supply Management rose to 52.6 in January, the best of the pandemic and the highest since January 2019.

Manufacturing Employment PMI

Markets will not trade the ADP release, but it will prime traders for Friday's NFP event.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.