Near term eur/$ outlook:

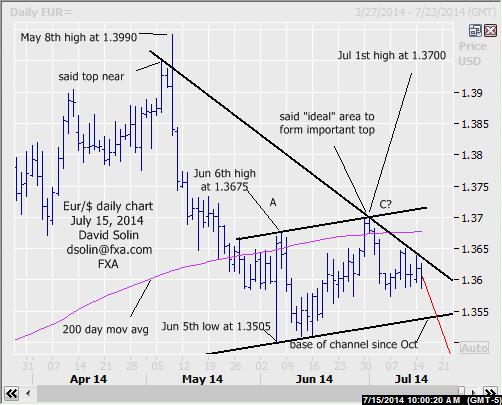

The market is trading near the middle of the 1.3505/1.3700 range that has been in place since Jun 5th. Seen as a correction with a resumption (potentially sharp) of the longer term declines after (see longer term below). Also as discussed in the Jun 8th email, this correction may have been completed at the Jul 1st high at 1.3700 (3 wave A-B-C, see numbering on daily chart below), and suggests that the resumption of the larger declines may be directly ahead. Key support is seen at 1.3505/30 (base of correction, base of bull channel from Oct, 38% retracement from the Jul 2013 low at 1.2755 and bull trendline from May 2012), with a break/close below potentially triggering that downside acceleration. Resistance is seen at the bearish trendline from May 6th (currently at 1.3640/55). Though a break above would not abort the bigger picture bearish view, it would raise the risk for a more extended period of wide correcting/consolidating before resuming the larger decline. Bottom line : month long correction may be complete with scope for a resumption of the larger declines ahead (potentially sharp).

Strategy/position:

Still short from the Jul 8th resell at 1.3610, and for now would continue to stop on a close 15 ticks above that bearish trendline from May 6th.

Longer term outlook:

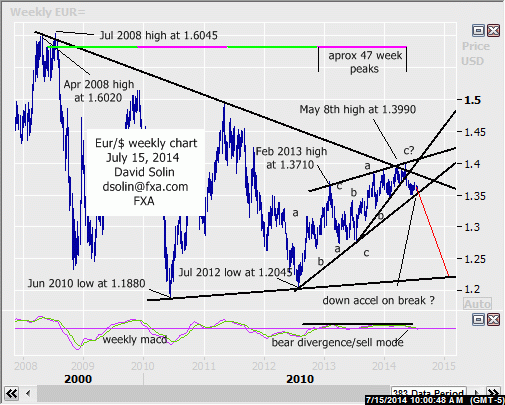

Still very bearish out the next number of months as an important top is seen in place at the May high at 1.3990, and with eventual declines all the way to the bullish trendline from Jun 2010/base of the triangle from Jul 2008 favored (currently at 1.2150/00, see in red on weekly chart/2nd chart below). Note that the market continues to trade within the huge triangle that has been forming since Apr 2008, with the May test of the ceiling near 1.40 targeting declines to the base. Other longer term negative remain and include technicals which remain bearish (see sell mode on weekly macd), the series of 47 week peaks which has recently topped, and the ECB which is clearly not comfortable with the market above 1.40. A last note, as discussed above the next downleg may be sharp as that bullish trendline from July 2012 (comes in the 1.3500 area) is also the base of a potential 2 year rising wedge (pattern that often resolves sharply), while such a move lower would also be seen as wave 3 in the fall from the May 1.3990 high (3rd waves are often the most "explosive" part of a trend). Bottom line : longer term bear, with a break below 1.3500/15 area potentially triggering a further, downside acceleration.

Strategy/position:

With a more important top seen in place, would stay with the longer term bearish bias that was put in place way back on Jan 17th at 1.3540 (got a bit caught).

Current:

Nearer term: short Jul 8th at 1.3610, scope for down acceleration on break below 1.3505/30.

Last: short May 23 at 1.3630, took profit Jun 18 above t-line from May (1.3580 , closed 1.3595).

Longer term: bearish Jan 17th at 1.3540, at least another few months of big picture downside ahead.

Last: bull bias Nov 26th at 1.3455, to neutral Nov 7th at 1.3635.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.