USD/JPY closing in on 1990 highs

BoJ more dovish than expected

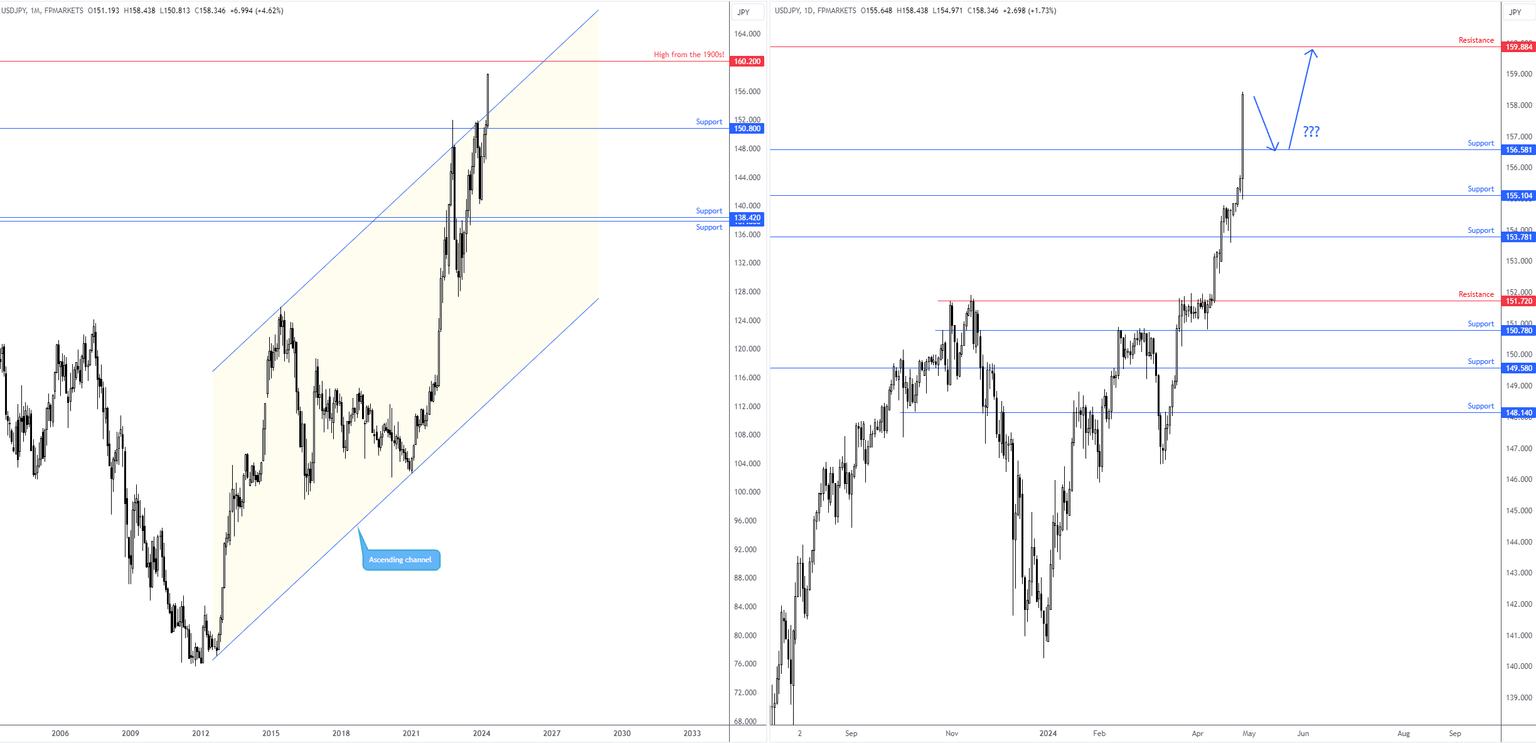

Friday witnessed a surge in dollar demand versus the beleaguered Japanese yen (JPY). The USD/JPY pairing not only recorded its largest one-day gain this year (+1.7%), but the exchange rate also refreshed multi-decade highs and is swiftly closing in on the ¥160 region, a 1990 peak.

Earlier on Friday, Asia Pac trading witnessed the Bank of Japan (BoJ) leave rates unchanged at 0.0%-0.1%, as widely expected. Yet, what was not anticipated by market analysts was that BoJ Governor Kazuo Ueda, following the rate announcement, communicated that yen weakness has so far had no ‘major’ impact on inflation. The central bank’s chief stated that the plan is to maintain an accommodative policy for now, which was more dovish than expected and, hence, further depreciation in the yen was seen.

The path of least resistance

Keeping things simple, working from the monthly chart, channel resistance, taken from the high of ¥125.85 and resistance at ¥150.80 (now marked as potential support), were engulfed in recent trading. Month to date, the currency pair is up +4.6% (on track to record its largest monthly gain since early 2023) and journeying towards highs from as far back as the 1990s at around ¥160.00. Sheltered just south of the ¥160.00 area is daily resistance coming in from ¥159.88.

While it’s clear the path of least resistance is north towards ¥160.00, should a correction materialise before attempting to find acceptance higher up emerge, support on the daily timeframe calls for attention at ¥156.58. As a result, this could be a location dip buyers show interest in if a retest occurs, with hopes of reaching fresh highs and connecting with ¥160.00.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,