GBP/USD Forecast: Sterling runs despite Brexit chaos

GBP/USD Current price: 1.3350

- Market players are leaving aside Brexit woes, with only a few weeks to reach a deal.

- UK‘s chief negotiator Frost ready to recommend leaving without an agreement.

- GBP/USD is overbought but without signs of upward exhaustion.

The GBP/USD pair broke higher at the end of the week to reach a fresh 2020 high of 1.3356, ending the week a handful of pips below this last. The absence of UK macroeconomic data and Brexit-related headlines played in favor of the sterling’s advance. However, there are only a few weeks left to seal a deal as EU officers said that they would need a couple of months to ratify any treaty before the end of the transition period on December 31.

Talks are stalemate. The EU refuses to discuss any other issue unless the UK engages on state aid, while UK‘s chief negotiator, David Frost, has said that he will recommend leaving without a deal if demands persist that the UK should align with its rules on state aid. So far, the market seems this negative factor is being left aside. The kingdom won’t publish macroeconomic data this Monday.

GBP/USD short-term technical outlook

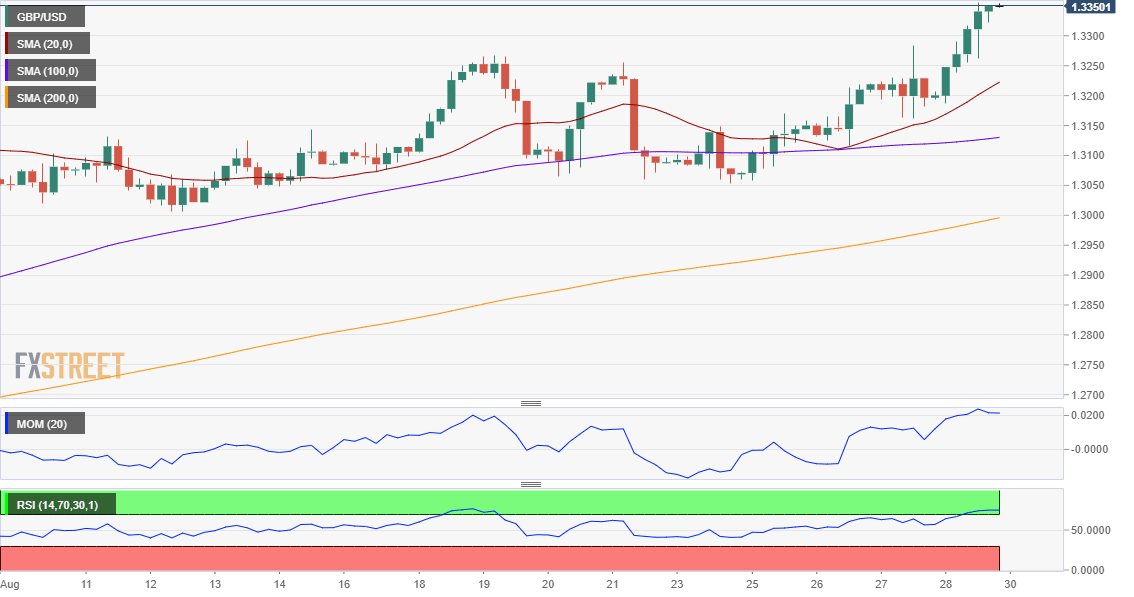

The GBP/USD pair is bullish according to the daily chart, as it accelerated its advance beyond a mildly ascendant 20 DMA. Technical indicators, in the meantime, present upward slopes within positive levels. In the shorter-term, and according to the 4-hour chart, the pair is overbought but without signs of bullish exhaustion. The 20 SMA has accelerated north above the 100 SMA, both well below the current level, while the Momentum indicator heads firmly higher and the RSI consolidates around 74.

Support levels: 1.3320 1.3285 1.3250

Resistance levels: 1.3360 1.3400 1.3445

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.