GBP/USD Forecast: Sterling overreaches and at risk of a pullback after soaring to highest in 2020

- GBP/USD has hit the highest levels since December amid dollar weakness.

- Concerns about Brexit and rising UK coronavirus cases and BOE Governor Bailey's speech are eyed.

- Friday's daily and four-hour charts are pointing to overbought conditions.

Powered by Powell – GBP/USD bulls can thank Federal Reserve Chairman Jerome Powell for the recent rise. The world's No. 1 central banker announced a major policy shift – allowing inflation to overheat to allow employment to rise – thus signaling lower rates for longer.

Investors had anticipated the move and the initial reaction was choppy – but after the dust settled, the prospects of long-term low borrowing costs are weighing on the dollar.

See Powell Quick Analysis: Fed fires on all cylinders, three factors fueling gold stocks, downing dollar

On the other side of the pond, there are fewer reasons to be cheerful. Apart from the damp weather, Britain is probably edging closer to a no-trade-deal Brexit. According to The Times, EU officials have laid down an ultimatum of two weeks in order to clinch a breakthrough in trade and security talks. David Frost, the UK's chief negotiator, reportedly rejected Brussels' approach and said he would not accept "dictates."

Andrew Bailey, Governor of the Bank of England, will address the virtual Jackson Hole Symposium – the same venue where Powell spoke. Bailey may respond to his American colleague by expressing openness to a similar policy.

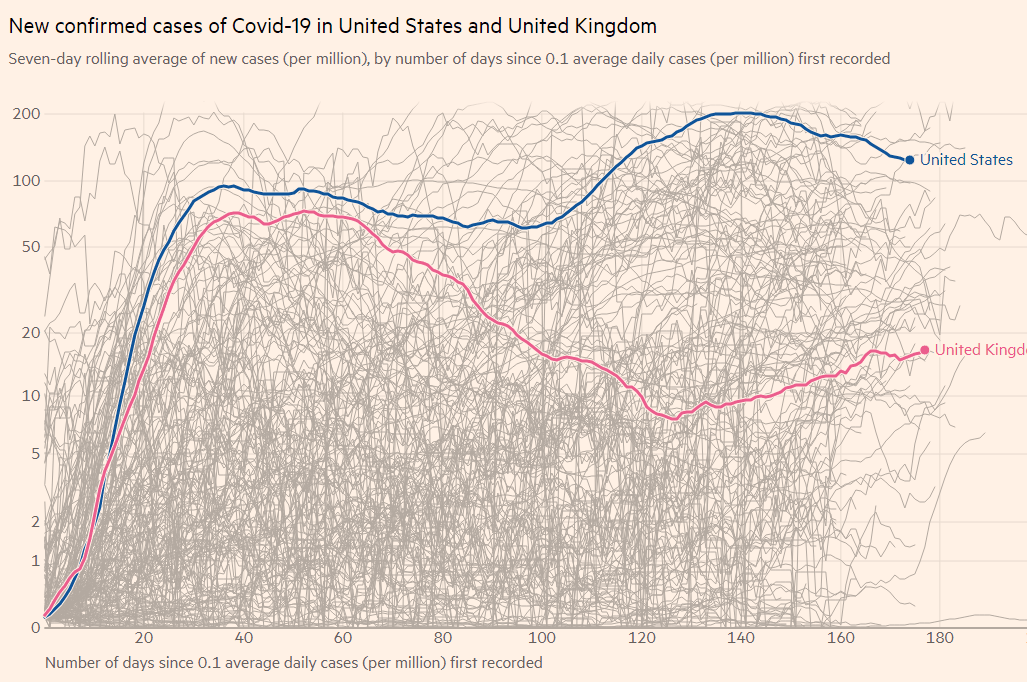

Another reason for concern is the increase in coronavirus cases in the UK, just as the school year begins. Authorities are scrambling to reopen schools safely, and the task has become harder amid an increase in infections. That compares with a gradual decrease in America's COVID-19 curve.

Source: FT

Apart from coronavirus headlines, markets will be watching American economic indicators. Personal spending and personal income have likely stabilized in July after several turbulent months. The economy seemed to be on a recovery path from May, albeit slowing down in the summer.

See Personal Income, Spending and Prices July Preview: The second opinion concurs

Thursday's initial jobless claims dropped back toward one million while continuing claims remained stubbornly high at 14.5 million.

GBP/USD Technical Analysis

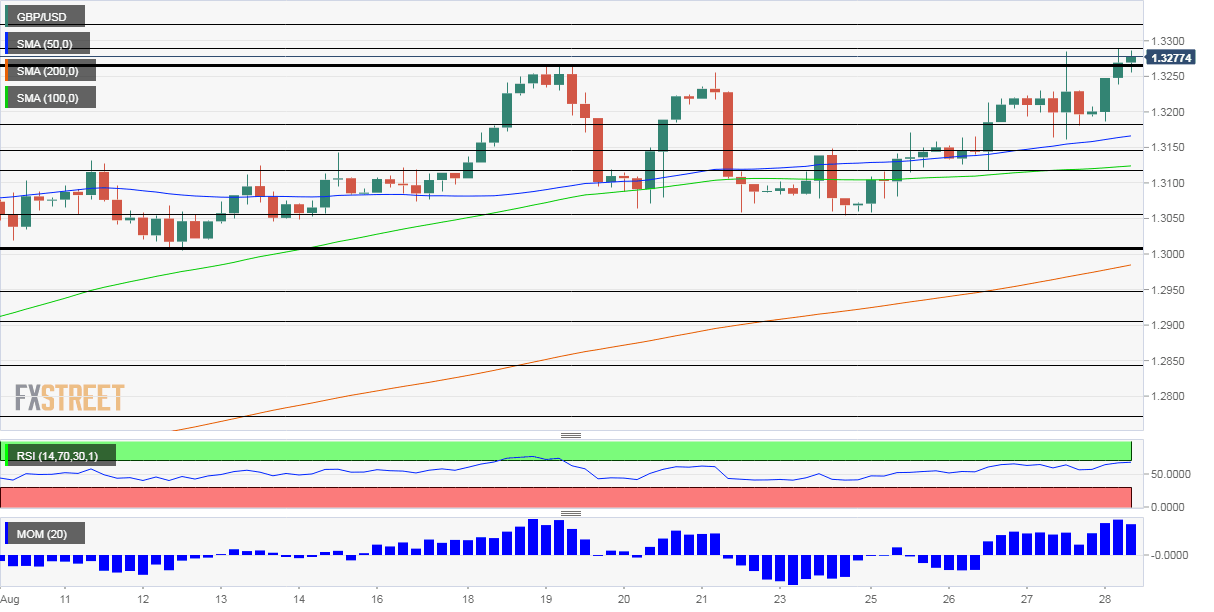

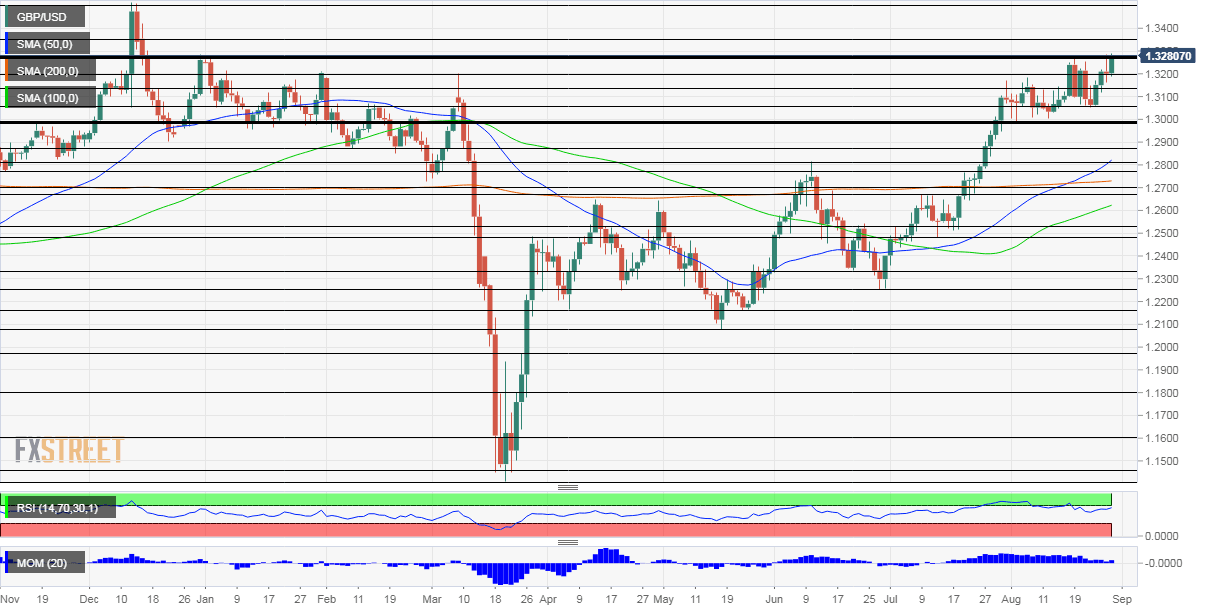

The Relative Strength Index on the four-hour chart is flirting with 70, indicating overbought conditions and countering upside momentum and the fact that cable is trading above the 50, 100, and 200 Simple Moving Averages.

The daily high of 1.3290 is the highest since December 2019 – an eight-month high. Above this level, the next target is 1.3330, which was a peak back then. The post-elections high of 1.3510 is the next level to watch.

Support is at 1.3265, last week's high, followed by 1.3180, which is the daily low. It is followed by 1.3150, which capped pound/dollar on its way up.

It is essential to note that the RSI on the daily chart is also approaching 70, entering overbought conditions.

See: Fed Rundown: Lower for (even) longer, and what's next for the dollar after the whipsaw

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.