- GBP/USD has been rising amid dollar weakness ahead of a critical speech by Fed Chair Powell.

- The resignation of the EU's Phil Hogan may soften Europe's approach to Brexit.

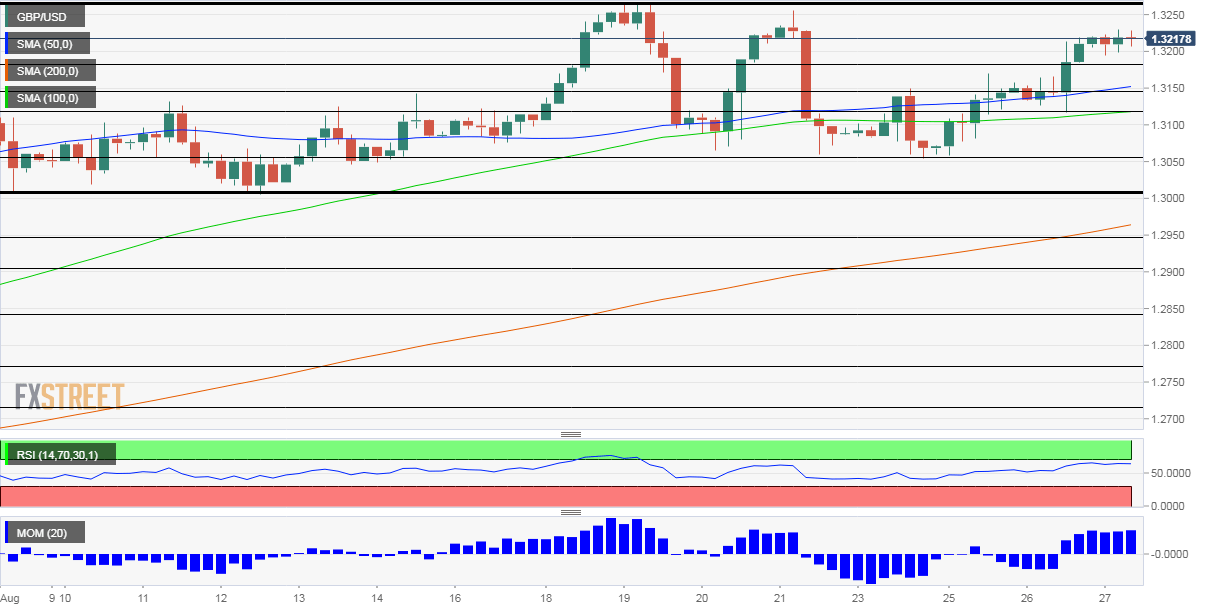

- Thursday's four-hour chart is showing bulls are in control.

Is Brexit becoming better? Michel Barnier, the gruntled chief EU Negotiator is still in charge, but he lost a close ally – Phil Hogan. The tall Irishman was prominent in influencing future commercial relations between Brussels and London through his post as Commissioner of Trade for the EU.

Hogan is out – following his violation of quarantine rules in his native Ireland. The European Commission may struggle to find a replacement as formidable – and knowledgeable of the sensitive issues on the Isle of Ireland – like the outgoing official.

Uncertainty about EU-UK relations hamstrung sterling and bulls may find some relief, allowing GBP/USD to rise amid dollar weakness.

The main of the week is due out later on Thursday – Jerome Powell, Chairman of the Federal Reserve, will deliver a highly-anticipated speech in the virtual Jackson Hole Symposium. Powell is set to lay out a new policy framework, allowing inflation to temporarily surpass the 2% target – catching up with slow rises in consumer prices beforehand.

While inflation is far from being a concern and rates are set to remain around zero through 2022, the long-term shift may weigh on the dollar. If investors foresee low borrowing costs for longer, yields on US Treasuries could fall, dragging the greenback along with it.

Powell's projected policy statement is not fully priced by markets and confirming the shift could trigger a fall in the dollar and a rise in cable. The devil may be in the details.

See

- Powell Speech Cheat Sheet: Three scenarios for the dollar and stocks

- Powell’s Jackson Hole Symposium Preview: Inflation’s virtual reality

Two American economic indicators serve as a warm-up to the Fed Chair's speech. Initial jobless claims are set to decline in the week ending August 21 after rising in the previous week and causing concern. The first revision of second-quarter Gross Domestic Product is set to show a minor improvement – albeit from a record crash of 32.9% annualized.

See:

- US Initial Jobless Claims Preview: It is the trend that matters

- US GDP: Will the corona-quarter look better at second sight? Not necessarily

Coronavirus headlines are mostly positive on both sides of the pond, with cases declining in the US and seemingly under control in Britain. Efforts to develop a vaccine are in full force and fresh headlines regarding medical developments could boost sentiment and depress the safe-haven dollar.

Overall, the combination of Hogan's departure and a dovish Powell could boost pound/dollar.

GBP/USD Technical Analysis

Cable continues benefiting from upside momentum on the four-hour chart and is trading above the 50, 100, and 200 Simple Moving Averages. Moreover, the Relative Strength Index remains below 70, outside overbought conditions.

Resistance is at the recent high of 1.3265, followed by the late 2019 peak of 1.3330. The next level is December's peak of 1.3510.

Support awaits at 1.3185, which was a swing high in early August. It is followed by 1.3150, a peak earlier this week, and 1.3130, a low point on Thursday. 1.3050 and 1.3005 are next.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.