Near term US 10 year note yield outlook:

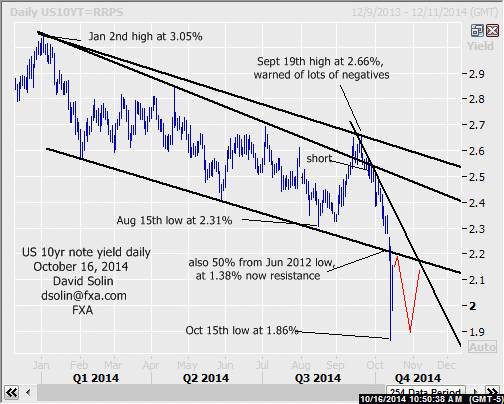

In the Oct 9th email, once again affirmed the bearish view (in the Sept 19th email said at least a few weeks of downside was favored). The market has indeed continued lower since, yesterday spiking below that long discussed 2.18/22% area (both the base of the bear channel since Jan and a 50% retracement from the June 2012 low at 1.38%, see daily chart below, now resistance). No doubt the market is oversold after the tumble from the Sept 19th high at 2.66%, and may have entered of period (at least a few weeks) of consolidating. Note too that markets will often retest these "spike" levels and adds to the potential for at least a few weeks of consolidating (see "ideal" scenario in red on daily chart below). Nearby resistance is seen at the key, broken 2.18/22% area and the bearish trendline from Sept (currently at 2.38/40%). Support is seen at 2.03/05% (on a closing basis, both the bullish trendline and 62% retracement from that June 2012 low at 1.38%) and yesterday's spike low at 1.84/86%.

Bottom line : likely few weeks of ranging (as broad as 1.86/2.20%), no confirmation of a more important low.

Strategy/position:

Still short yield from the Sept 26th sell at 2.53% and given the risk for a few weeks of broad consolidating, would use a wide stop on a close above 2.27% (above that 2.20% resistance area). A final note, if a bit shorter term can look to fade extremes ("ideally" 1.86/2.20%), and then be aggressive with trailing in an attempt to capture some of the expected shorter term swings as the market consolidates.

Long term outlook:

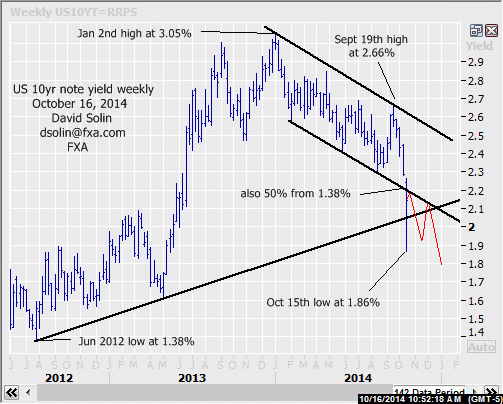

The market did indeed finally reach that long discussed 2.20% area, barely hesitating before spiking below. Though there is scope for at least a few weeks of consolidating (see shorter term above), there is still no confirmation of a more important low. Note too that the long discussed bigger picture negatives remain, and in turn argues further declines after. Those negatives include a continued bearish outlook for stocks (view of tumble into late Oct and more major top for at least 9-12 months, see last week's email, contact me at [email protected] is you need a copy), the seasonal chart that declines into the end of the year (see 3rd chart below), and the still mostly positive sentiment in yield (contrary indicator). Bottom line : at least a few weeks of consolidating, but still no major bottom seen.

Strategy/position:

With no confirmation of a more major bottom and the market quickly nearing that key 2.20% resistance area, would switch the longer term bias to the bearish side here (currently at 2.15%).

Current:

Nearer term: short Sept 26th at 2.53%, scope for a few weeks of wide consolidating ahead.

Last: long Sept 12th at 2.61%, stopped Sept 23rd at 2.53%.

Longer term: bearish bias Oct 16th at 2.15, no major bottom seen (so far).

Last: neutral Sept 26 at 2.53% from bull Sept 12 at 2.61%, risk of more basing toward 2.31%.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.