GBP/USD Forecast: Battling with the critical 1.3000 level

GBP/USD Current price: 1.3001

- Improved UK data lent support to the Pound in a dollar-averse market.

- Brexit headache remains in the background for the EU and the UK.

- GBP/USD struggling to extend gains beyond the 1.3000 mark, yet firmly bullish.

The GBP/USD pair flirted with the 1.3000 level, retreating just modestly from it ahead of the US Federal Reserve announcement, only to surpass it afterwards. Market players had no reasons to buy the dollar as the coronavirus numbers continue to suggest the economic downturn in the country has not yet reached a bottom.

Market players have continued to ignore Brexit-related headlines that paint a gloomy picture for the UK. Despite both parts are committed to reaching a deal, they have failed miserably in finding common ground within discussions. Meanwhile, the UK BRC Shop Price Index came in at -1.3% in June, following a -1.6% reading in the previous month. Consumer Credit in the same period beat expectations, printing at £-0.086 B. The UK won’t release macroeconomic data this Thursday.

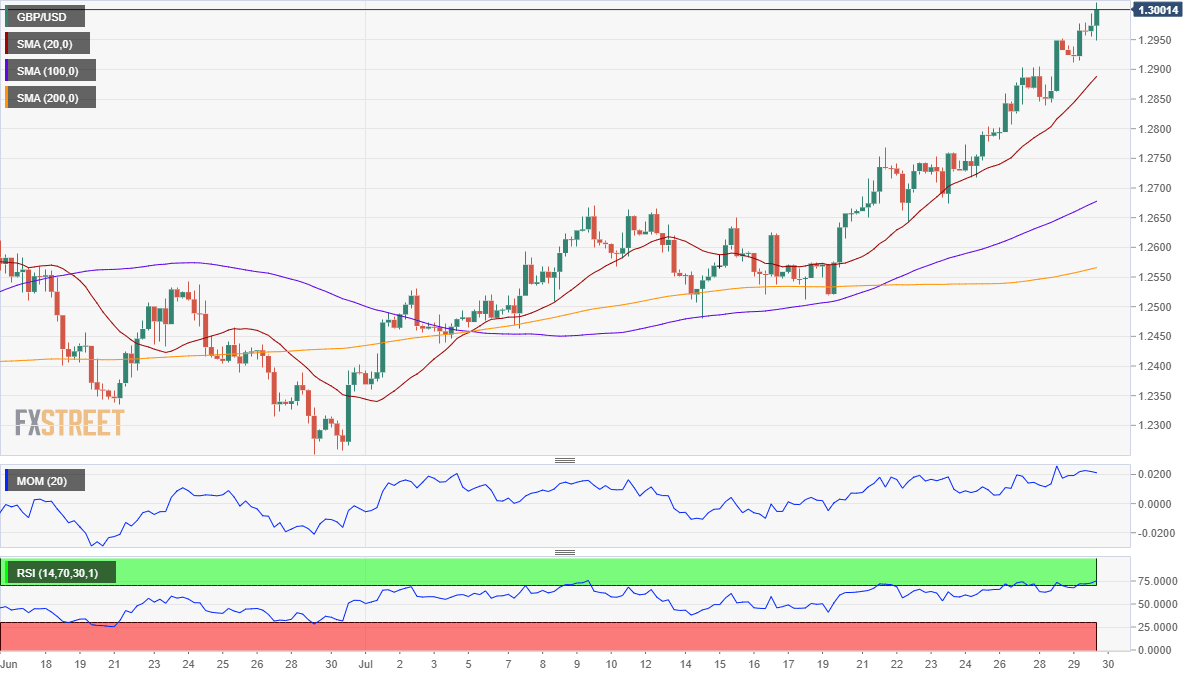

GBP/USD short-term technical outlook

The GBP/USD pair retreated from its daily high but trades around the 1.3000 price zone after the dust settled, anyway poised to continue rallying. The overall positive stance persists, given that, in the 4-hour chart, the pair continues to develop well above bullish moving averages. Technical indicators may have lost their positive momentum but remain well above their midlines, in line with another leg north coming up next.

Support levels: 1.2940 1.2885 1.2830

Resistance levels: 1.3000 1.3045 1.3090

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.