GBP/USD Forecast: Bulls ready to challenge this year’s high

GBP/USD Current price: 1.4193

- The UK’s unemployment rate unexpectedly fell to 4.8% in the three months to March.

- UK annual inflation is expected to have recovered to 1.4% YoY in April.

- GBP/USD positive momentum set to continue in the near-term.

The GBP/USD pair surged to 1.4219 on the back of the persistent dollar’s weakness and better than expected UK data. The kingdom published the ILO unemployment rate for the three months to March, which contracted to 4.8% vs the steady 4.9% expected. Also, the Claimant Count Change fell by 15.1K in April, much better than the 25.6K increase expected. The pair´s positive momentum eased during the American afternoon, as Wall Street was unable to post substantial gains, instead closing mixed.

The UK will publish April inflation figures on Wednesday. The annual Consumer Price Index is foreseen at 1.4% from 0.7% in the previous month, while the core reading is expected to have recovered from 1.1% to 1.3%. The country will also publish the April Producer Price Index and the March DCLG House Price Index.

GBP/USD short-term technical outlook

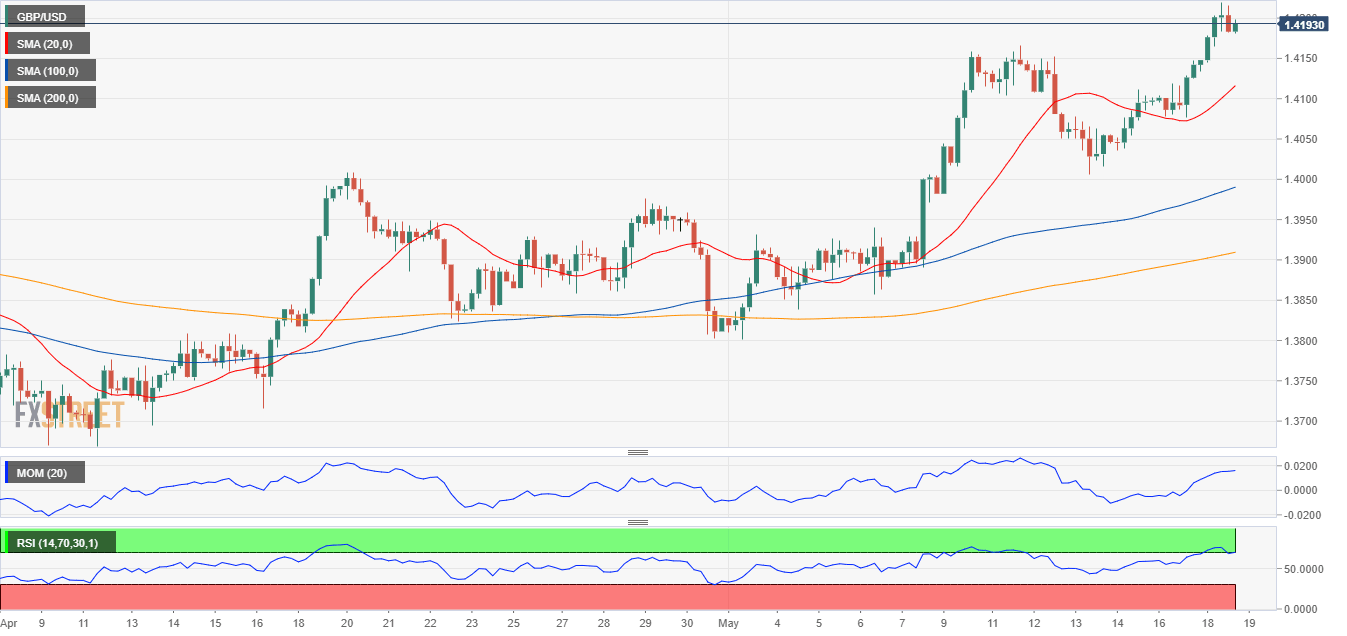

The GBP/USD pair retreated from the mentioned high, now trading a handful of pips below the 1.4200 threshold. The near-term picture indicates that bulls paused but retain control. The 4-hour chart shows that technical indicators retreated from intraday highs, with the Momentum holding well into positive levels and the RSI consolidating around 69. In the same chart, the 20 SMA accelerated higher above the longer ones and below the current level, indicating persistent buying interest. The year’s high comes at 1.4237, the level to surpass to confirm a bullish extension during the upcoming sessions.

Support levels: 1.4165 1.4115 1.4070

Resistance levels: 1.4240 1.4290 1.4335

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.