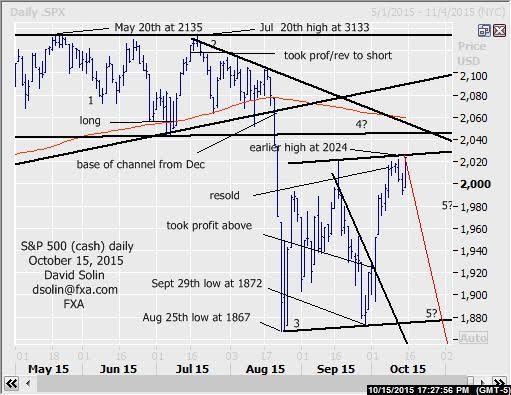

S&P 500 (cash) near term outlook:

The market remains firm near recent highs and testing lots of resistance in the 2024/33 area (both the ceiling of the bullish channel from the Aug 25th low at 1867 and a 62% retracement from the May high at 2135). Seen part of a larger correction from the Aug 24th low at 1867 (wave 4 the decline from that May high) and with eventual declines below there after (within wave 5). Though there is no confirmation of even a shorter term peak so far (5 waves down for example), the market is overbought after the last few weeks of sharp gains and within an "ideal" area to form such a top. Note too that the market is within the often dangerous mid/late Oct timeframe and raises the risk that such a move lower (if it does indeed occur) may be sharp. Further resistance above 2024/33 is seen at 2055/60 (both the bearish trendline from July and the 200 day moving average). Nearby support is seen at 1990/93 and 1945/50. Bottom line : seen nearing the upper end of the large correction since Aug, with new lows below 1867 after.

Strategy/position:

Still short from the Oct 8th resell at 2013. At this point, with no confirmation of a top and risk for further (but likely limited) gains, would continue to use that wide stop on a close 5 pts above that bearish trendline from July. However, with the magnitude of initial declines below that 1867 low potentially limited and short lived (see longer term below), will want to get more aggressive on nearby weakness and especially a break below.

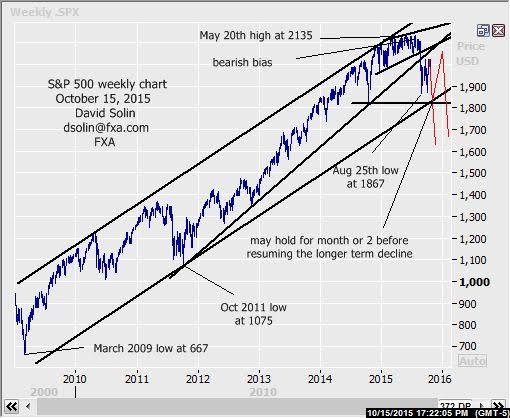

Long term outlook:

Long held view of a major top in place at that May high at 2135 (for at least another 6-9 months and likely longer) and after finally resolving lower from that long discussed bullish channel from Dec 2014 on Aug 20th (then at 2065), still playing out. A still long term overbought market (after the surge from the March 2009 low at 667), the end of QE last Autumn (was seen as main driver to upside over the last few years), continued widespread complacency in regards to a more significant decline (20%, 40% or more declines are not out of the ordinary historically) and that longer term time cycle that peaked in early June (Bradley Model) all support this continued, longer term bearish view. But note that "pivotal" big picture support is just below that Aug 1867 low in the 1800/20 area (both the base of the bullish channel since 2009 and the Oct 2014 low). Seen as "pivotal" as it could provide as much as a few months of consolidating within this longer term downtrend. However, breaking below could trigger a downside acceleration and with the market within that dangerous mid/late Oct timeframe is a risk to aware of (won't use the "c" word, see weekly chart/2nd chart below). Further long term support below there is seen at 1725/40 (8% retracement from the Oct 2011 low at 1075) and 1595/10 (50%). Bottom line : major top still seen in place at the May 2135 high, keep close eye on the "pivotal" 1800/20 area.

Long term strategy/position:

With an important top seen in place, would stay with the bearish bias that was put in place on July 16th at 2122.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.