GBP/USD Forecast: BOE’s Super Thursday may bring no surprises

GBP/USD Current price: 1.3901

- The Bank of England will likely leave its policy unchanged, upgrade forecasts.

- The UK’s economic recovery is being overshadowed by Brexit tensions.

- GBP/USD hovers around 1.3900 with limited bearish potential in the near-term.

The GBP/USD pair hovers around the 1.3900 figure, marginally higher for the day but confined to familiar levels. The pair hit an intraday high of 1.3925 during European trading hours, confined to familiar levels amid the absence of UK data and as investors wait for the Bank of England. Meanwhile, tensions about fisheries rights between the UK and France continue, discouraging pound buyers.

The BOE is having a “Super Thursday,” as it will not only announce its monetary policy decision but will also report fresh growth and inflation forecasts. Ever since its latest meeting, the economy has shown signs of improvement, exacerbated by the speedy immunization campaign that led to economic reopenings. That means upward revisions could be expected, although it is too early to consider some form of tightening. The central bank will likely leave rates unchanged as well as the APP program. A hawkish stance from UK’s policymakers is mostly priced in, which means that the pound’s reaction will be wider in the case of a dovish BOE.

GBP/USD short-term technical outlook

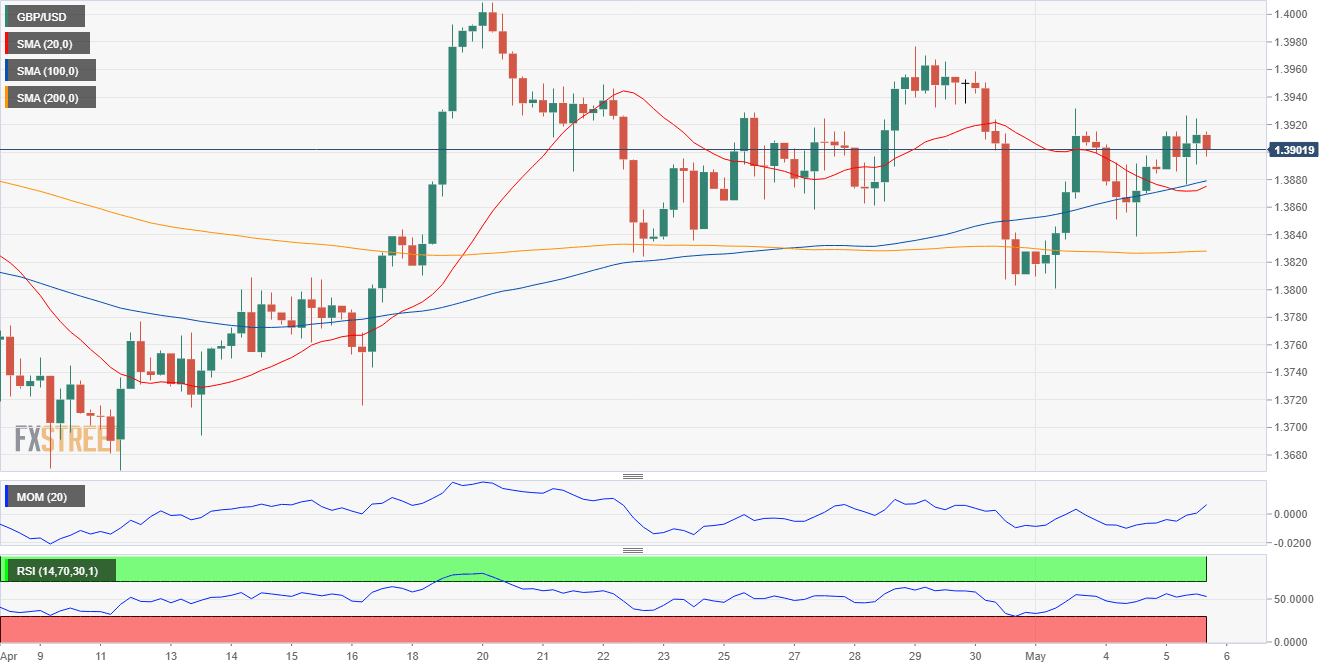

The GBP/USD pair is trapped within familiar levels and would need a strong catalyst to find directional strength. In the meantime, the near-term risk is skewed to the upside, although the pair needs to clear a Fibonacci resistance at 1.3930. The 4-hour chart shows that the pair is developing above all of its moving averages, with the 20 and the 100 SMAs converging a few pips below the 1.3880 Fibonacci support level. The Momentum indicator retreated but remains above its midline, while the RSI indicator is directionless around 54, indicating limited selling interest.

Support levels: 1.3880 1.3840 1.3800

Resistance levels: 1.3930 1.3975 1.4010

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.