GBP/USD Forecast: More Brexit chaos in the docket

GBP/USD Current price: 1.2795

- The UK Parliament will discuss the Internal Market Bill this Monday.

- Mixed UK data add pressure on the sterling, as it showed slow economic progress.

- GBP/USD is poised to extend its decline on a break below 1.2760.

The sterling was the worst performer last week, smashed by mounting tensions between the UK and the EU reducing chances of a trade deal by the end of the Brexit transition period between the two economies. The GBP/USD pair lost roughly 500 pips last week after UK PM Johnson sent the Parliament the Internal Market Bill, which allows the kingdom to change the Withdrawal Agreement. In response, the EU has threatened with legal actions. Talks last week ended without progress, with differences in important areas still unresolved.

Mixed UK data further pressured the local currency. July monthly GDP came in at 6.6%, below the 6.7% expected and the previous 8.7%. Industrial Production in the same month came in at -7.8%, better than expected but still negative. Consumer Inflation Expectations contracted to 2.8% from 2.9% previously. This Monday, the focus will be in the kingdom’s Parliament, as lawmakers will discuss the mentioned Internal Market Bill.

GBP/USD short-term technical outlook

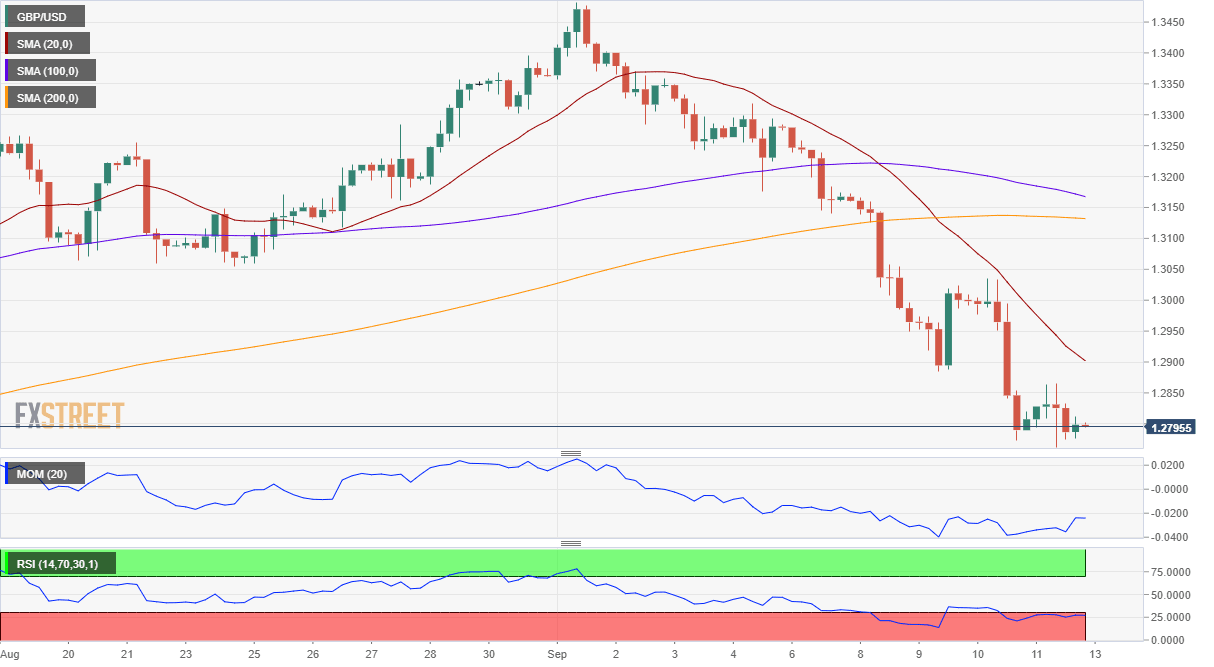

The GBP/USD pair settled at 1.2795, a level that was last seen in July, not far from a weekly low of 1.2762. In the daily chart, the bearish case is clear, as the pair is now well below its 20 DMA while barely holding above the larger ones, which anyway lack directional strength. Technical indicators have decelerated but stand at daily lows within negative levels. In the 4-hour chart, the 20 SMA heads firmly lower below the larger ones, as technical indicators turned flat well into negative territory.

Support levels: 1.2760 1.2715 1.2665

Resistance levels: 1.2840 1.2885 1.2930

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.