GBP/USD Forecast: Holds above key support but recovery lacks momentum

Current Price: 1.2854

- GBP/USD advances for the second day in a row but lacks follow-through.

- The Bank of England might be preparing for a rate cut.

The GBP/USD pair advanced for the second day in a row on Wednesday, extending its recovery from four-month lows scored last Friday, helped by Fed’s decision to cut the federal funds' target range to 1.25-1% on Tuesday. While the RBA, the Fed and the BoC have delivered rate cuts, other major central banks are expected to follow the same path amid global recession fears. Incoming Bank of England Governor Andrew Bailey said more evidence is needed before deciding on a move, but indicated a willingness to act quickly. He expects to have to provide supply-chain finance and said the BoE will coordinate action with the Treasury. Meanwhile, uncertainty stemming from talks about future EU-UK relationship post-Brexit continues to darken the Sterling’s outlook.

GBP/USD short-term technical outlook

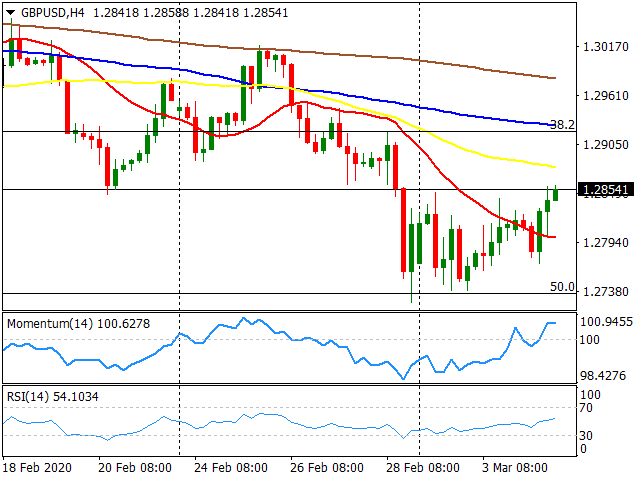

From a technical view, the pair holds a positive short-term bias according to indicators in the 4-hour chart. The pullback of the GBP/USD from December’s high of 1.3514 has been contained by the 50% retracement of the Sep-Dec rally, which stands at 1.2735 and has been tested several times over the last sessions. As long as this support holds, the cable could attempt to regain the 20-day SMA hovering at the 1.2920 zone. If GBP/USD breaks below the 1.2735-25 support area – confluence of recent low, Fibonacci level – pressure on the pair would increase, opening the way towards 1.2695, 200-day SMA which stands as the next significant barrier on the downside.

Support levels: 1.2725 1.2695 1.2655

Resistance levels: 1.2920 1.3000 1.3050

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.